Question: Requirement 1A 1B 2A 2B 6 Problem 6-20 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating

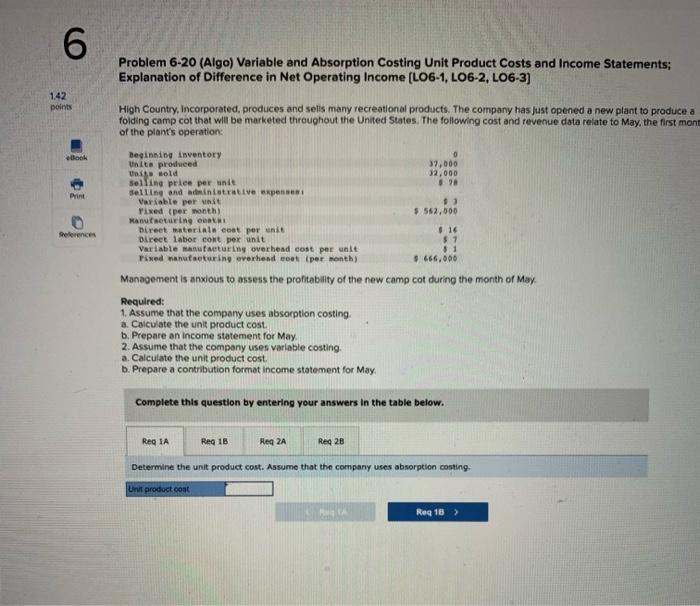

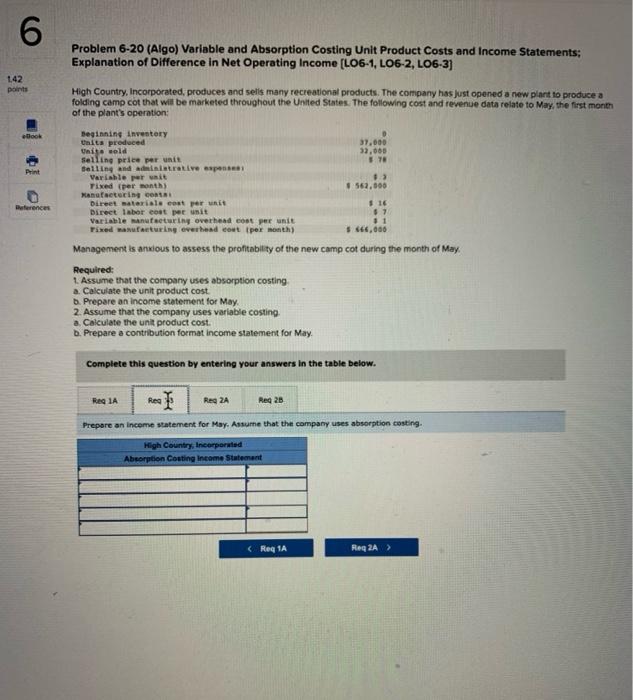

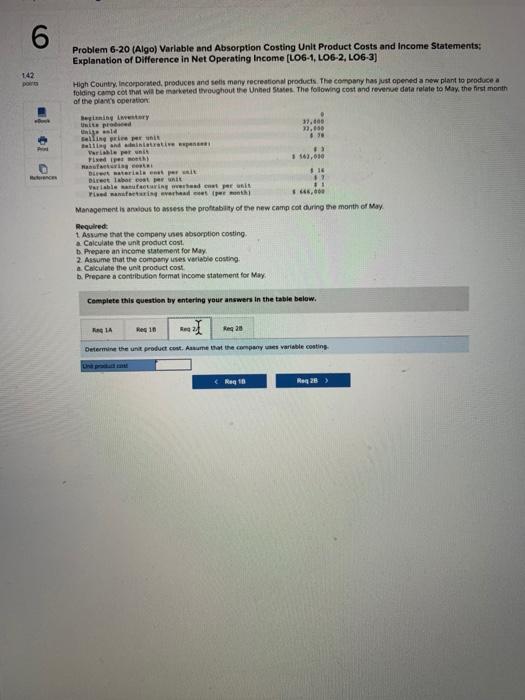

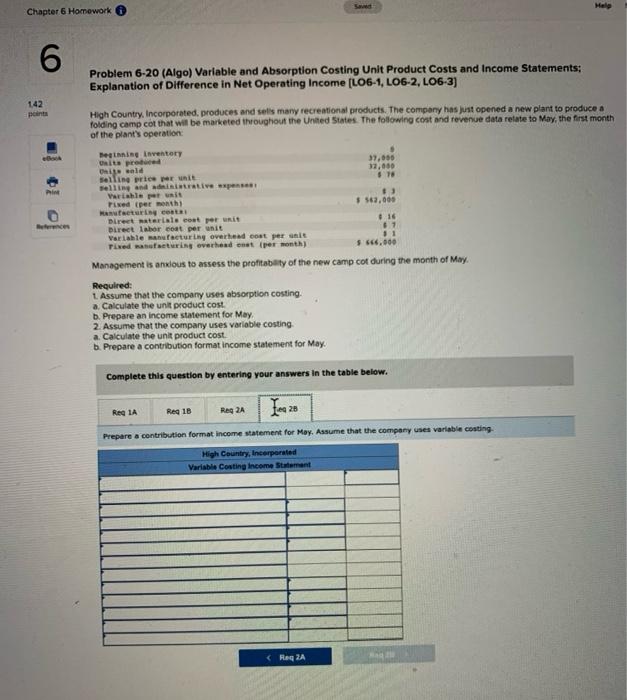

6 Problem 6-20 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income (LO6-1, LO6-2, LO6-3) 1.42 points High Country, Incorporated produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first mont of the plant's operation: Book 10 Print References Beginning inventory units produced 37,000 Un sold 32,000 Selling price per unit $98 Selling and administrative expennent Variable per i 13 Fixed (per month $ 562.000 Manutseturing Cat Direet materials cost per unit 116 Direct labor cont per unit $ 7 Variable manufacturing overhead cost per unit 11 Tixed manufacturing everhend cool per month) 666.606 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May 2. Assume that the company uses variable costing, a. Calculate the unit product cost. b. Prepare a contribution format income statement for May Complete this question by entering your answers in the table below. Reg 1A Reg 18 Reg 2A Reg 28 Determine the unit product cost. Assume that the company uses absorption costing, Unit product cont Reg 18 ) 6 Problem 6-20 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements: Explanation of Difference in Net Operating Income (L06-1, LO6-2, LO6-3) 1.42 pos High Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Check Print References 17 Beginning inventory Units produced 37.000 Unis. weld 32,065 selling price per unit TB telling and Administrative expenses Variable per at #3 Fixed (per month) 563.000 Manufacturing con Direet materials cost per #16 Direct labor cost per unit Variable manufacturing overhead cont per unit 11 Tixed manufacturing everhead cut per month) $646.000 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing a. Calculate the unit product cost b. Prepare an income statement for May 2. Assume that the company uses variable costing a. Calculate the unit product cost. b. Prepare a contribution format income statement for May Complete this question by entering your answers in the table below. Reg 1A Reg 1 Ree ZA Reg 28 Prepare an income statement for May. Assume that the company uses absorption costing. High Country, Incorporated Absorption Costing Income Statement ( Req1A Req2A > 6 Problem 6-20 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income (L06-1, LOG-2, LO6-3) 142 port . High Country, Incorporated produces and sells many recreational products. The company has just opened a new plant to produce folding cam co that will be marketed roughout the United States. The following cost and revenue data relate to May the first month of the plant's operation Bing inter patta 37.000 3.600 Selling price 630 le per unit Fixed per 1 541,010 malar materiale per i 18 Direct la coat Variable in what per Pineda verdi #445,000 Management is analous to assess the profitability of the new camp cot during the month of May Required 1. Assume that the company es absorption costing a Calculate the un product cost ts. Prepare an income statement for May 2. Assume that the compuses variable costing Calculate the unit product cost b. Prepare a contribution format income statement for May Complete this question by entering your answers in the table below. RIA Res 10 Re20 Determine the una productos. Assume that the company variable costing Drap Rag 18 Reg 28) Melo Chapter 6 Homework 6 Problem 6-20 (Algo) Variable and Absorption Costing Unit Product Costs and income Statements: Explanation of Difference in Net Operating Income (L06-1, L06-2, LO6-3) 142 point High Country, Incorporated produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation Pin 16 ces tegning Inventory Units produce 37,066 Old 32.000 selline price per unit 678 selling and live expenses Veriale per unit 3 Fixed per month 563.000 Haring Direct materiale cat per un Direct labor coat per unit 8.1 Variable manufacturing overhead coat per unit 11 Tixed manufacturing overhead net per month) $ 666.600 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing a. Calculate the unit product cost. b. Prepare an income statement for May 2. Assume that the company uses variable costing a. Calculate the unit product cost b. Prepare a contribution format income statement for May Complete this question by entering your answers in the table below. Reg 1A Reg 1B Reg 2A 28 Prepare a contribution format income statement for May. Assume that the company uses variable costing. High Country. Incorporated Variable Costing Income Statement Reg 2A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts