Question: Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and

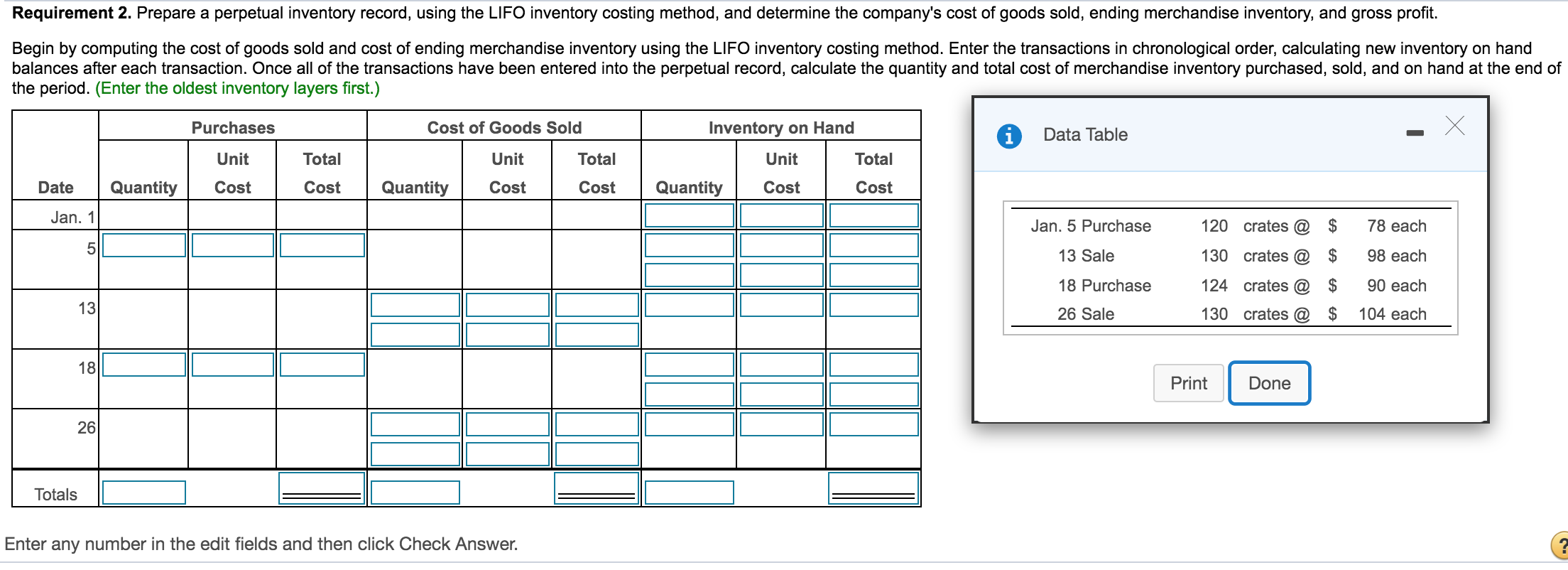

Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand A Data Table Unit Total Total Unit Unit Cost Total Cost Date Quantity Cost Cost Quantity Cost Quantity Cost Jan. 1 Jan. 5 Purchase 13 Sale 18 Purchase 26 Sale 120 crates @ 130 crates @ 124 crates @ 130 crates @ $ $ $ $ 78 each 98 each 90 each 104 each Print Print Done Done 26 Totals Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts