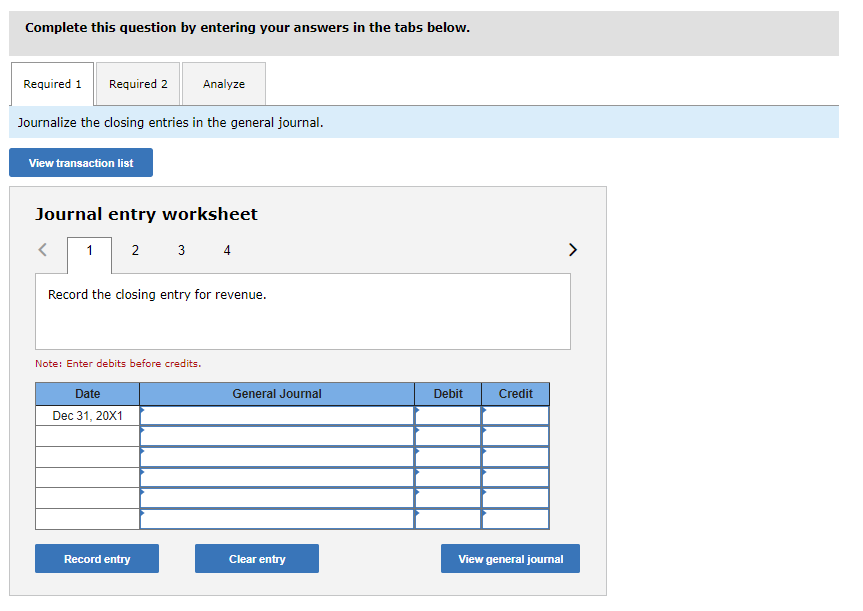

Question: required1: Journal entry worksheet 1. Record the closing entry for revenue. 2. Record the closing entry for expenses. 3. Record the closing entry for the

required1: Journal entry worksheet

1. Record the closing entry for revenue.

2. Record the closing entry for expenses.

3. Record the closing entry for the balance of income summary.

4. Record the closing entry for the drawing account.

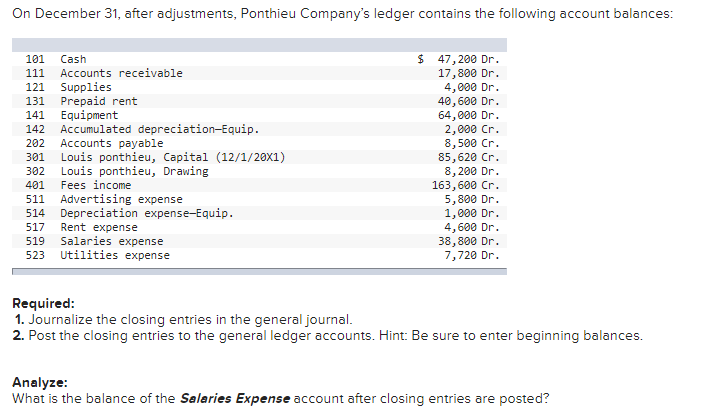

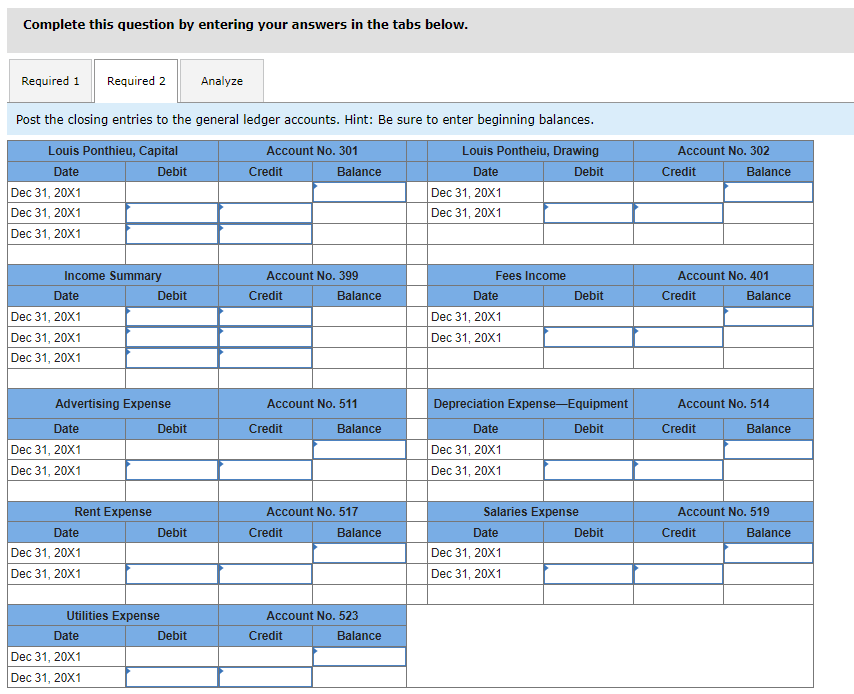

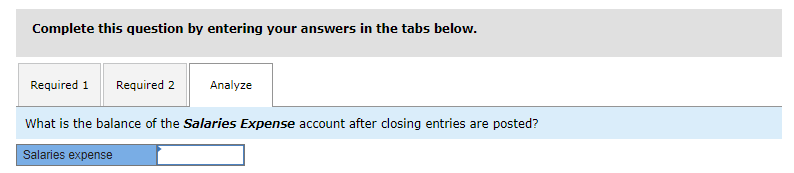

On December 31, after adjustments, Ponthieu Company's ledger contains the following account balances: 101 Cash 111 Accounts receivable 121 Supplies 131 Prepaid rent 141 Equipment 142 Accumulated depreciation-Equip. 202 Accounts payable 301 Louis ponthieu, Capital (12/1/20x1) 302 Louis ponthieu, Drawing 401 Fees income 511 Advertising expense 514 Depreciation expense-Equip. 517 Rent expense 519 Salaries expense 523 Utilities expense $ 47,200 Dr. 17,800 Dr. 4,000 Dr. 40,600 Dr. 64,000 Dr. 2,000 Cr. 8,500 Cr. 85,620 Cr. 8,200 Dr. 163,600 Cr. 5,800 Dr. 1,000 Dr. 4,600 Dr. 38,800 Dr. 7,720 Dr. Required: 1. Journalize the closing entries in the general journal. 2. Post the closing entries to the general ledger accounts. Hint: Be sure to enter beginning balances. Analyze: What is the balance of the Salaries Expense account after closing entries are posted? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze Journalize the closing entries in the general journal. View transaction list Journal entry worksheet 1 2 3 4 Record the closing entry for rever revenue. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 20X1 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze Post the closing entries to the general ledger accounts. Hint: Be sure to enter beginning balances. Louis Ponthieu, Capital Account No. 301 Louis Pontheiu, Drawing Date Debit Credit Balance Date Debit Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Account No. 302 Credit Balance Account No. 399 Account No. 401 Credit Balance Credit Balance Debit Income Summary Date Debit Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Fees Income Date Dec 31, 20X1 Dec 31, 20X1 Account No. 511 Depreciation Expense-Equipment Account No. 514 Credit Balance Date Debit Credit Balance Advertising Expense Date Debit Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Dec 31, 20X1 Account No. 517 Credit Balance Account No. 519 Credit Balance Rent Expense Date Debit Dec 31, 20X1 Dec 31, 20X1 Salaries Expense Date Debit Dec 31, 20X1 Dec 31, 20X1 Account No. 523 Credit Balance Utilities Expense Date Debit Dec 31, 20X1 Dec 31, 20X1 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze What is the balance of the Salaries Expense account after closing entries are posted? Salaries expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts