Question: Required: Using the information in tables 1 and 2 along with the June transactions listed below, prepare an income statement and balance sheet for the

Required:

Using the information in tables 1 and 2 along with the June transactions listed below, prepare an income statement and balance sheet for the month of June.

While not required, the following steps will help you to gather the information that you need for the income statement and balance sheet:

-

Prepare the necessary journal entries to reflect the transactions below. Use the chart of accounts shown in Table 1.

-

Beginning with the June 1 account balances shown in Table 2, create a worksheet which shows the ending balances in all accounts after the monthly journal entries have been posted.

-

Journalize the closing entries.

-

Create a post-closing trial balance.

Note: Otter Land handles the production, distribution and sales of the otter toys and the Otter Land transactions are not recorded here.

Transactions during June at Water World include the following:

1. During June, seasonal plants and paint costs $1,500,000 paid in cash. (Hint: use maintenance expense.)

2. Season passes are sold for $600,000 cash. All season passes provide free admission for the summer, June 1 through August 31.

3. The medical team, full-time staff members, spent 35% of their time during June treating otters for minor injuries and inoculations. The animals in the other exhibits required the rest of their time.

4. General sanitizing chemicals (from the water chemicals inventory) were used to treat the water in the water park rides and the animal tanks, $250,000. Some animal tanks required salinization, so $30,000 in water saline inventory was used as well.

5. Cash admissions for the month totaled $2,500,000.

6. Concession sales totaled $700,000 in cash for goods costing $250,000.

7. The following cash salaries paid for the month. You may ignore withholding and taxes. Use "expense salary operating and/or expense salary administration as needed.

Medical team: $120,000

Dolphin trainers: $50,000

Otter Handlers: $80,000

Administration: $225,000

8. Purchased fish, squid and other food and supplements costing $60,000 on account. $100,000 of food was used during the month.

9. The cost of utilities for the month totaled $25,000, which was paid immediately. Adjusting entries:

10. At the end of the month, depreciation on the buildings and equipment is recorded. The buildings and equipment have an expected useful life of 35 years, and a salvage value of $5,000,000. Water World uses straight line depreciation techniques to depreciate the building and equipment.

11. June interest on the note payable is accrued. The annual interest rate on the note payable is 6 %, and the payment is due on January 1 of each year.

12. Season ticket revenue is recorded for the month.

13. Prepaid insurance is adjusted. The balance as of June 1 represents 8 months of remaining coverage.

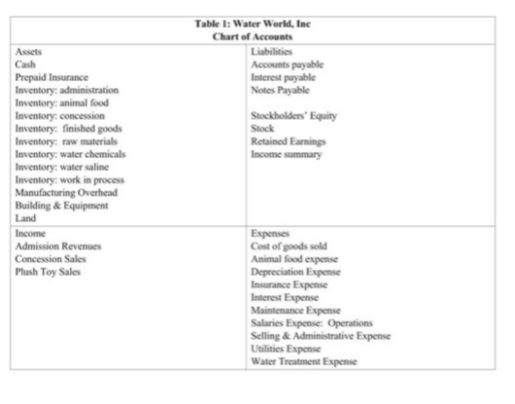

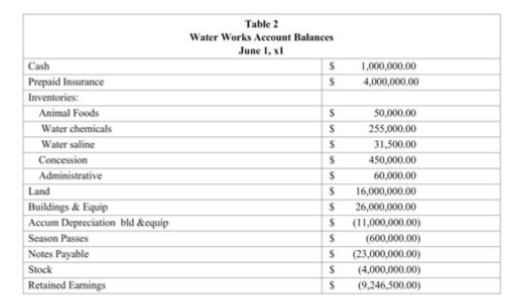

Table 1: Water World, Inc Chart of Accounts Liabilities Accounts payable Interest payable Notes Payable Stockholders' Equity Stock Retained Earnings Income summary Assets Cash Prepaid Insurance Inventory: administration Inventory animal food Inventory: concession Inventory: finished goods Inventory raw materials Inventory: water chemicals Inventory: water saline Inventory work in process Manufacturing Overhead Building & Equipment Land Income Admission Revenues Concession Sales Plush Toy Sales Expenses Cost of goods sold Animal food expense Depreciation Expense Insurance Expense Interest Expense Maintenance Expense Salaries Expense: Operations Selling & Administrative Expense Utilities Expense Water Treatment Expense Table 2 Water Works Account Balances June 1, s S 1,000,000.00 4,000,000.00 Cash Prepaid Insurance Inventories: Animal Foods Water chemicals Water saline Concession Administrative Land Buildings & Equip Accum Depreciation bld &equip Season Passes Notes Payable Stock Retained Earnings $ s s s S S S 50,000.00 255,000.00 31,500.00 450,000.00 60,000.00 16,000,000.00 26,000,000.00 (11,000,000,00) (600,000.00) (23,000,000.00) (4,000,000.00) (9,246,500.00) S s s S $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts