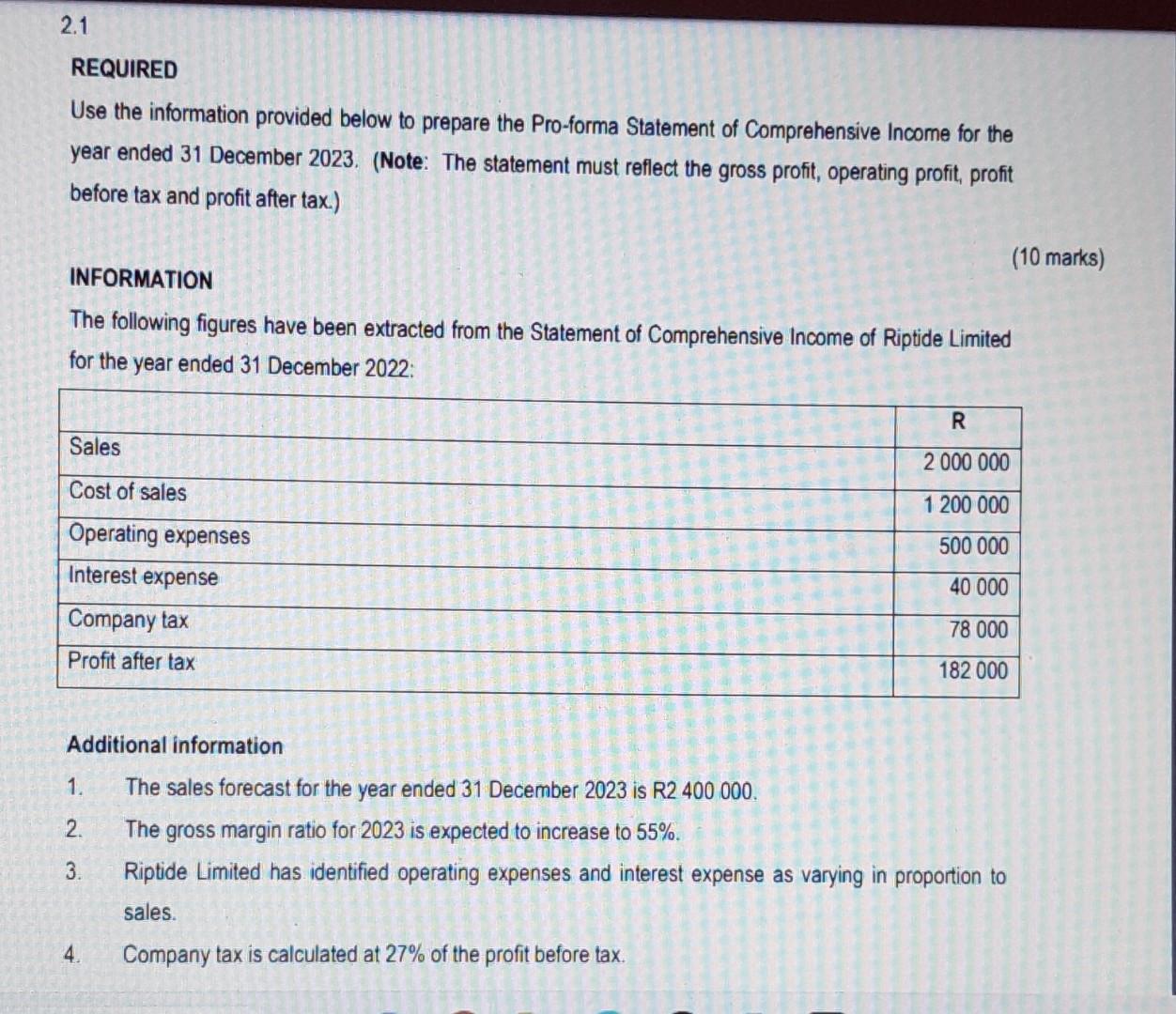

Question: REQUIRED Use the information provided below to prepare the Pro-forma Statement of Comprehensive Income for the year ended 31 December 2023. (Note: The statement must

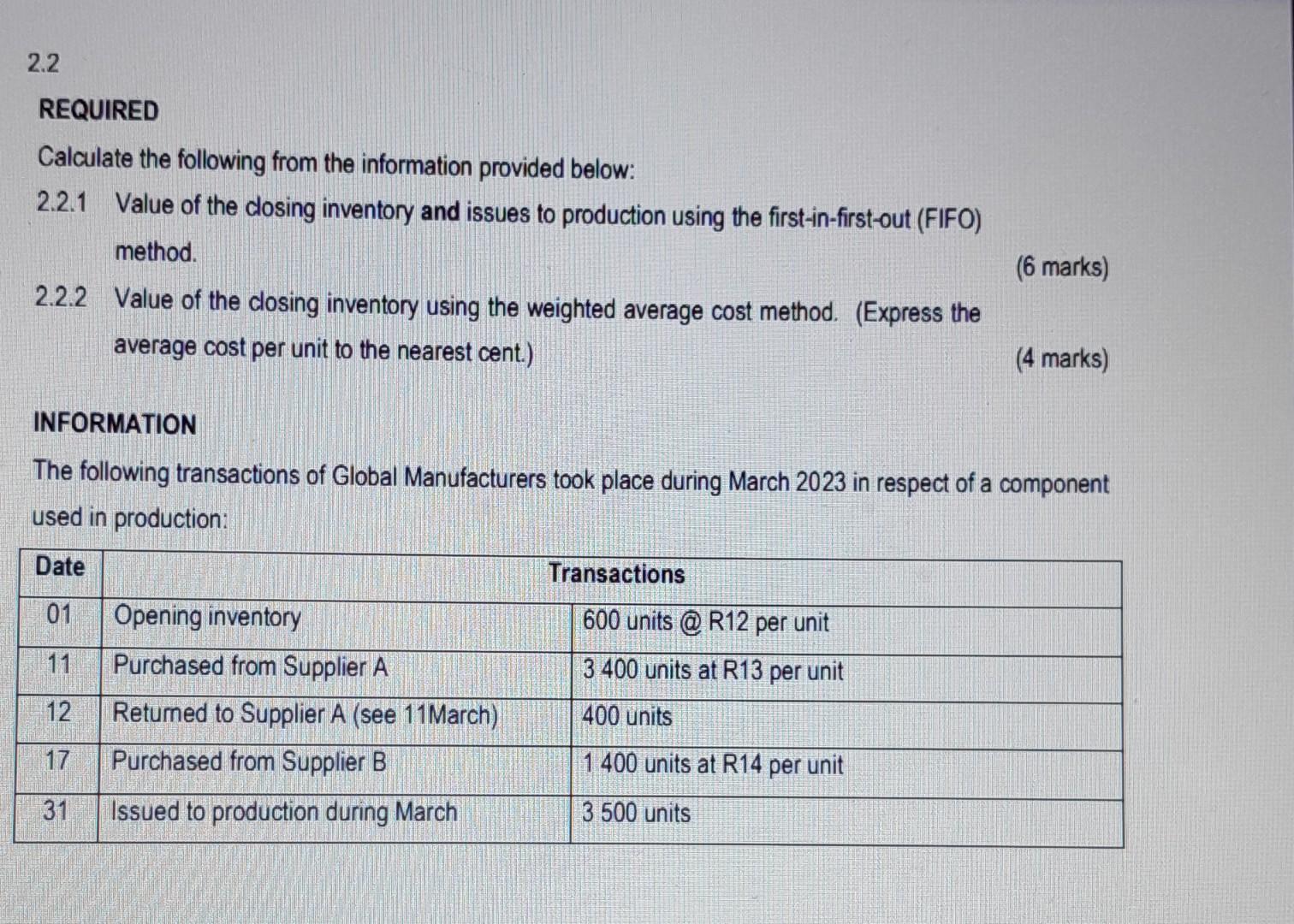

REQUIRED Use the information provided below to prepare the Pro-forma Statement of Comprehensive Income for the year ended 31 December 2023. (Note: The statement must reflect the gross profit, operating profit, profit before tax and profit after tax.) INFORMATION \\( (10 \\) The following figures have been extracted from the Statement of Comprehensive Income of Riptide Limited for the year ended 31 December 2022: Additional information 1. The sales forecast for the year ended 31 December 2023 is R2 400000 . 2. The gross margin ratio for 2023 is expected to increase to \55. 3. Riptide Limited has identified operating expenses and interest expense as varying in proportion to sales. 4. Company tax is calculated at \27 of the profit before tax. 2.2 REQUIRED Calculate the following from the information provided below: 2.2.1 Value of the closing inventory and issues to production using the first-in-first-out (FIFO) method. (6 marks) 2.2.2 Value of the closing inventory using the weighted average cost method. (Express the average cost per unit to the nearest cent.) (4 marks) INFORMATION The following transactions of Global Manufacturers took place during March 2023 in respect of a component used in production: REQUIRED Use the information provided below to prepare the Pro-forma Statement of Comprehensive Income for the year ended 31 December 2023. (Note: The statement must reflect the gross profit, operating profit, profit before tax and profit after tax.) INFORMATION \\( (10 \\) The following figures have been extracted from the Statement of Comprehensive Income of Riptide Limited for the year ended 31 December 2022: Additional information 1. The sales forecast for the year ended 31 December 2023 is R2 400000 . 2. The gross margin ratio for 2023 is expected to increase to \55. 3. Riptide Limited has identified operating expenses and interest expense as varying in proportion to sales. 4. Company tax is calculated at \27 of the profit before tax. 2.2 REQUIRED Calculate the following from the information provided below: 2.2.1 Value of the closing inventory and issues to production using the first-in-first-out (FIFO) method. (6 marks) 2.2.2 Value of the closing inventory using the weighted average cost method. (Express the average cost per unit to the nearest cent.) (4 marks) INFORMATION The following transactions of Global Manufacturers took place during March 2023 in respect of a component used in production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts