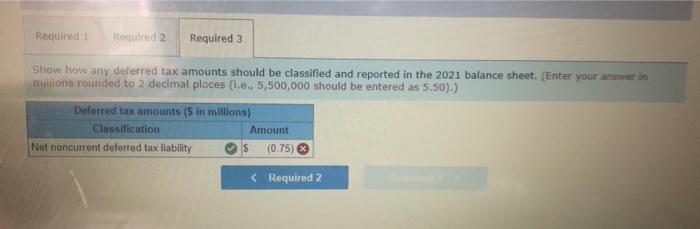

Question: Required Required 2 Required 3 Show how any deferred tax amounts should be classified and reported in the 2021 balance sheet. (Enter your answer in

Required Required 2 Required 3 Show how any deferred tax amounts should be classified and reported in the 2021 balance sheet. (Enter your answer in millions rounded to 2 decimal places (I.e., 5,500,000 should be entered as 5.50).) Deferred tax amounts (5 in millions) Classification Amount Net noncurrent deferred tax liability (0.75)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock