Question: required: what is the added fixed manufacturing overhead cost deferred in inventory under absorption costing and absorption costing net operating income? Denton Company manufactures and

required:

required:

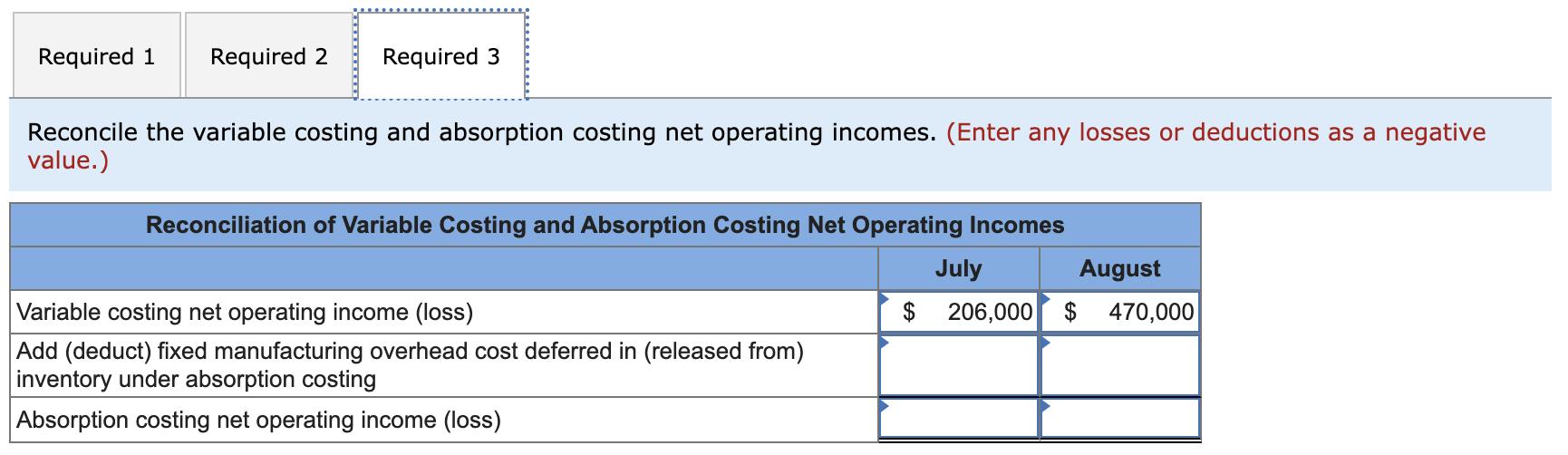

what is the added fixed manufacturing overhead cost deferred in inventory under absorption costing and absorption costing net operating income?

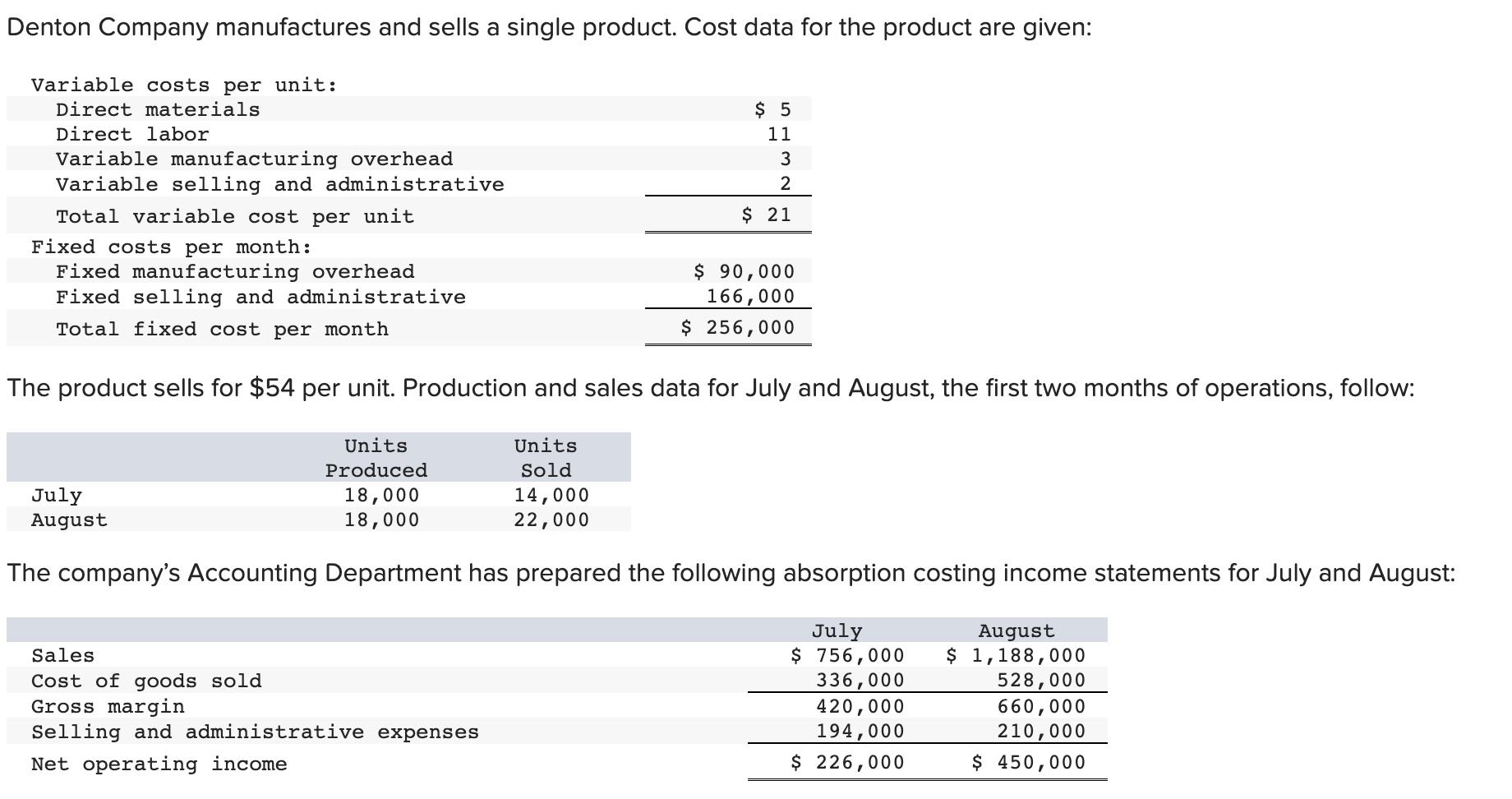

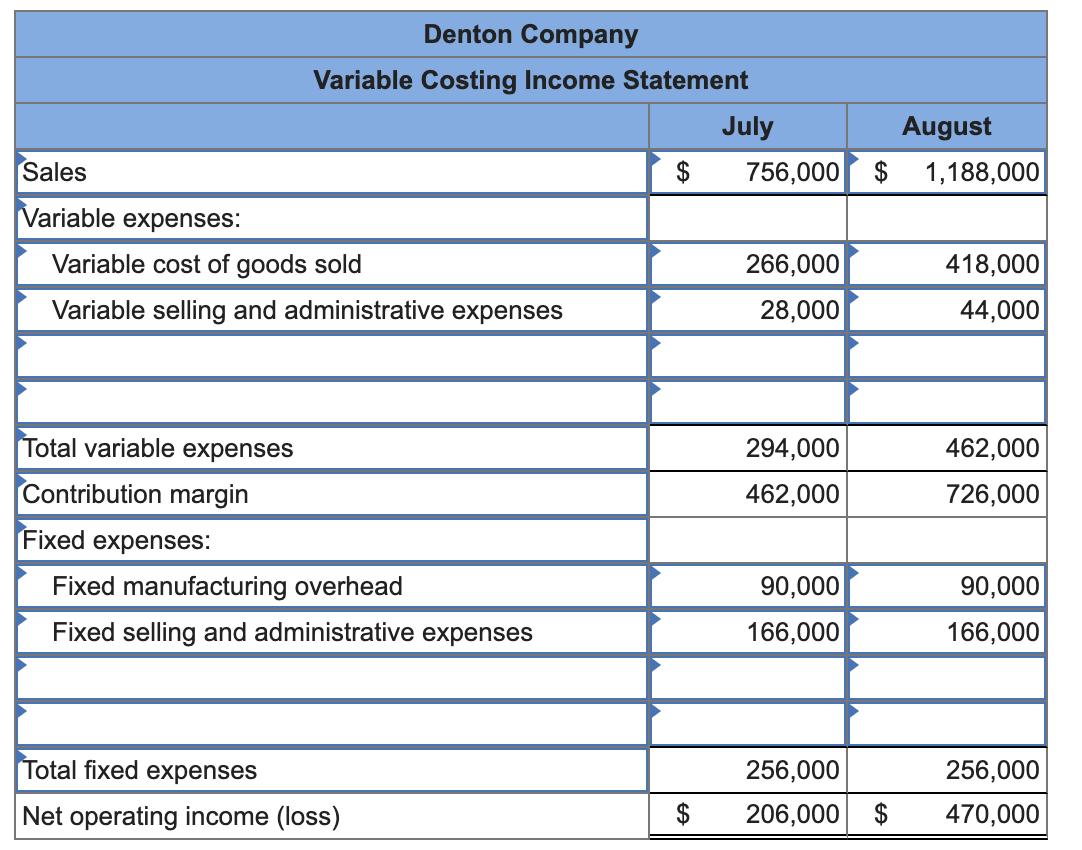

Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative Total fixed cost per month $5 11 3 2 $ 21 The product sells for $54 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Sold 14,000 22,000 July August $ 90,000 166,000 $ 256,000 Units Produced 18,000 18,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income July August $ 756,000 $ 1,188,000 336,000 420,000 194,000 $ 226,000 528,000 660,000 210,000 $ 450,000

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Month Variable Costing Net Operating Income Absorption Costing Net Ope... View full answer

Get step-by-step solutions from verified subject matter experts