Question: Required: Which division ( s ) will likely accept the proposal, and which will likely reject the proposal? Explain. 2. (20 points) Lee Company has

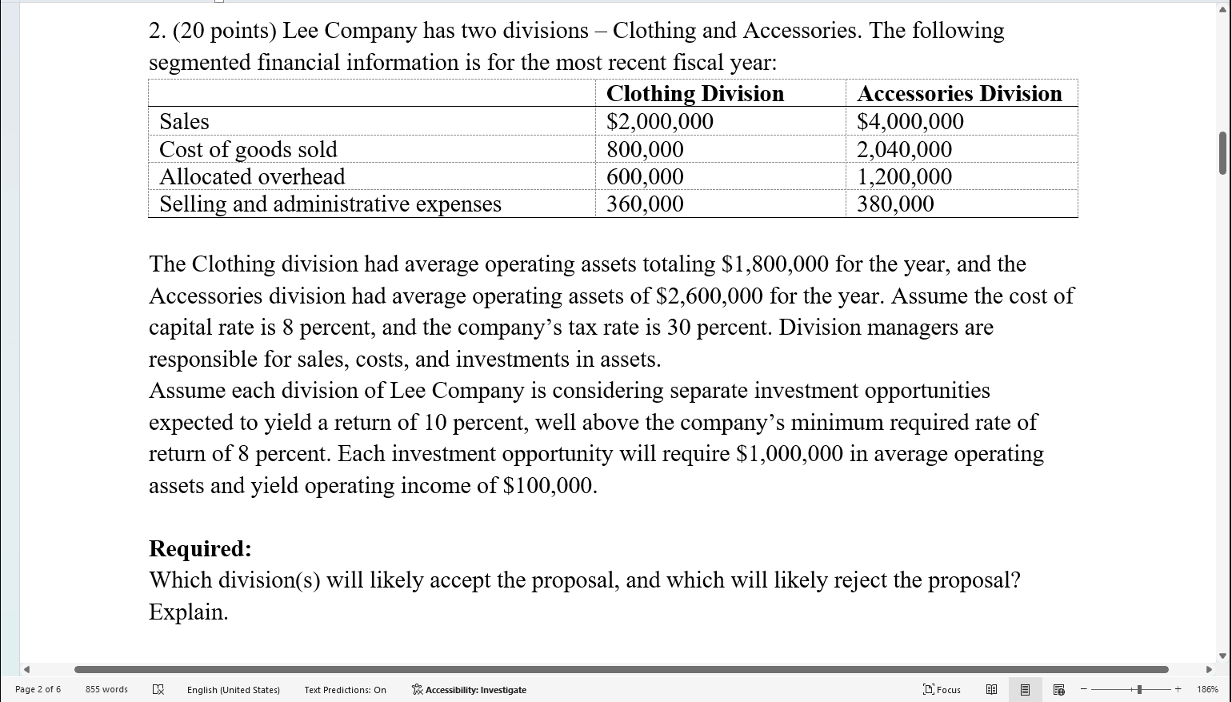

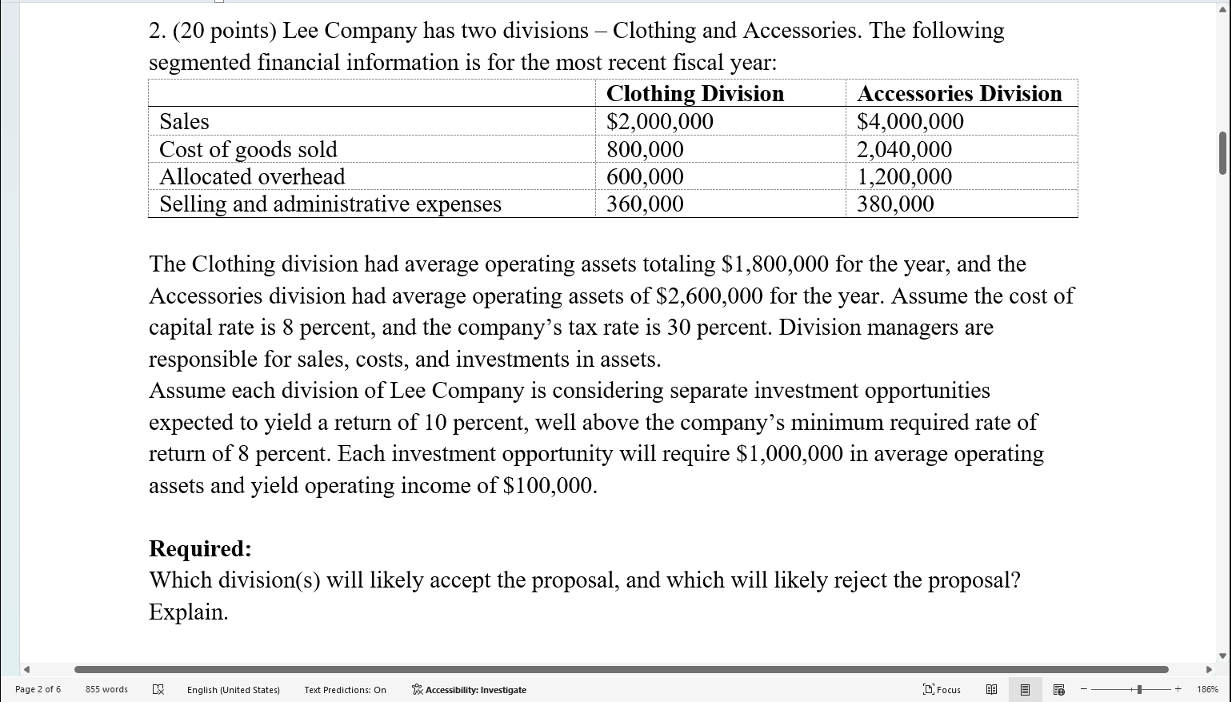

2. (20 points) Lee Company has two divisions Clothing and Accessories. The following segmented financial information is for the most recent fiscal year: Sales Cost of goods sold Allocated overhead Selling and administrative expenses Clothin Division 800,000 600,000 360,000 Accessories Division 380,000 The Clothing division had average operating assets totaling $1,800,000 for the year, and the Accessories division had average operating assets of $2,600,000 for the year. Assume the cost of capital rate is 8 percent, and the company's tax rate is 30 percent. Division managers are responsible for sales, costs, and investments in assets. Assume each division of Lee Company is considering separate investment opportunities expected to yield a return of 10 percent, well above the company's minimum required rate of return of 8 percent. Each investment opportunity will require S I ,000,000 in average operating assets and yield operating income of $100,000. Required: Which division(s) will likely accept the proposal, and which will likely reject the proposal? Explain. page Engli:n lunited States' r dictions: O Acc.ibility: In

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts