Question: Required Using Excell 1. Compute income from the special offer. 2. Should the company accept or reject the special offer? MAX produces and sells power

Required Using Excell 1. Compute income from the special offer. 2. Should the company accept or reject the special offer?

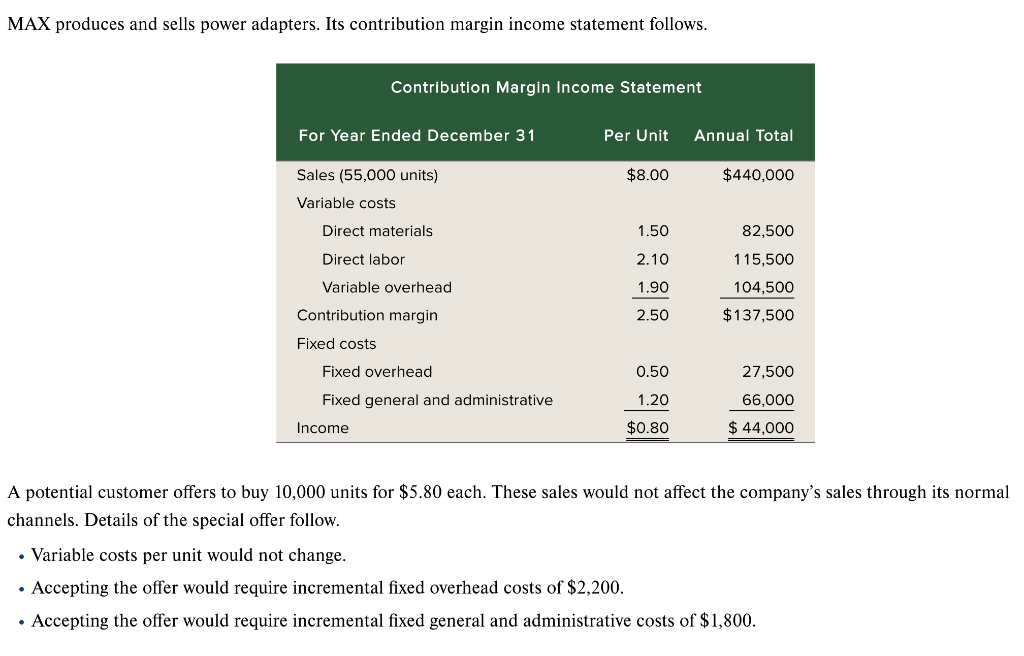

MAX produces and sells power adapters. Its contribution margin income statement follows. Contribution Margin Income Statement For Year Ended December 31 Per Unit Annual Total Sales (55,000 units) $8.00 $440,000 Variable costs Direct materials 1.50 82,500 Direct labor 2.10 115,500 104,500 Variable overhead 1.90 Contribution margin 2.50 $137,500 Fixed costs Fixed overhead 0.50 27,500 66,000 Fixed general and administrative 1.20 Income $0.80 $ 44,000 A potential customer offers to buy 10,000 units for $5.80 each. These sales would not affect the company's sales through its normal channels. Details of the special offer follow. Variable costs per unit would not change. Accepting the offer would require incremental fixed overhead costs of $2,200. Accepting the offer would require incremental fixed general and administrative costs of $1,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts