Question: Requirement 1 option ( should or should not) (negative or positive) Requirement 2 options( negative or positive) (large enough not large enough) ( should or

Requirement 1 option (should or should not) (negative or positive)

Requirement 2 options(negative or positive) (large enough not large enough) (should or should not)

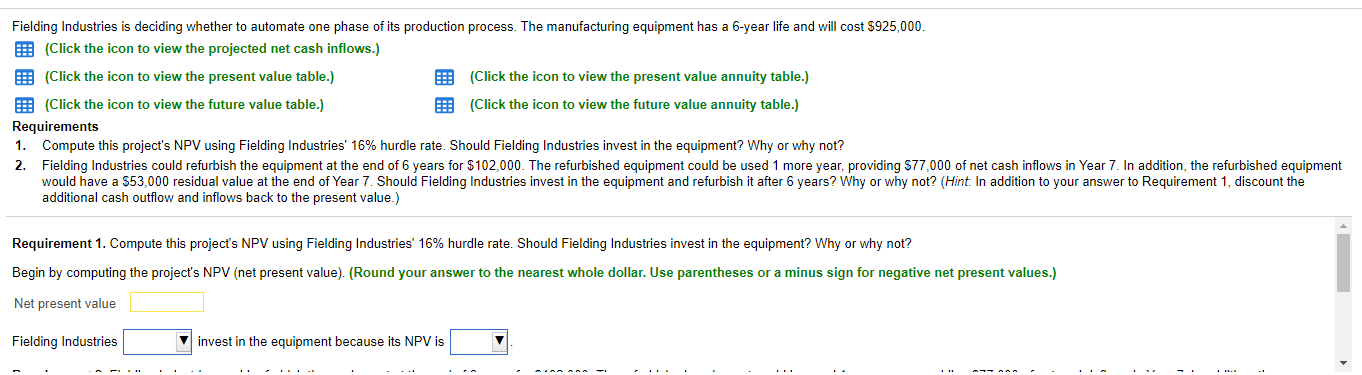

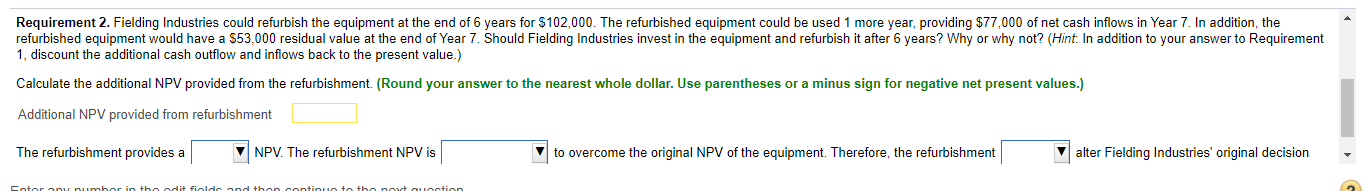

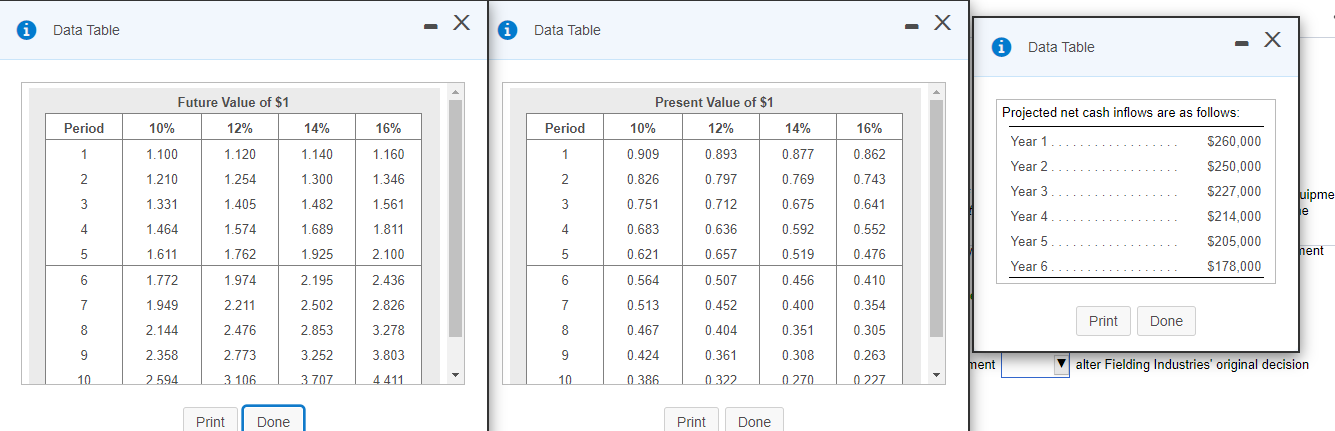

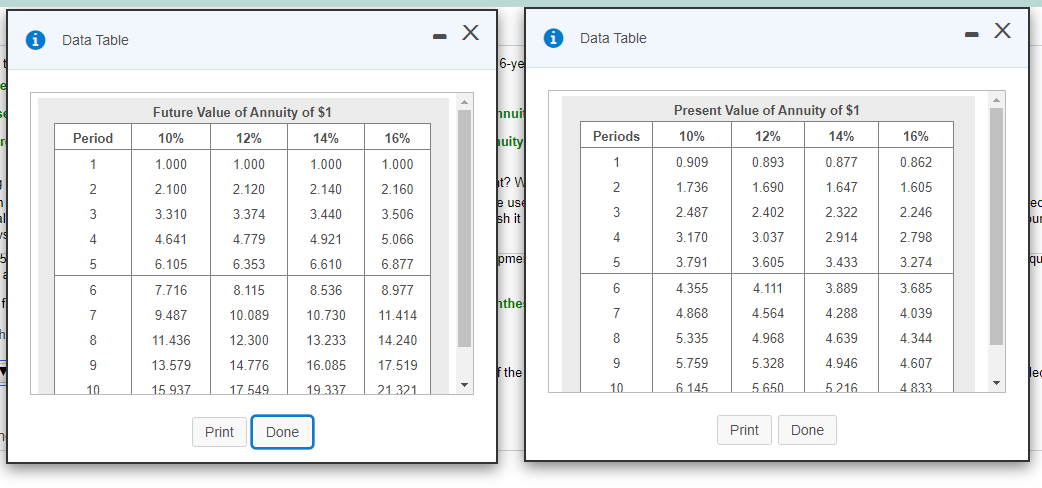

Fielding Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a 6-year life and will cost $925,000. (Click the icon to view the projected net cash inflows.) E: (Click the icon to view the present value table.) (Click the icon to view the present value annuity table.) : (Click the icon to view the future value table.) E (Click the icon to view the future value annuity table.) Requirements 1. Compute this project's NPV using Fielding Industries' 16% hurdle rate. Should Fielding Industries invest in the equipment? Why or why not? 2. Fielding Industries could refurbish the equipment at the end of 6 years for $102,000. The refurbished equipment could be used 1 more year, providing $77,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $53,000 residual value at the end of Year 7. Should Fielding Industries invest in the equipment and refurbish it after 6 years? Why or why not? (Hint. In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Requirement 1. Compute this project's NPV using Fielding Industries' 16% hurdle rate. Should Fielding Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Net present value Fielding Industries invest in the equipment because its NPV is Requirement 2. Fielding Industries could refurbish the equipment at the end of 6 years for $102,000. The refurbished equipment could be used 1 more year, providing $77,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $53,000 residual value at the end of Year 7. Should Fielding Industries invest in the equipment and refurbish it after 6 years? Why or why not? (Hint. In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Calculate the additional NPV provided from the refurbishment. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Additional NPV provided from refurbishment 1 The refurbishment provides a NPV. The refurbishment NPV is to overcome the original NPV of the equipment. Therefore, the refurbishment Valter Fielding Industries' original decision thon continuo to the nortonction i - X . X 0 Data Table Data Table i . Data Table Future Value of $1 Present Value of $1 Projected net cash inflows are as follows: Period 10% 12% 14% 16% Period 10% 12% 14% 16% Year 1 $260,000 1 1 1.100 1.120 1.140 1.160 1 0.909 0.893 0.877 0.862 Year 2 $250,000 2 1.210 1.254 1.300 1.346 2 0.826 0.797 0.769 0.743 $227,000 3 1.331 1.405 1.482 1.561 3 0.751 0.712 0.675 0.641 Year 3 Year 4 uipme je 4 1.464 1.574 1.689 1.811 4 0.683 0.636 0.592 0.552 Year 5 $214,000 $205,000 $178,000 5 1.611 1.762 1.925 2.100 5 0.621 0.657 0.519 0.476 nent Year 6 6 1.772 1.974 6 0.564 0.507 0.456 0.410 2.195 2.502 2.436 2.826 7 1.949 2.211 7 0.513 0.452 0.400 0.354 0.305 Print 8 Done 2.144 2.476 2.853 3.278 8 0.467 0.404 0.351 9 2.358 2.773 3.252 3.803 9 0.424 0.361 0.308 0.263 ment Valter Fielding Industries' original decision 10 2594 3 106 3 707 4 411 10 0 386 0322 0270 0227 Print Done Print Done - Data Table Data Table i 6-ye e hnui Present Value of Annuity of $1 10% 12% 14% Period 16% Periods r 16% uity 1 Future Value of Annuity of $1 10% 12% 14% 1.000 1.000 1.000 2.100 2.120 2.140 3.310 3.374 3.440 1.000 1 1 0.909 0.877 0.862 0.893 1.690 2 2.160 2. 1.736 1.647 1.605 lt? W e use sh it 3 3.506 3 2.487 2.402 2.322 al 2.246 ec bu 1S 4 4.641 4.779 4.921 5.066 4 3.170 3.037 2.914 2.798 5 5 6.105 6.353 6.610 6.877 pme 5 3.791 3.605 3.433 3.274 qu 6 7.716 8.115 8.536 8.977 6 4.355 4.111 3.889 3.685 hthe 7 9.487 10.089 10.730 11.414 7 4.868 4.564 4.288 4.039 n 8 11.436 12.300 13.233 14.240 8 5.335 4.968 4.639 4.344 9 13.579 14.776 16.085 17.519 9 5.759 5.328 4.946 4.607 Fthe led 10 15.937 17 549 19 337 21 321 10 6 145 5 650 5 216 4833 Print Done Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts