Question: Requirement 1: Compute a predetermined factory overhead rate for each alternative base. As an assistant cost accountant for Firewall Industries, you have been assigned to

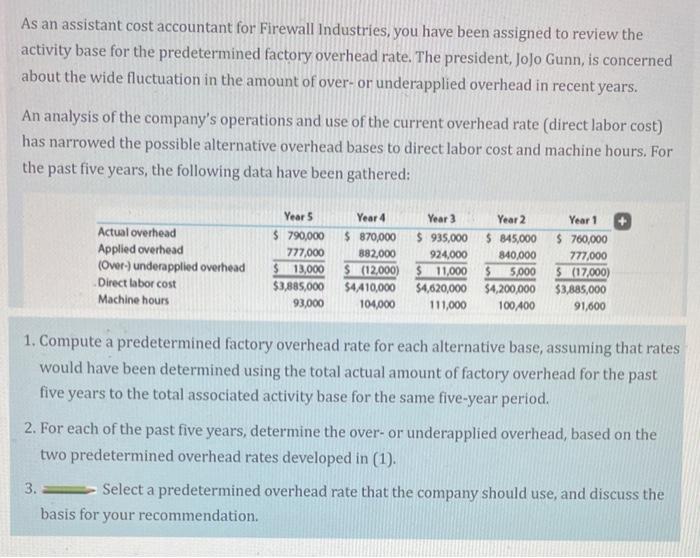

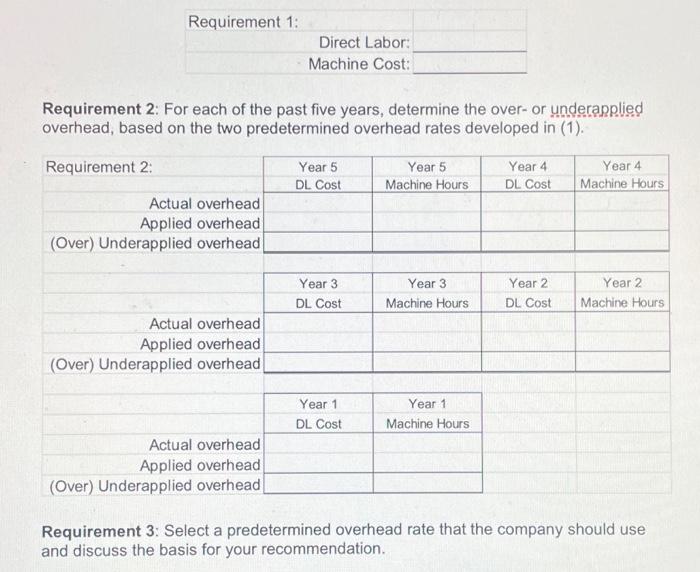

Requirement 1: Compute a predetermined factory overhead rate for each alternative base. As an assistant cost accountant for Firewall Industries, you have been assigned to review the activity base for the predetermined factory overhead rate. The president, Jolo Gunn, is concerned about the wide fluctuation in the amount of over- or underapplied overhead in recent years. An analysis of the company's operations and use of the current overhead rate (direct labor cost) has narrowed the possible alternative overhead bases to direct labor cost and machine hours. For the past five years, the following data have been gathered: 1. Compute a predetermined factory overhead rate for each alternative base, assuming that rates would have been determined using the total actual amount of factory overhead for the past five years to the total associated activity base for the same five-year period. 2. For each of the past five years, determine the over- or underapplied overhead, based on the two predetermined overhead rates developed in (1). 3. Select a predetermined overhead rate that the company should use, and discuss the basis for your recommendation. Requirement 2: For each of the past five years, determine the over- or underappljed overhead, based on the two predetermined overhead rates developed in (1). Requirement 3: Select a predetermined overnead rate that the company should use and discuss the basis for your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts