Question: requirement 2 only 0 Question to Question 4 Spoints American Construction Company has entered into a contract with American University in Cairo beginning January 1,

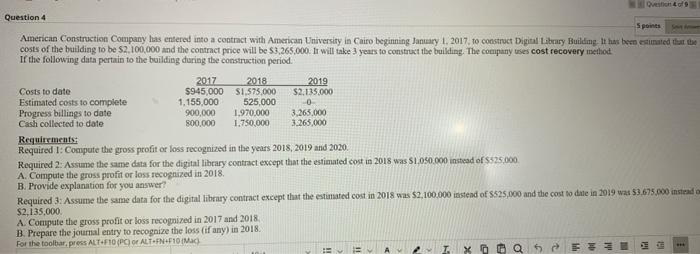

0 Question to Question 4 Spoints American Construction Company has entered into a contract with American University in Cairo beginning January 1, 2017 to construct Digital Library Building. It has bem estimated that the costs of the building to be 52.100,000 and the contract price will be 53.265,000. It will take 3 years to construct the building. The company uses cost recovery method If the following duta pertain to the building during the construction period. 2017 2018 2019 Costs to date $945,000 $1.575.000 $2.135.000 Estimated costs to complete 1.155,000 525,000 Progress billings to date 900,000 1.970.000 3.263.000 Cash collected to date 800,000 1.750,000 3.263.000 Requirements: Required 1: Compute the gross profit or loss recognized in the years 2018, 2019 and 2020. Required 2: Assume the same data for the digital library contract except that the estimated cost in 2018 was $1.050.000 instead of $525.000 A. Compute the gross profit or loss recognized in 2018. B. Provide explanation for you answer? Required 3: Assume the same data for the digital library contract except that the estimated cost in 2018 was $2,100,000 instead of 525,000 and the cost to date in 2019 was 53.675.000 instead $2,135,000 A. Compute the gross profit or loss recognized in 2017 and 2018 B. Prepare the journal entry to recognize the loss (if any) in 2018 For the toolbar, press ALT+F10 (PC) or ALTIN+F10 Mac) 16 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts