Question: Required: The time from acceptance to maturity on a $1,000,000 banker's acceptance is 90 days. The importer's bank's acceptance commission is 1.75 percent and the

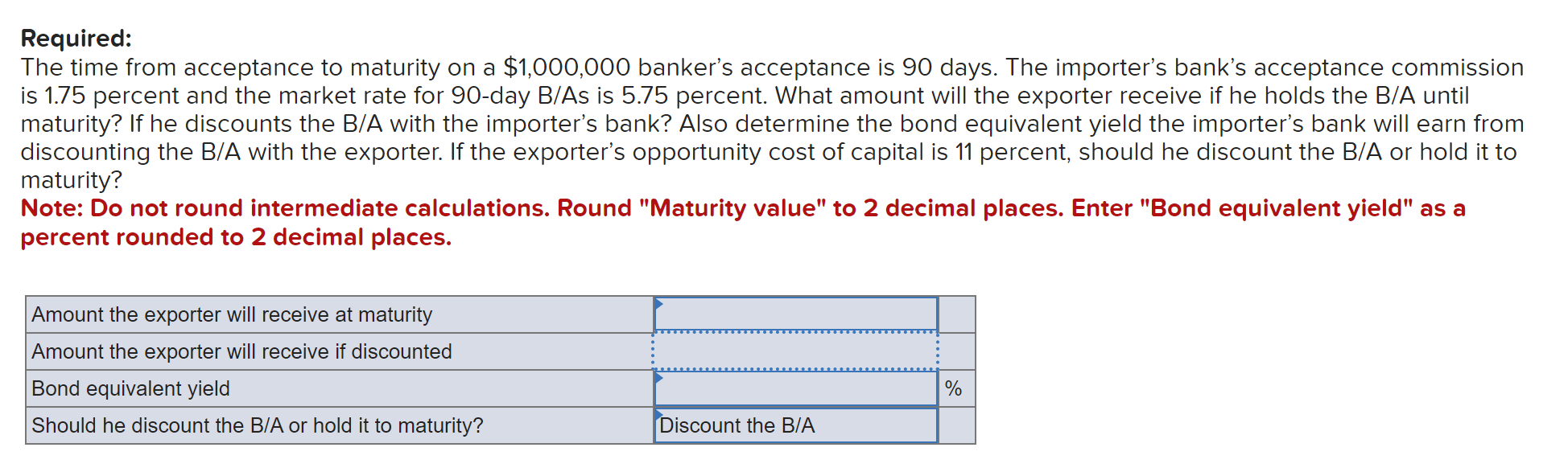

Required: The time from acceptance to maturity on a $1,000,000 banker's acceptance is 90 days. The importer's bank's acceptance commission is 1.75 percent and the market rate for 90 -day B/As is 5.75 percent. What amount will the exporter receive if he holds the B/A until maturity? If he discounts the B/A with the importer's bank? Also determine the bond equivalent yield the importer's bank will earn from discounting the B/A with the exporter. If the exporter's opportunity cost of capital is 11 percent, should he discount the B/A or hold it to maturity? Note: Do not round intermediate calculations. Round "Maturity value" to 2 decimal places. Enter "Bond equivalent yield" as a percent rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts