Question: Required solution ugent Subject: Finance Note: Using updated data please Solution required urgent.. Spring 2021 Financial Statements and Ratio Analysis Instructor: M. Pechersky Assignment Choose

Required solution ugent

Subject: Finance Note: Using updated data please

Solution required urgent..

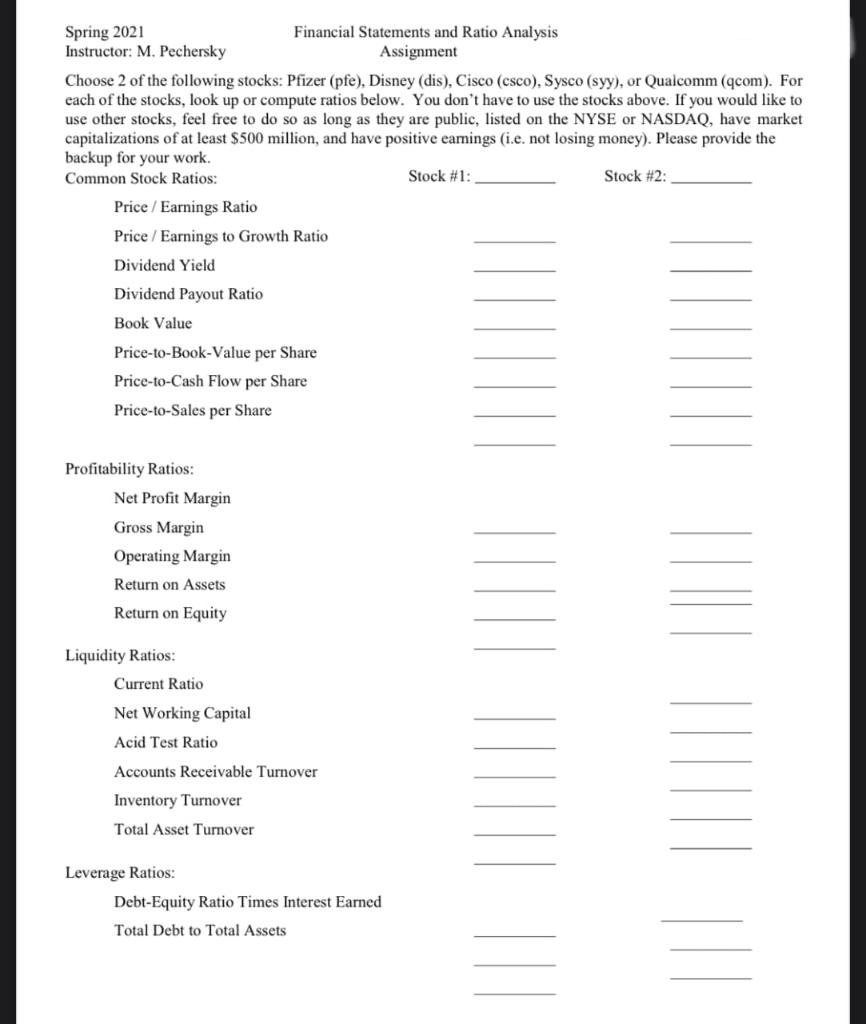

Spring 2021 Financial Statements and Ratio Analysis Instructor: M. Pechersky Assignment Choose 2 of the following stocks: Pfizer (pfe), Disney (dis), Cisco (csco), Sysco (syy), or Qualcomm (qcom). For cach of the stocks, look up or compute ratios below. You don't have to use the stocks above. If you would like to use other stocks, feel free to do so as long as they are public, listed on the NYSE or NASDAQ, have market capitalizations of at least $500 million, and have positive earnings (i.e. not losing money). Please provide the backup for your work. Common Stock Ratios: Stock #1: Stock #2 Price/Earnings Ratio Price/Earnings to Growth Ratio Dividend Yield Dividend Payout Ratio Book Value Price-to-Book-Value per Share Price-to-Cash Flow per Share Price-to-Sales per Share Profitability Ratios: Net Profit Margin Gross Margin Operating Margin Return on Assets Return on Equity Liquidity Ratios: Current Ratio Net Working Capital Acid Test Ratio Accounts Receivable Turnover Inventory Turnover Total Asset Turnover Leverage Ratios: Debt-Equity Ratio Times Interest Earned Total Debt to Total Assets Spring 2021 Financial Statements and Ratio Analysis Instructor: M. Pechersky Assignment Choose 2 of the following stocks: Pfizer (pfe), Disney (dis), Cisco (csco), Sysco (syy), or Qualcomm (qcom). For cach of the stocks, look up or compute ratios below. You don't have to use the stocks above. If you would like to use other stocks, feel free to do so as long as they are public, listed on the NYSE or NASDAQ, have market capitalizations of at least $500 million, and have positive earnings (i.e. not losing money). Please provide the backup for your work. Common Stock Ratios: Stock #1: Stock #2 Price/Earnings Ratio Price/Earnings to Growth Ratio Dividend Yield Dividend Payout Ratio Book Value Price-to-Book-Value per Share Price-to-Cash Flow per Share Price-to-Sales per Share Profitability Ratios: Net Profit Margin Gross Margin Operating Margin Return on Assets Return on Equity Liquidity Ratios: Current Ratio Net Working Capital Acid Test Ratio Accounts Receivable Turnover Inventory Turnover Total Asset Turnover Leverage Ratios: Debt-Equity Ratio Times Interest Earned Total Debt to Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts