Question: Required:1. Prepare classified multiple- step income statement that would be used by the business's owners.2. prepare multiple-step income statement that would be used by external

Required:1. Prepare classified multiple- step income statement that would be used by the business's owners.2. prepare multiple-step income statement that would be used by external users. 3. prepare single-step income statement that would be provided to decision makers outside the company. Analysis component: If you were a decision maker external to Bell Servicing, which income statement format would you prefer and why, if you had a choice?which income statement format(s) could you expect as an external user?

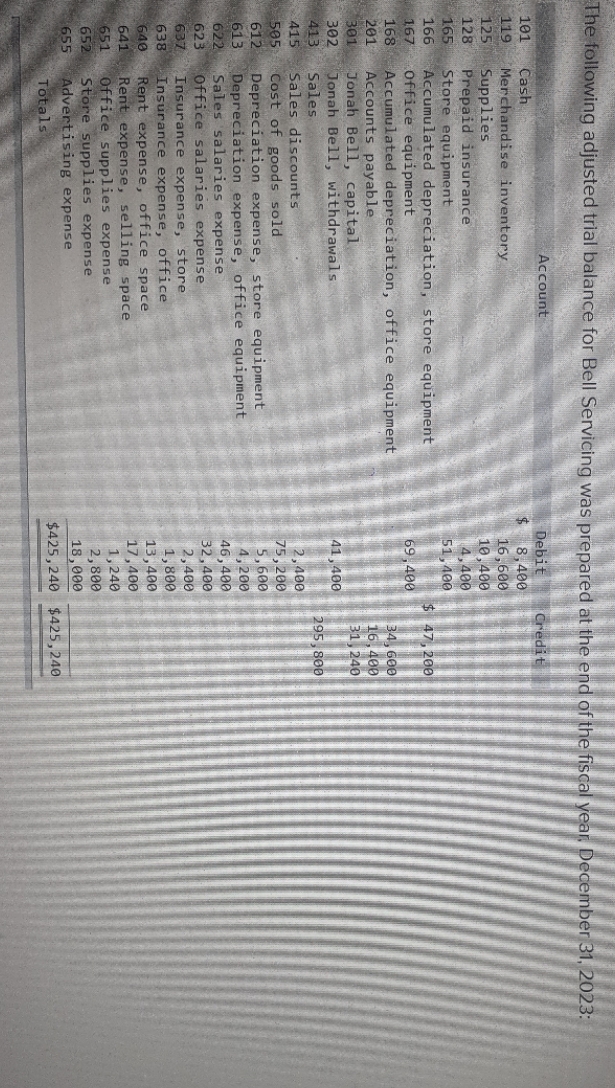

The following adjusted trial balance for Bell Servicing was prepared at the end of the fiscal year, December 31, 2023: Account Debit Credit 101 Cash 8,400 119 Merchandise inventory 16, 600 125 Supplies 10 , 400 128 Prepaid insurance 4, 400 165 Store equipment 51, 100 166 Accumulated depreciation, store equipment $ 47, 200 167 Office equipment 69.400 168 Accumulated depreciation, office equipment 34, 600 201 Accounts payable 16, 460 301 Jonah Bell, capital 31 240 302 Jonah Bell, withdrawals 41 , 400 413 Sales 295, 800 415 Sales discounts 2, 100 505 Cost of goods sold 75, 200 612 Depreciation expense, store equipment 5,600 613 Depreciation expense, office equipment 4, 206 622 Sales salaries expense 46, 400 623 Office salaries expense 32, 400 637 Insurance expense, store 2, 400 638 Insurance expense, office 1, 800 640 Rent expense, office space 13, 400 641 Rent expense, selling space 17, 400 651 Office supplies expense 1, 240 652 Store supplies expense 2, 800 655 Advertising expense 18, 090 Totals $425, 240 $425, 240