Question: Requirement 2. Determine the amount that would be reported in ending merchandise inventory on May 15 using the LIFO inventory costing method Enter the transactions

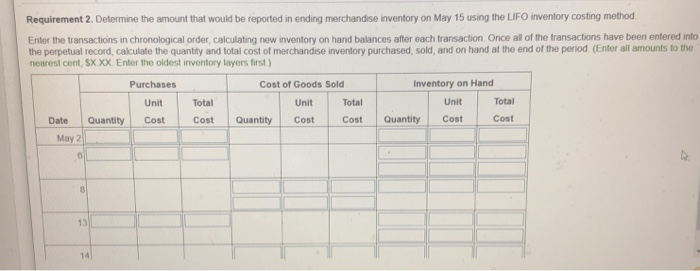

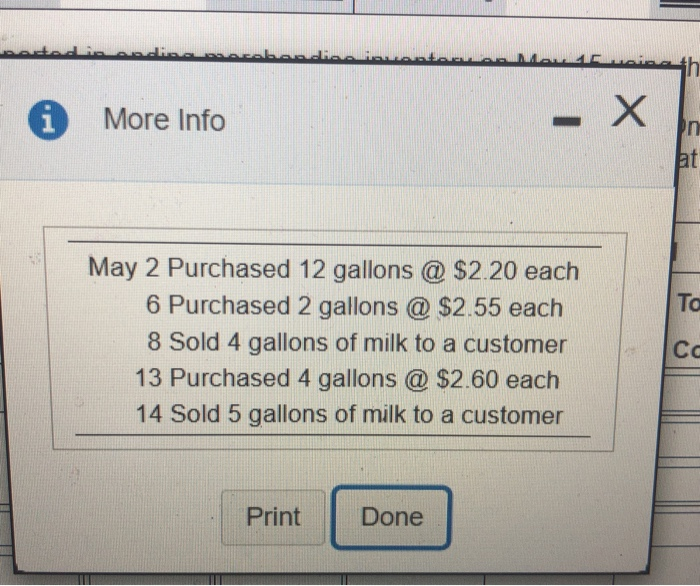

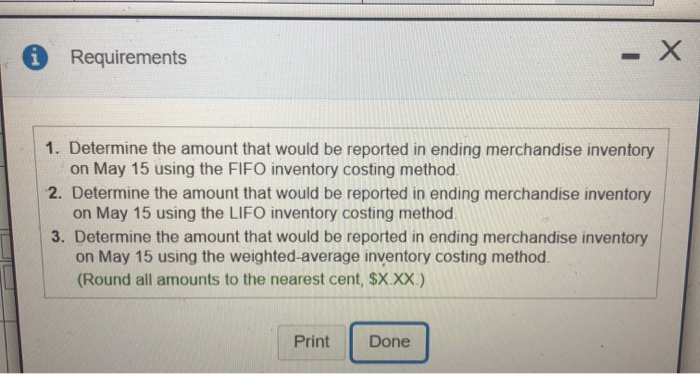

Requirement 2. Determine the amount that would be reported in ending merchandise inventory on May 15 using the LIFO inventory costing method Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cent, SX.XX. Enter the oldest inventory layers first) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost May 2 0 8 13 14 at NASA... baudies inventous. Mov 16 uri..th - X in at 1 More Info Ta May 2 Purchased 12 gallons @ $2.20 each 6 Purchased 2 gallons @ $2.55 each 8 Sold 4 gallons of milk to a customer 13 Purchased 4 gallons @ $2.60 each 14 Sold 5 gallons of milk to a customer Print Done Requirements - X 1. Determine the amount that would be reported in ending merchandise inventory on May 15 using the FIFO inventory costing method. 2. Determine the amount that would be reported in ending merchandise inventory on May 15 using the LIFO inventory costing method. 3. Determine the amount that would be reported in ending merchandise inventory on May 15 using the weighted average inventory costing method. (Round all amounts to the nearest cent, $X.XX.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts