Question: Requirement 1. By computing the ratio of (/ ) select the best investment that you should undertake, assuming you are a risk-averse investor. Explain the

Requirement

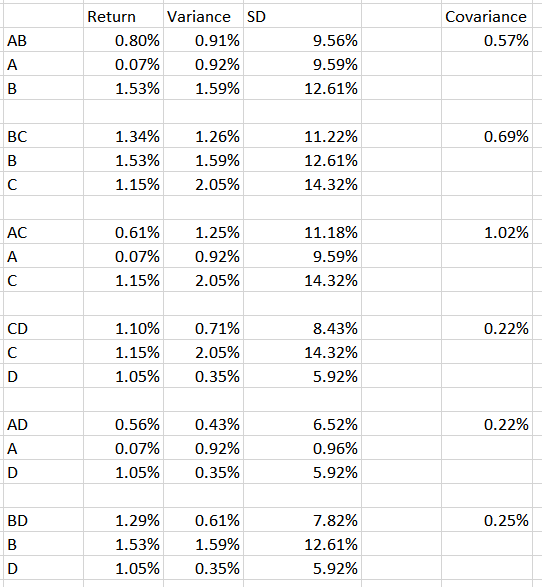

1. By computing the ratio of (/ ) select the best investment that you should undertake, assuming you are a risk-averse investor. Explain the rationale for your choice of investment

2. Draw a portfolio graph (showing Risk on the X-axis and Return on the Y-axis) for the investment portfolio that you have chosen in (4) above for a range of investment weights that you could choose from (i.e., you could invest 5% in one company and 95% in the other or 10% in one company and 90% in the other and so on). Determine from the portfolio graph the minimum risk you could obtain for this portfolio and the respective weightings that should be invested in each of the securities in the portfolio.

Covariance 0.57% AB A B Return Variance SD 0.80% 0.91% 0.07% 0.92% 1.53% 1.59% 9.56% 9.59% 12.61% BC 0.69% B 1.34% 1.53% 1.15% 1.26% 1.59% 2.05% 11.22% 12.61% 14.32% 1.02% AC A C 0.61% 0.07% 1.15% 1.25% 0.92% 2.05% 11.18% 9.59% 14.32% 0.22% CD D 1.10% 1.15% 1.05% 0.71% 2.05% 0.35% 8.43% 14.32% 5.92% 0.22% AD D 0.56% 0.07% 1.05% 0.43% 0.92% 0.35% 6.52% 0.96% 5.92% 0.25% BD B 1.29% 1.53% 1.05% 0.61% 1.59% 0.35% 7.82% 12.61% 5.92% D Covariance 0.57% AB A B Return Variance SD 0.80% 0.91% 0.07% 0.92% 1.53% 1.59% 9.56% 9.59% 12.61% BC 0.69% B 1.34% 1.53% 1.15% 1.26% 1.59% 2.05% 11.22% 12.61% 14.32% 1.02% AC A C 0.61% 0.07% 1.15% 1.25% 0.92% 2.05% 11.18% 9.59% 14.32% 0.22% CD D 1.10% 1.15% 1.05% 0.71% 2.05% 0.35% 8.43% 14.32% 5.92% 0.22% AD D 0.56% 0.07% 1.05% 0.43% 0.92% 0.35% 6.52% 0.96% 5.92% 0.25% BD B 1.29% 1.53% 1.05% 0.61% 1.59% 0.35% 7.82% 12.61% 5.92% D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts