Question: Requirement #2 - Financial Statement Analysis a) Joe has a policy of collecting accounts receivable within 45 days. How does the average collection period compare

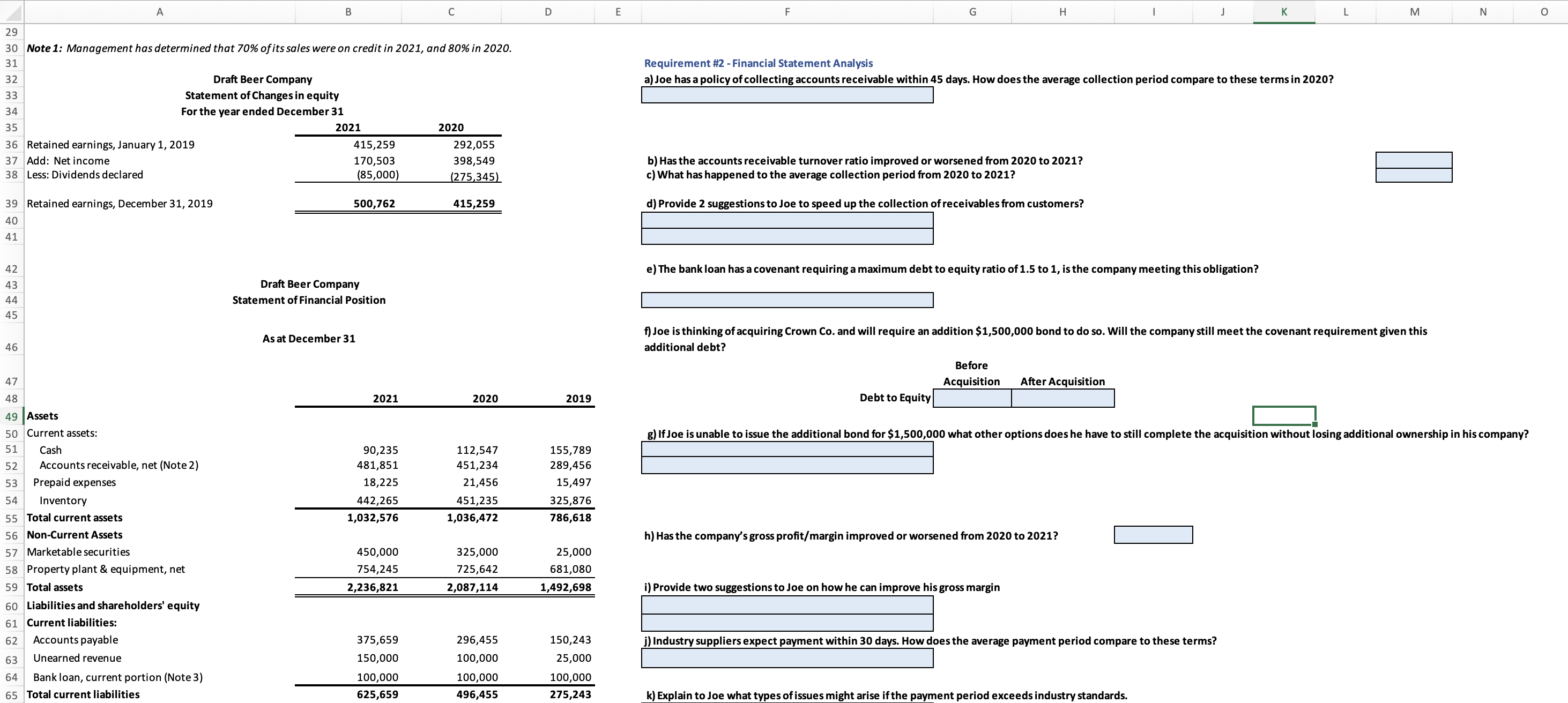

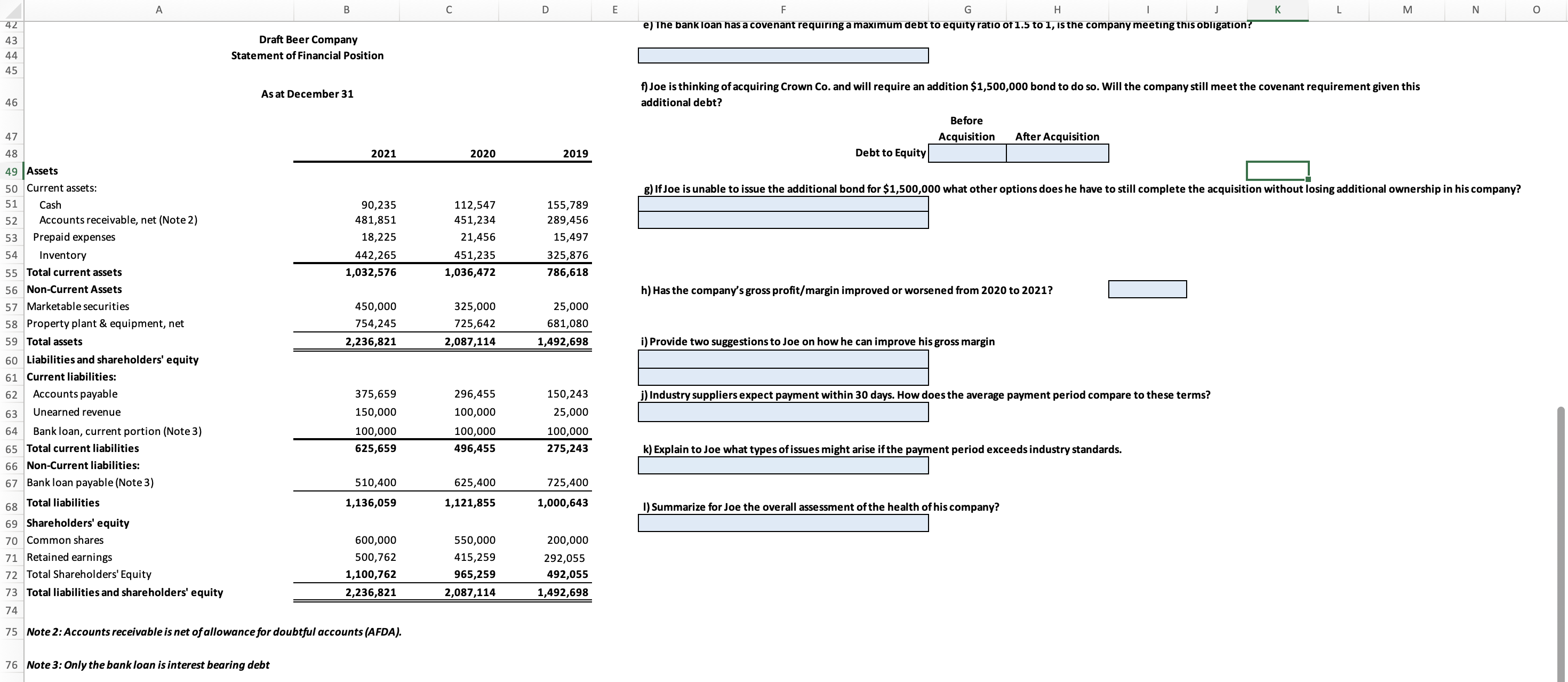

Requirement \#2 - Financial Statement Analysis a) Joe has a policy of collecting accounts receivable within 45 days. How does the average collection period compare to these terms in 2020 ? b) Has the accounts receivable turnover ratio improved or worsened from 2020 to 2021 ? c) What has happened to the average collection period from 2020 to 2021 ? d) Provide 2 suggestions to Joe to speed up the collection of receivables from customers? e) The bank loan has a covenant requiring a maximum debt to equity ratio of 1.5 to 1 , is the company meeting this obligation? f) Joe is thinking of acquiring Crown Co. and will require an addition $1,500,000 bond to do so. Will the company still meet the covenant require additional debt? Debt to E g) If Joe is unable to issue the additional bond for $1,500,000 what other options does he have to still complete the acquisition without losing ad h) Has the company's gross profit/margin improved or worsened from 2020 to 2021 ? g) If Joe is unable to issue the additional bond for $1,500,000 what other options does he have to still complete the acquisition without losing additional ownership in his company? h) Has the company's gross profit/margin improved or worsened from 2020 to 2021 ? i) Provide two suggestions to Joe on how he can improve his gross margin j) Industry suppliers expect payment within 30 days. How does the average payment period compare to these terms? k) Explain to Joe what types of issues might arise if the payment period exceeds industry standards. 1) Summarize for Joe the overall assessment of the health of his company? Note 2: Accounts receivable is net of allowance for doubtful accounts (AFDA). Requirement \#2 - Financial Statement Analysis a) Joe has a policy of collecting accounts receivable within 45 days. How does the average collection period compare to these terms in 2020 ? b) Has the accounts receivable turnover ratio improved or worsened from 2020 to 2021 ? c) What has happened to the average collection period from 2020 to 2021 ? d) Provide 2 suggestions to Joe to speed up the collection of receivables from customers? e) The bank loan has a covenant requiring a maximum debt to equity ratio of 1.5 to 1 , is the company meeting this obligation? f) Joe is thinking of acquiring Crown Co. and will require an addition $1,500,000 bond to do so. Will the company still meet the covenant require additional debt? Debt to E g) If Joe is unable to issue the additional bond for $1,500,000 what other options does he have to still complete the acquisition without losing ad h) Has the company's gross profit/margin improved or worsened from 2020 to 2021 ? g) If Joe is unable to issue the additional bond for $1,500,000 what other options does he have to still complete the acquisition without losing additional ownership in his company? h) Has the company's gross profit/margin improved or worsened from 2020 to 2021 ? i) Provide two suggestions to Joe on how he can improve his gross margin j) Industry suppliers expect payment within 30 days. How does the average payment period compare to these terms? k) Explain to Joe what types of issues might arise if the payment period exceeds industry standards. 1) Summarize for Joe the overall assessment of the health of his company? Note 2: Accounts receivable is net of allowance for doubtful accounts (AFDA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts