Question: Required ( Use the Template for Response tab to answer the questions ) : a . Using the preceding information, prepare a consolidated worksheet for

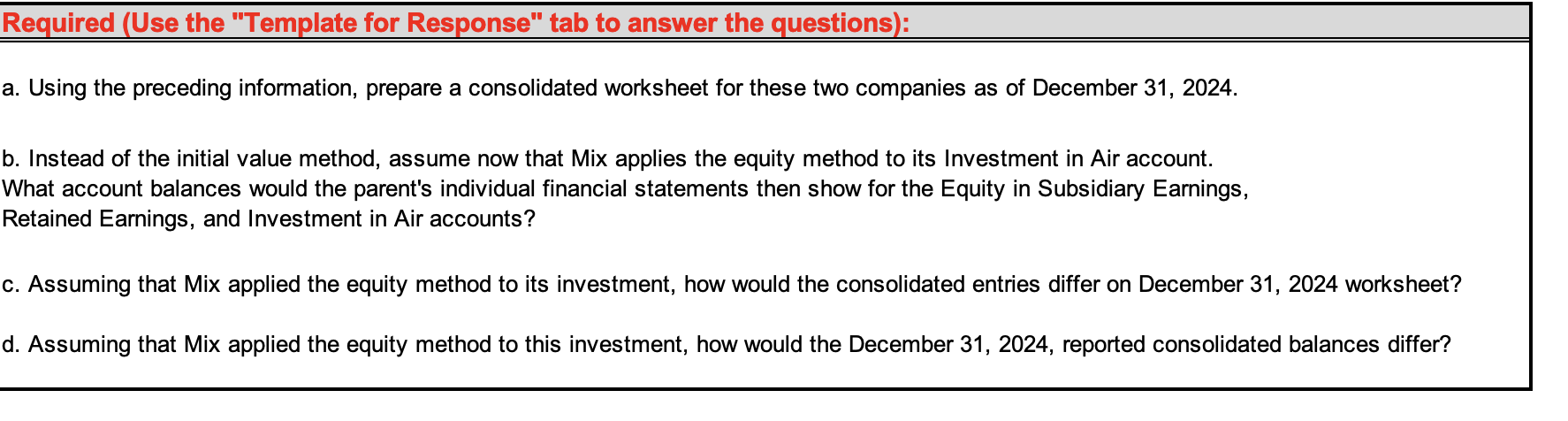

Required Use the "Template for Response" tab to answer the questions: a Using the preceding information, prepare a consolidated worksheet for these two companies as of December b Instead of the initial value method, assume now that Mix applies the equity method to its Investment in Air account. What account balances would the parent's individual financial statements then show for the Equity in Subsidiary Earnings, Retained Earnings, and Investment in Air accounts? c Assuming that Mix applied the equity method to its investment, how would the consolidated entries differ on December worksheet? d Assuming that Mix applied the equity method to this investment, how would the December reported consolidated balances differ? Part a Figuring out Excess Amortization and Conversion to Equity Method

Fair Value allocation and Annual Amortization

Fair value of Air Co

Book value of subsidiary

Excess fair over book valueAssigned to specific account based on fair market valueRemaining Life yearsAnnual Excess AmortizationsRoyalty agreements Trademark

Conversion to equity method for years prior to

Air retained earnings,

Retained earnings at acquisitiondate

Increase since acquisitiondate

Excess amortization expenses

Conversion to equity method for years

Using the dropdown list, enter this column to indicate:

A Unamortized allocations

C Credit balance

D Intercompany dividends

E Excess amortization expe

I Intercompany income acd

S Subsidiary stockholders' prior to Part b Equity method What ccount balances would be altered on Mix's financial statements?

Part c Equity method What changes would be necessary in the consolidation entries in the December

Consolidation Worksheet?

Part d Equity method What changes would be created in the consolidation figures to be reported by this combination.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock