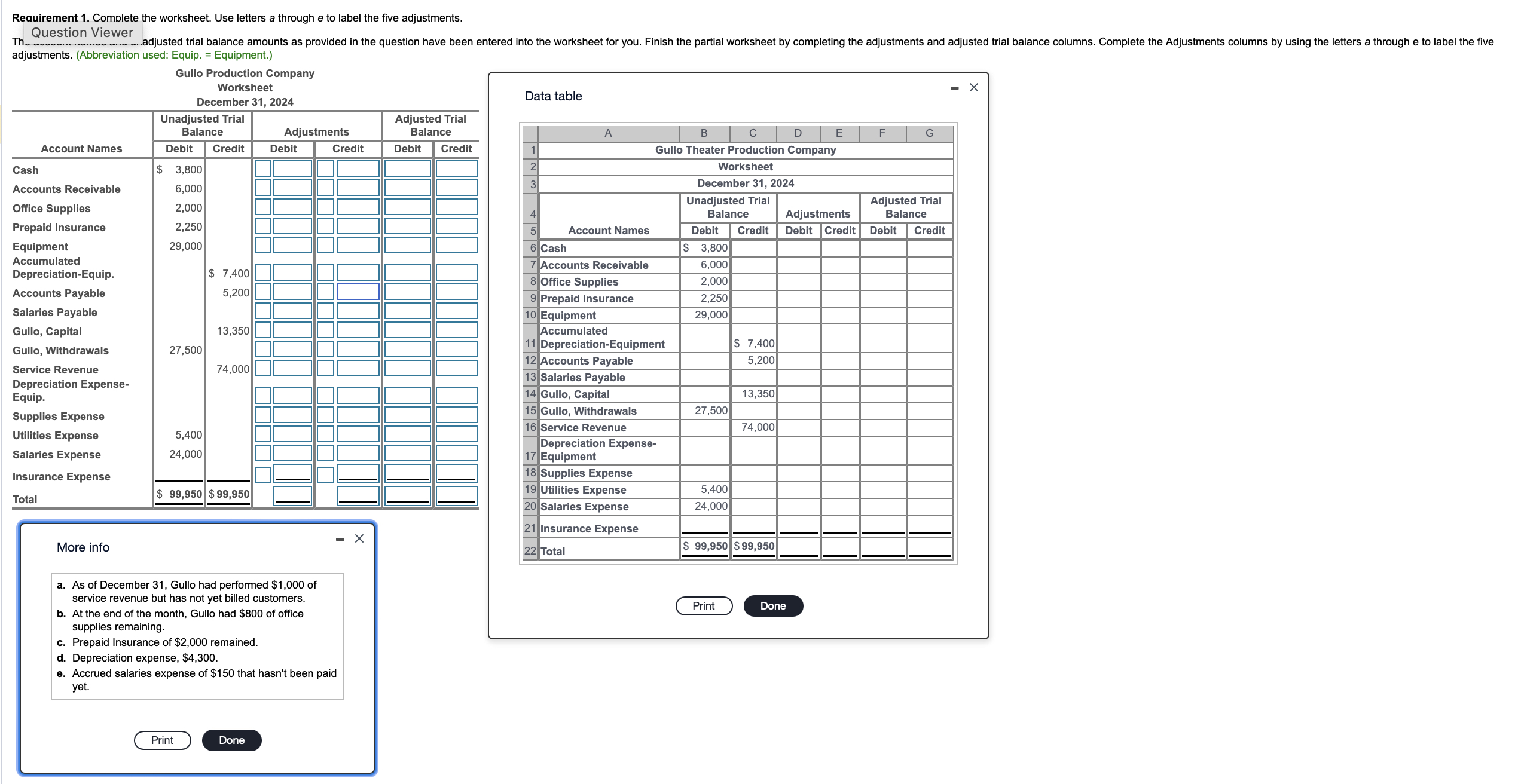

Question: Requirement 1. Complete the worksheet. Use letters a through e to label the five adjustments. Question Viewer Th_ ..adjusted trial balance amounts as provided

Requirement 1. Complete the worksheet. Use letters a through e to label the five adjustments. Question Viewer Th_ ..adjusted trial balance amounts as provided in the question have been entered into the worksheet for you. Finish the partial worksheet by completing the adjustments and adjusted trial balance columns. Complete the Adjustments columns by using the letters a through e to label the five adjustments. (Abbreviation used: Equip. = Equipment.) Gullo Production Company Worksheet December 31, 2024 Data table Unadjusted Trial Balance Adjustments Adjusted Trial Balance A B CDE F G Account Names Debit Credit Debit Credit Debit Credit Cash $ 3,800 -23 1 Gullo Theater Production Company Accounts Receivable 6,000 Office Supplies 2,000 4 Prepaid Insurance 2,250 Equipment 29,000 Accumulated Depreciation-Equip. $ 7,400 Accounts Payable 5,200 Salaries Payable Gullo, Capital Gullo, Withdrawals 13,350 7 Accounts Receivable 8 Office Supplies 10 Equipment Accumulated 11 Depreciation-Equipment 12 Accounts Payable Service Revenue Depreciation Expense- Equip. Supplies Expense $ 3,800 6,000 2,000 9 Prepaid Insurance 2,250 29,000 27,500 $ 7,400 5,200 74,000 13 Salaries Payable 14 Gullo, Capital 13,350 15 Gullo, Withdrawals 27,500 74,000 5 6 Cash Account Names Worksheet December 31, 2024 Unadjusted Trial Balance Debit Credit Debit Adjusted Trial Adjustments Balance Credit Debit Credit Utilities Expense Salaries Expense 5,400 24,000 16 Service Revenue Depreciation Expense- 17 Equipment Insurance Expense $ 99,950 $ 99,950 Total 18 Supplies Expense 19 Utilities Expense 20 Salaries Expense 5,400 24,000 21 Insurance Expense More info a. As of December 31, Gullo had performed $1,000 of service revenue but has not yet billed customers. b. At the end of the month, Gullo had $800 of office supplies remaining. c. Prepaid Insurance of $2,000 remained. d. Depreciation expense, $4,300. e. Accrued salaries expense of $150 that hasn't been paid yet. 22 Total Print Done $ 99,950 $99,950 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts