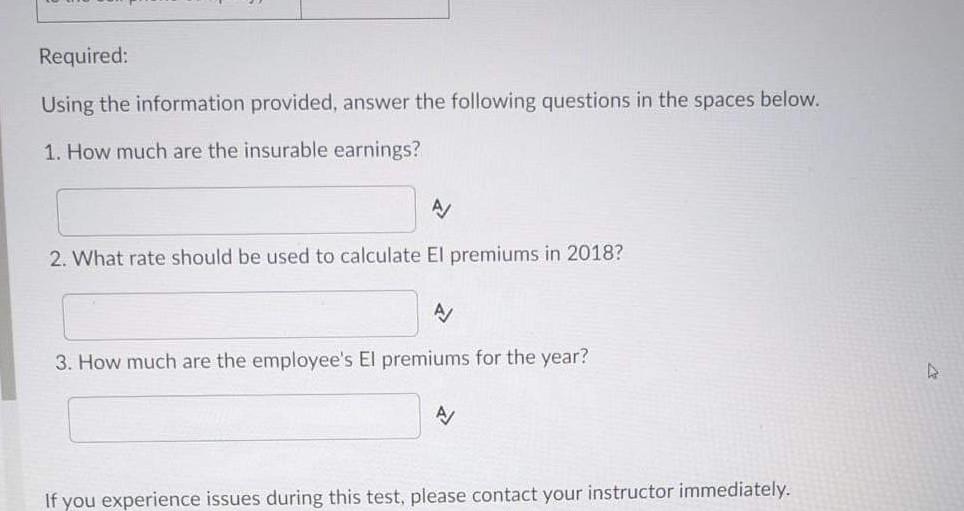

Question: Required: Using the information provided, answer the following questions in the spaces below. 1. How much are the insurable earnings? A/ 2. What rate should

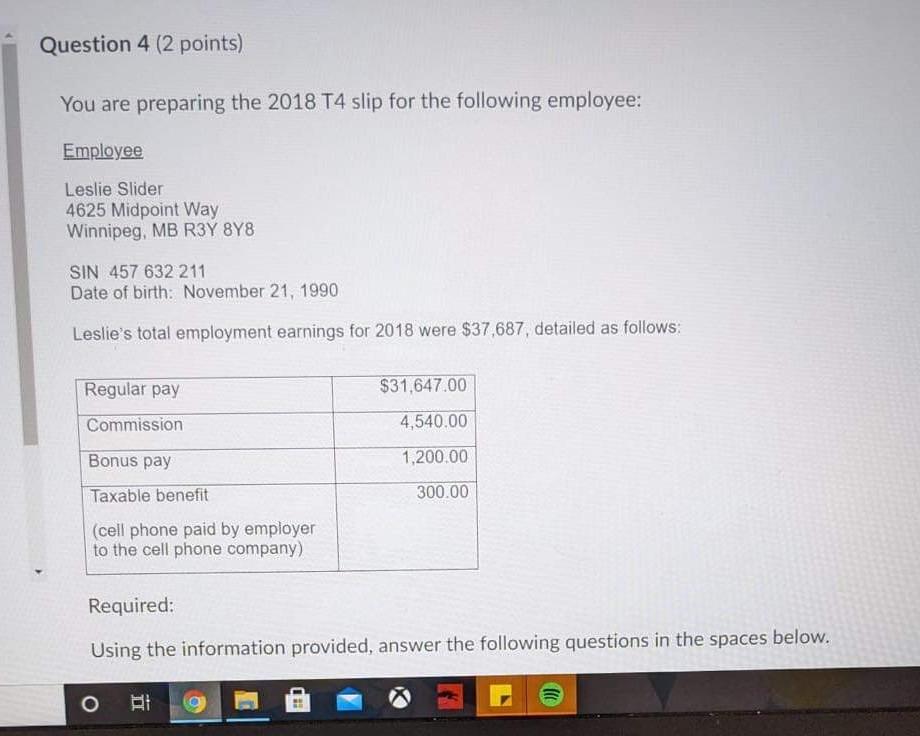

Required: Using the information provided, answer the following questions in the spaces below. 1. How much are the insurable earnings? A/ 2. What rate should be used to calculate El premiums in 2018? A/ 3. How much are the employee's El premiums for the year? A If you experience issues during this test, please contact your instructor immediately. Question 4 (2 points) You are preparing the 2018 T4 slip for the following employee: Employee Leslie Slider 4625 Midpoint Way Winnipeg, MB R3Y 8Y8 SIN 457 632 211 Date of birth: November 21, 1990 Leslie's total employment earnings for 2018 were $37,687, detailed as follows: Regular pay $31,647.00 Commission Bonus pay 4,540.00 1,200.00 300.00 Taxable benefit (cell phone paid by employer to the cell phone company) Required: Using the information provided, answer the following questions in the spaces below. OBI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts