Question: Required Round EPS figures to two decimal places. Calculate basic EPS. (4 marks) Calculate the individual effect for diluted EPS for each of the above

RequiredRound EPS figures to two decimal places.

- Calculate basic EPS.(4 marks)

- Calculate the individual effect for diluted EPS for each of the above items.The tax rate is 30%.For options, calculate shares issued and shares retired.(9 marks)

- Calculate diluted EPS. (8 marks)

- Assume Lilac Corp. had discontinued operations loss of $68,000.Calculate Basic and diluted EPS for discontinued operations and net earnings.Show how EPS would be presented on the statement of comprehensive income.(4 marks)

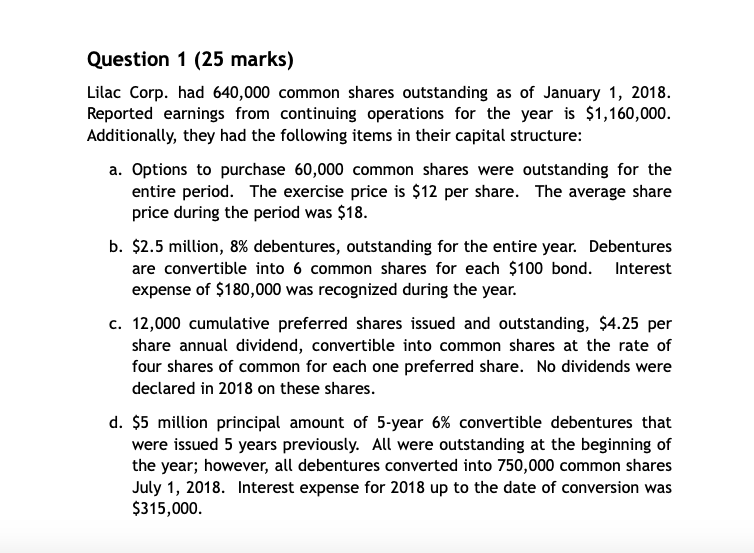

Question 1 (25 marks} Lilac Corp. had 640,000 common shares outstanding as of January 1, 2010. Reported earnings from continuing operations for the year is $1,160,000. Additionally, they had the following items in their capital structure: a. Options to purchase 60,000 common shares were outstanding for the entire period. The exercise price is $12 per share. The average share price during the period was $10. b. 52.5 million, 3% debentures, outstanding for the entire year. Debentures are convertible into I5 common shares for each 5100 bond. Interest expense of $130,000 was recognized during the year. c. 12,000 cumulative preferred shares issued and outstanding, $4.25 per share annual dividend, convertible into common shares at the rate of four shares of common for each one preferred share. No dividends were declared in 2010 on these shares. d. 55 million principal amount of 5-year 6% convertible debentures that were issued 5 years previously. All were outstanding at the beginning of the year; however, all debentures converted into ?50,000 common shares July 1, 2013. Interest expense for 2010 up to the date of conversion was $315,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts