Question: Required: The answer must show the calculation without any words. For example: 50,000+ 2,000=52,000 ,,,,,, 3,000 - 1,000= 2,000 1) Texas Corporation is undergoing a

Required: The answer must show the calculation without any words. For example: 50,000+ 2,000=52,000 ,,,,,, 3,000 - 1,000= 2,000

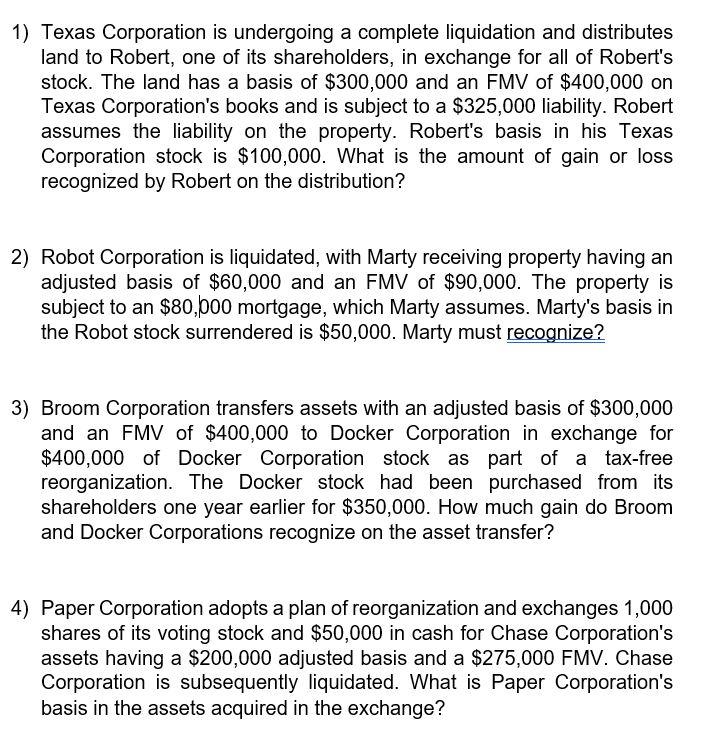

1) Texas Corporation is undergoing a complete liquidation and distributes land to Robert, one of its shareholders, in exchange for all of Robert's stock. The land has a basis of $300,000 and an FMV of $400,000 on Texas Corporation's books and is subject to a $325,000 liability. Robert assumes the liability on the property. Robert's basis in his Texas Corporation stock is $100,000. What is the amount of gain or loss recognized by Robert on the distribution? 2) Robot Corporation is liquidated, with Marty receiving property having an adjusted basis of $60,000 and an FMV of $90,000. The property is subject to an $80,000 mortgage, which Marty assumes. Marty's basis in the Robot stock surrendered is $50,000. Marty must recognize? 3) Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization. The Docker stock had been purchased from its shareholders one year earlier for $350,000. How much gain do Broom and Docker Corporations recognize on the asset transfer? 4) Paper Corporation adopts a plan of reorganization and exchanges 1,000 shares of its voting stock and $50,000 in cash for Chase Corporation's assets having a $200,000 adjusted basis and a $275,000 FMV. Chase Corporation is subsequently liquidated. What is Paper Corporation's basis in the assets acquired in the exchange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts