Question: Required: Use the space below or upload Excel file to answer the following. Show all work. 1. Prepare the Year 2 income statement for Mission

Required: Use the space below or upload Excel file to answer the following. Show all work.

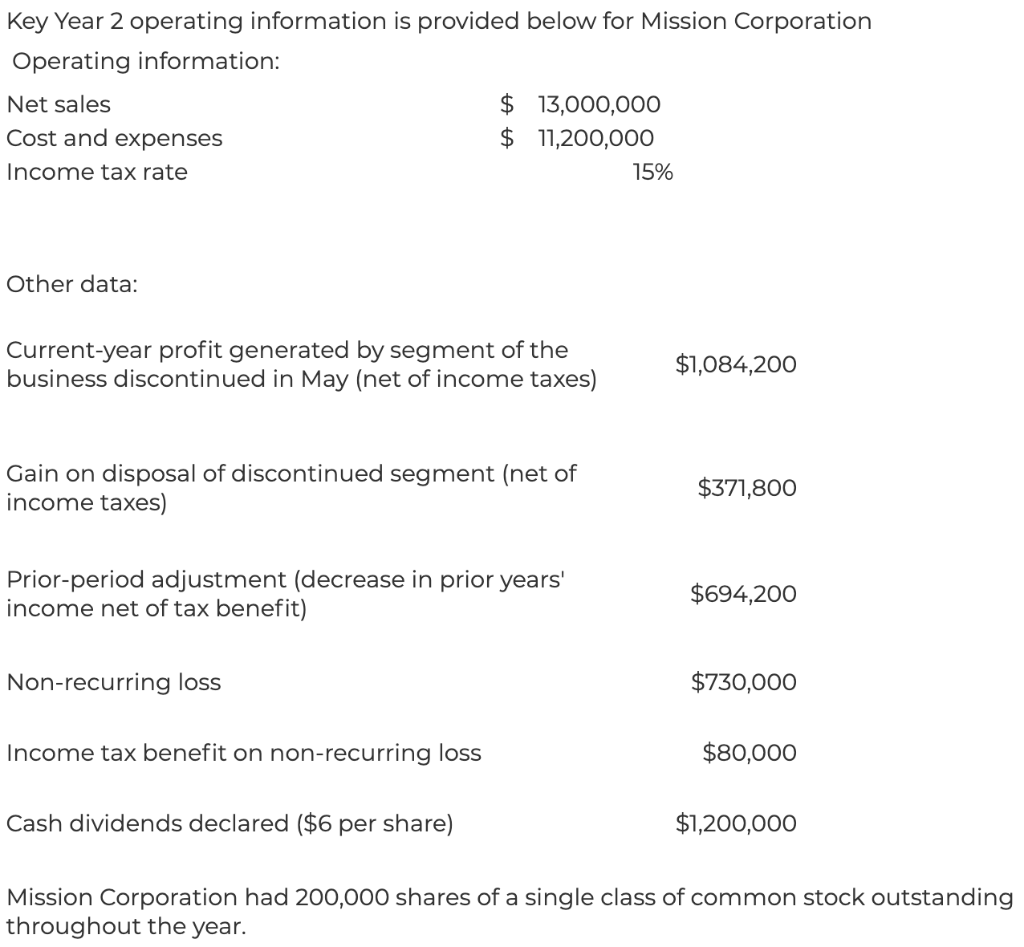

1. Prepare the Year 2 income statement for Mission Corporation (the income statement must be properly formatted, including all line items, subtotals, and totals).

2. Prepare Year 2 earnings per share figures for each of the following:

- continuing operations;

- discontinued operations; and

- net income

Key Year 2 operating information is provided below for Mission Corporation Operating information: Net sales $ 13,000,000 Cost and expenses $ 11,200,000 Income tax rate 15% Other data: Current-year profit generated by segment of the business discontinued in May (net of income taxes) $1,084,200 Gain on disposal of discontinued segment (net of income taxes) $371,800 Prior-period adjustment (decrease in prior years' income net of tax benefit) $694,200 Non-recurring loss $730,000 Income tax benefit on non-recurring loss $80,000 Cash dividends declared ($6 per share) $1,200,000 Mission Corporation had 200,000 shares of a single class of common stock outstanding throughout the year. Key Year 2 operating information is provided below for Mission Corporation Operating information: Net sales $ 13,000,000 Cost and expenses $ 11,200,000 Income tax rate 15% Other data: Current-year profit generated by segment of the business discontinued in May (net of income taxes) $1,084,200 Gain on disposal of discontinued segment (net of income taxes) $371,800 Prior-period adjustment (decrease in prior years' income net of tax benefit) $694,200 Non-recurring loss $730,000 Income tax benefit on non-recurring loss $80,000 Cash dividends declared ($6 per share) $1,200,000 Mission Corporation had 200,000 shares of a single class of common stock outstanding throughout the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts