Question: Required: Which machine would have the greater Net Present Value and should be selected (using Income- Basis Method). The Finance director of the company is

Required: Which machine would have the greater Net Present Value and should be selected (using Income- Basis Method).

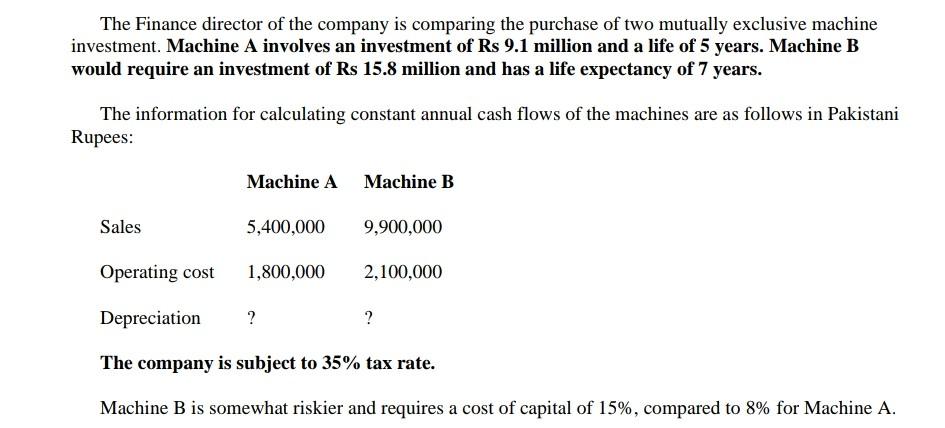

The Finance director of the company is comparing the purchase of two mutually exclusive machine investment. Machine A involves an investment of Rs 9.1 million and a life of 5 years. Machine B would require an investment of Rs 15.8 million and has a life expectancy of 7 years. The information for calculating constant annual cash flows of the machines are as follows in Pakistani Rupees: Machine A Machine B Sales 5,400,000 9,900,000 Operating cost 1,800,000 2,100,000 Depreciation ? ? The company is subject to 35% tax rate. Machine B is somewhat riskier and requires a cost of capital of 15%, compared to 8% for Machine A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts