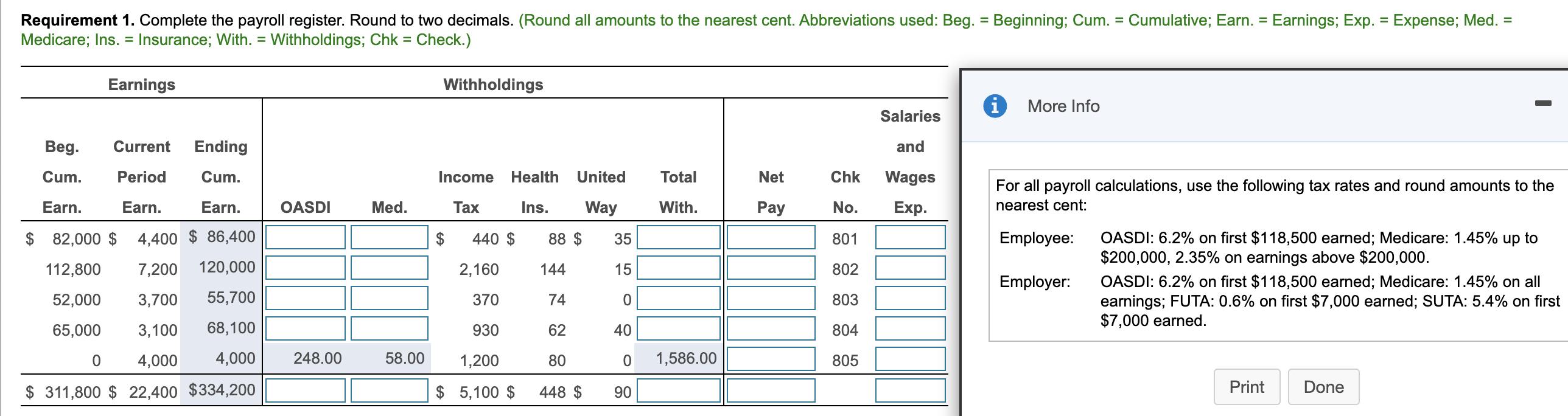

Question: Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. =

Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk = Check.) Earnings Beg. Current Cum. Period Earn. Earn. Earn. $82,000 $4,400 $ 86,400 112,800 7,200 120,000 52,000 3,700 55,700 65,000 3,100 68,100 0 4,000 4,000 $ 311,800 $ 22,400 $334,200 Ending Cum. OASDI 248.00 Med. 58.00 Withholdings Income Tax Health United Total Ins. With. Way 88 $ 440 $ 2,160 370 930 1,200 $ 5,100 $ 144 74 62 80 448 $ 35 15 0 40 0 90 1,586.00 Net Pay Salaries and Chk Wages No. Exp. 801 802 803 804 805 More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: I OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Done

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

To complete the payroll register we need to calculate OASDI and Medicare withholdings for each emplo... View full answer

Get step-by-step solutions from verified subject matter experts