Question: Requirement 1 Define materiality. Do not copy this from the textbook; write it in your own words in a way that would be understandable for

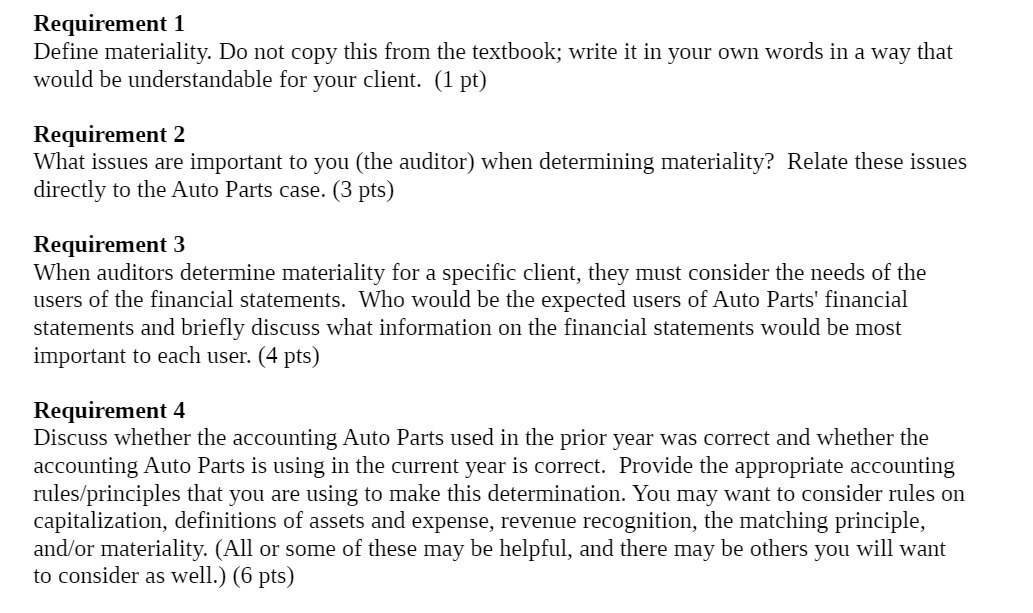

Requirement 1 Define materiality. Do not copy this from the textbook; write it in your own words in a way that would be understandable for your client. (1 pt) Requirement 2 What issues are important to you {the auditor) when determining materiality? Relate these issues directly to the Auto Parts case. (3 pts) Requirement 3 When auditors determine materiality for a specific client, they must consider the needs of the users of the financial statements. 'Who would be the expected users of Auto Parts' financial statements and briey discuss what information on the financial statements would be most important to each user. (4 pts) Requirement 4 Discuss whether the accounting Auto Parts used in the prior year was correct and whether the accounting Auto Parts is using in the current year is correct. Provide the appropriate accounting rulesr'principles that you are using to make this determination. You may want to consider rules on capitalization, definitions of assets and expense, revenue recognition, the matching principle, andfor materiality. (All or some of these may be helpful, and there may be others you will want to consider as well.) (6 pts)

Step by Step Solution

There are 3 Steps involved in it

It seems that the image contains the questions you provided earlier Ill now proceed to answer each of the questions in detail Requirement 1 Define materiality Materiality refers to the significance of ... View full answer

Get step-by-step solutions from verified subject matter experts