Question: Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September 10

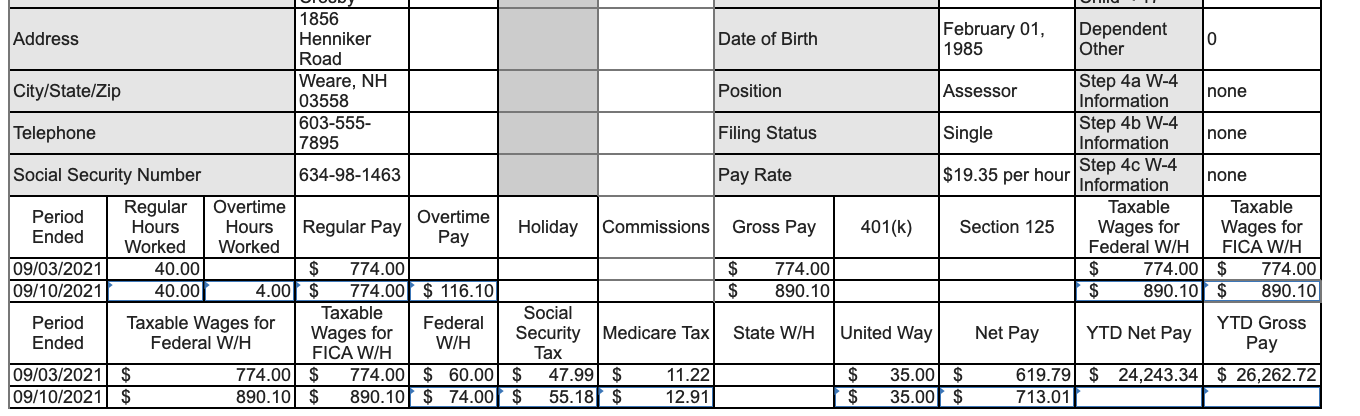

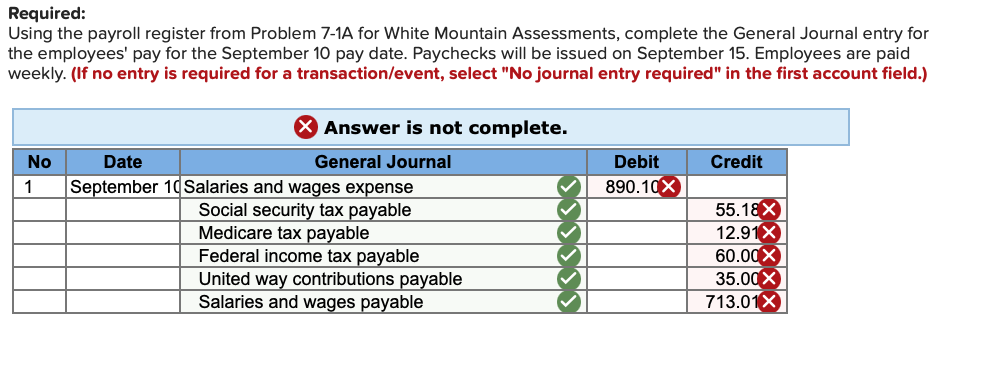

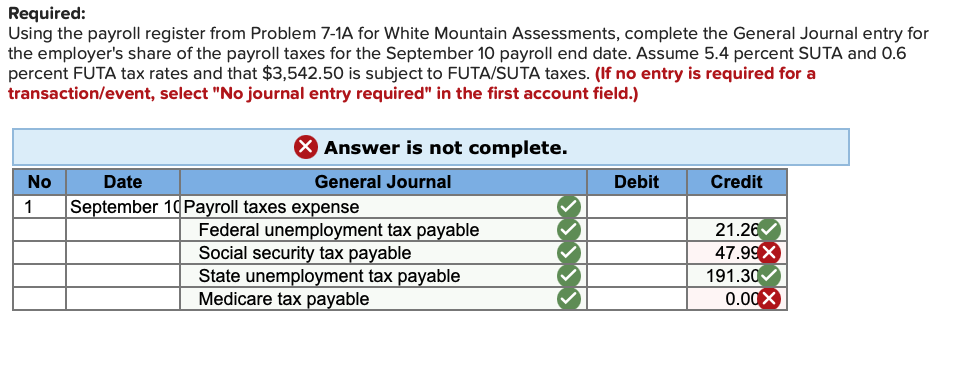

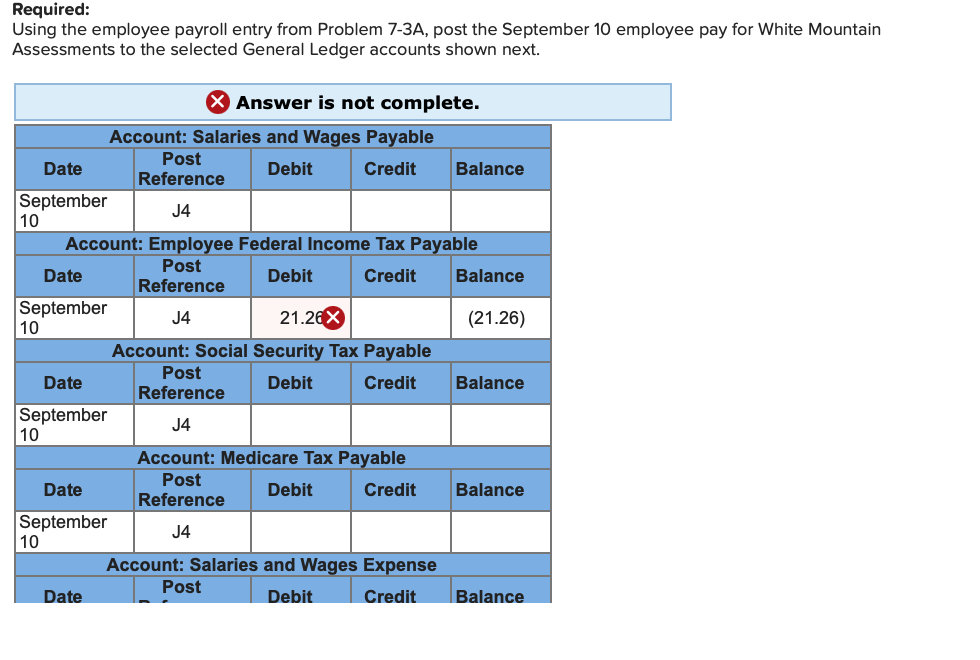

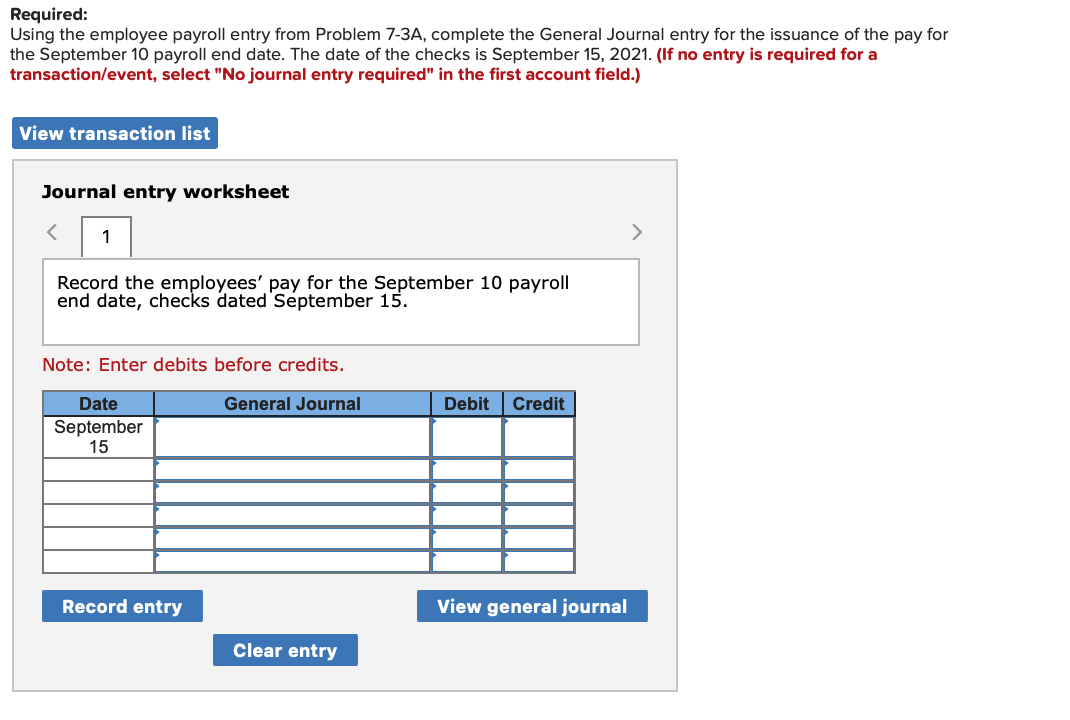

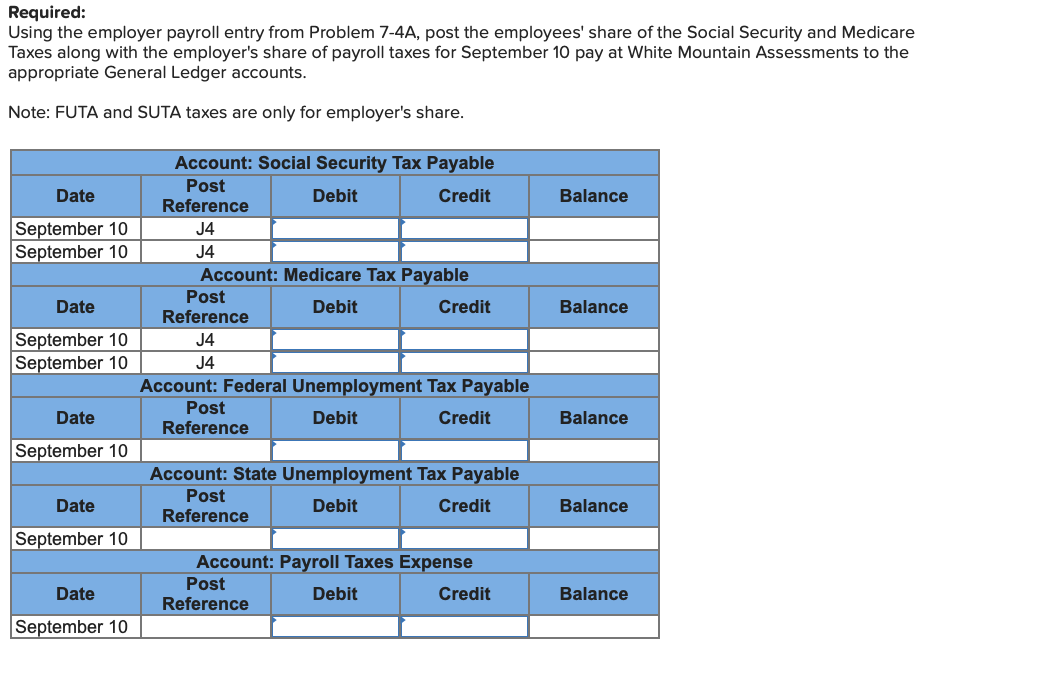

Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September 10 pay date. Paychecks will be issued on September 15 . Employees are paid weekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date. Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3,542.50 is subject to FUTA/SUTA taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the employee payroll entry from Problem 7-3A, post the September 10 employee pay for White Mountain Assessments to the selected General Ledger accounts shown next. Required: Using the employee payroll entry from Problem 7-3A, complete the General Journal entry for the issuance of the pay for the September 10 payroll end date. The date of the checks is September 15, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the employees' pay for the September 10 payroll end date, checks dated September 15. Note: Enter debits before credits. Required: Using the employer payroll entry from Problem 7-4A, post the employees' share of the Social Security and Medicare Taxes along with the employer's share of payroll taxes for September 10 pay at White Mountain Assessments to the appropriate General Ledger accounts. Note: FUTA and SUTA taxes are only for employer's share. Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September 10 pay date. Paychecks will be issued on September 15 . Employees are paid weekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date. Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3,542.50 is subject to FUTA/SUTA taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the employee payroll entry from Problem 7-3A, post the September 10 employee pay for White Mountain Assessments to the selected General Ledger accounts shown next. Required: Using the employee payroll entry from Problem 7-3A, complete the General Journal entry for the issuance of the pay for the September 10 payroll end date. The date of the checks is September 15, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the employees' pay for the September 10 payroll end date, checks dated September 15. Note: Enter debits before credits. Required: Using the employer payroll entry from Problem 7-4A, post the employees' share of the Social Security and Medicare Taxes along with the employer's share of payroll taxes for September 10 pay at White Mountain Assessments to the appropriate General Ledger accounts. Note: FUTA and SUTA taxes are only for employer's share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts