Question: Requirement 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the

Requirement 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate.

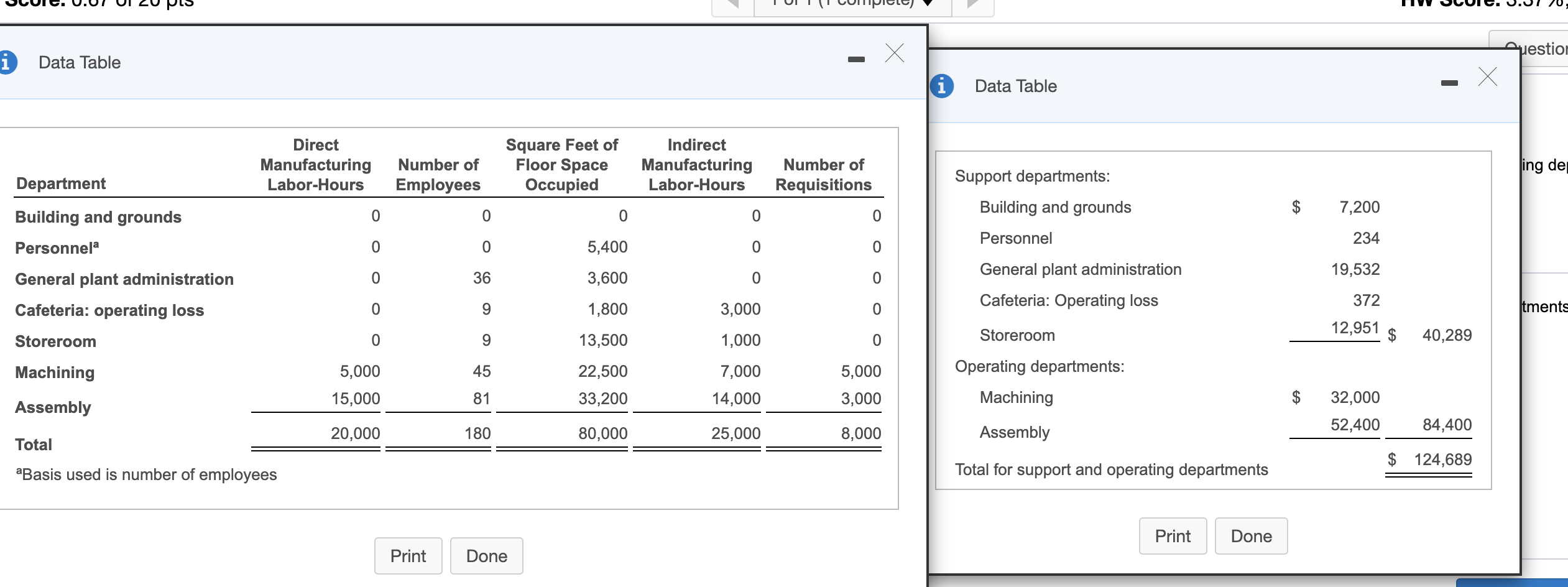

Begin by selecting the allocation base for each support department.

| Support Department | Allocation Base |

| Building and grounds | Square feet of floor space occupied |

| Personnel | Number of employees |

| General plant administration | Manufacturing labor-hours |

| Cafeteria: operating loss | Number of employees |

| Storeroom | Number of requisitions |

Using the step-down method, allocate support-department costs. Allocate the costs of the support departments in the order given in this problem. (Round all indirect allocation rates to the nearest cent and all other computations to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs.)

|

| Support Departments | Operating Departments | ||||||

|

|

| General | Cafeteria |

|

|

| ||

| Bldg and |

| Plant | Operating |

|

|

| ||

|

|

| Grounds | Personnel | Admin. | Loss | Storeroom | Machining | Assembly |

| Costs incurred |

|

|

|

|

|

|

| |

| Allocation of costs: | ||||||||

| Building and grounds |

|

|

|

|

|

|

| |

| Personnel |

| |||||||

| General plant administration | ||||||||

| Cafeteria | ||||||||

| Storeroom |

| |||||||

| Total budgeted costs of operating departments |

| |||||||

Develop overhead rates per direct manufacturing labor-hour for machining and assembly using the step-down method. (Round the overhead rates to three decimal places.)

| Step-down method: |

|

|

| Overhead rate per direct | |

|

| Total costs allocated to department | Direct manufacturing labor-hours | = | manufacturing labor-hour | |

| Machining | |||||

| Assembly | |||||

Requirement 2. Using the direct method, rework requirement 1.

Using the direct method, allocate support-department costs. (Round cost allocations to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs.)

|

| Support Departments | Operating Departments | ||||||

|

|

| General | Cafeteria |

|

|

| ||

| Bldg and |

| Plant | Operating |

|

|

| ||

|

|

| Grounds | Personnel | Admin. | Loss | Storeroom | Machining | Assembly |

| Costs incurred | ||||||||

| Allocation of costs: | ||||||||

| Building and grounds | ||||||||

| Personnel | ||||||||

| General plant administration | ||||||||

| Cafeteria | ||||||||

| Storeroom | ||||||||

Develop overhead rates per direct manufacturing labor-hour for machining and assembly using the direct method. (Round the overhead rates to three decimal places.)

| Direct method: |

|

|

| Overhead rate per direct | |

|

| Total costs allocated to department | Direct manufacturing labor-hours | = | manufacturing labor-hour | |

| Machining | |||||

| Assembly | |||||

Requirement 3. Based on the information about two jobs

LOADING...

, determine the total overhead costs for each job by using rates developed in (a) requirement 1 and (b) requirement 2.

Start by computing the total overhead costs for each job using the rates developed in (a) requirement 1 (the step-down method.) (Round the total overhead costs to the nearest cent.)

| (a) Step-down method: | Total | |

|

| Overhead Costs | |

| Job 88: | Machining |  |

| Assembly | ||

| Total cost of Job 88 | ||

| Job 89: | Machining | |

| Assembly | ||

|

| Total cost of Job 89 | |

Now compute the total overhead costs for each job using the rates developed in (b) requirement 2 (the direct method). (Round the total overhead costs to the nearest cent.)

| (b) Direct method: | Total | |

|

| Overhead Costs | |

| Job 88: | Machining | |

| Assembly | ||

| Total cost of Job 88 | ||

| Job 89: | Machining | |

| Assembly | ||

|

| Total cost of Job 89 | |

Requirement 4. The company evaluates the performance of the operating department managers on the basis of how well they managed their total costs, including allocated costs. As the manager of the Machining Department, which allocation method would you prefer from the results obtained in requirements 1 and 2? Explain.

The manager of machining department would

prefer the direct method

since

this method results in the lesser

amount of overhead costs being allocated to the machining department.

X Question i Data Table i X Data Table Direct Manufacturing Labor-Hours Square Feet of Floor Space Occupied Indirect Manufacturing Labor-Hours Number of Employees ing de Department Number of Requisitions Support departments: 7,200 Building and grounds 0 Building and grounds 0 0 0 0 Personnel 234 Personnela 0 0 5,400 0 0 19,532 General plant administration 0 36 3,600 0 0 General plant administration Cafeteria: Operating loss 372 Cafeteria: operating loss 0 9 1,800 3,000 0 tments 12,951 Storeroom 0 9 13,500 $ 1,000 0 Storeroom 40,289 Machining 45 5,000 15,000 22,500 33,200 7,000 14,000 5,000 3,000 Operating departments: Machining 81 $ Assembly 32,000 52,400 20,000 80,000 180 84,400 25,000 Assembly 8,000 Total $ 124,689 aBasis used is number of employees Total for support and operating departments Print Done Print Done X Question i Data Table i X Data Table Direct Manufacturing Labor-Hours Square Feet of Floor Space Occupied Indirect Manufacturing Labor-Hours Number of Employees ing de Department Number of Requisitions Support departments: 7,200 Building and grounds 0 Building and grounds 0 0 0 0 Personnel 234 Personnela 0 0 5,400 0 0 19,532 General plant administration 0 36 3,600 0 0 General plant administration Cafeteria: Operating loss 372 Cafeteria: operating loss 0 9 1,800 3,000 0 tments 12,951 Storeroom 0 9 13,500 $ 1,000 0 Storeroom 40,289 Machining 45 5,000 15,000 22,500 33,200 7,000 14,000 5,000 3,000 Operating departments: Machining 81 $ Assembly 32,000 52,400 20,000 80,000 180 84,400 25,000 Assembly 8,000 Total $ 124,689 aBasis used is number of employees Total for support and operating departments Print Done Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts