Question: Requirement 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture: Land: Accounts Payable; Utilities

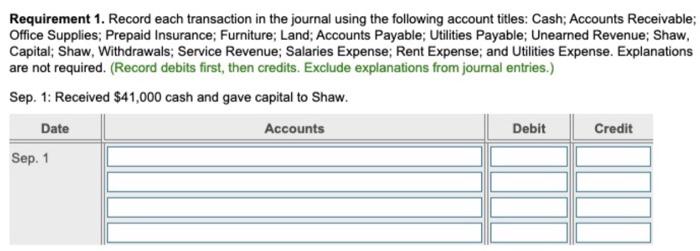

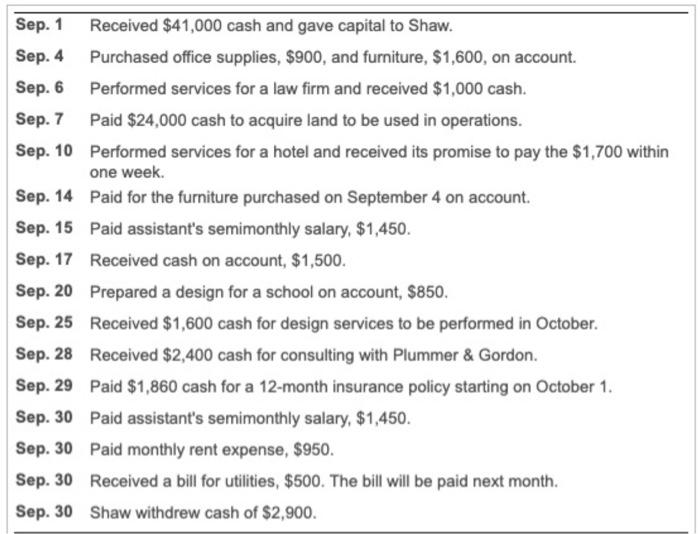

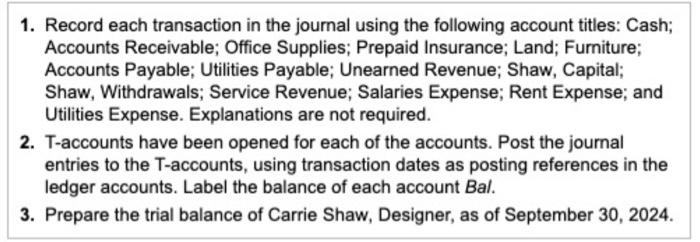

Requirement 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture: Land: Accounts Payable; Utilities Payable; Unearned Revenue; Shaw, Capital; Shaw, Withdrawals; Service Revenue; Salaries Expense; Rent Expense; and Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Sep. 1: Received $41,000 cash and gave capital to Shaw. Date Accounts Debit Credit Sep. 1 Sep. 1 Received $41,000 cash and gave capital to Shaw. Sep.4 Purchased office supplies, $900, and furniture, $1,600, on account. Sep. 6 Performed services for a law firm and received $1,000 cash. Sep. 7 Paid $24,000 cash to acquire land to be used in operations. Sep. 10 Performed services for a hotel and received its promise to pay the $1,700 within one week. Sep. 14 Paid for the furniture purchased on September 4 on account. Sep. 15 Paid assistant's semimonthly salary, $1,450. Sep. 17 Received cash on account, $1,500. Sep. 20 Prepared a design for a school on account, $850, Sep. 25 Received $1,600 cash for design services to be performed in October Sep. 28 Received $2,400 cash for consulting with Plummer & Gordon. Sep. 29 Paid $1,860 cash for a 12-month insurance policy starting on October 1. Sep. 30 Paid assistant's semimonthly salary, $1,450. Sep. 30 Paid monthly rent expense, $950. Sep. 30 Received a bill for utilities, $500. The bill will be paid next month. Sep. 30 Shaw withdrew cash of $2,900. 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Furniture; Accounts Payable; Utilities Payable; Unearned Revenue; Shaw, Capital; Shaw, Withdrawals; Service Revenue; Salaries Expense; Rent Expense; and Utilities Expense. Explanations are not required. 2. T-accounts have been opened for each of the accounts. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger accounts. Label the balance of each account Bal. 3. Prepare the trial balance of Carrie Shaw, Designer, as of September 30, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts