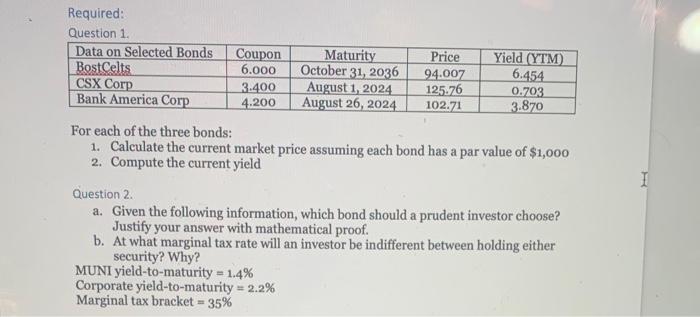

Question: Required: Question 1. Data on Selected Bonds BostCelts CSX Corp Bank America Corp Coupon 6.000 3-400 4.200 Maturity October 31, 2036 August 1, 2024 August

Required: Question 1. Data on Selected Bonds BostCelts CSX Corp Bank America Corp Coupon 6.000 3-400 4.200 Maturity October 31, 2036 August 1, 2024 August 26, 2024 Price 94.007 125.76 102.71 Yield (YTM) 6.454 0.703 3.870 For each of the three bonds: 1. Calculate the current market price assuming each bond has a par value of $1,000 2. Compute the current yield I Question 2 a. Given the following information, which bond should a prudent investor choose? Justify your answer with mathematical proof. b. At what marginal tax rate will an investor be indifferent between holding either security? Why? MUNI yield-to-maturity = 1.4% Corporate yield-to-maturity = 2.2% Marginal tax bracket -35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts