Question: Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold, ending merchandise invento

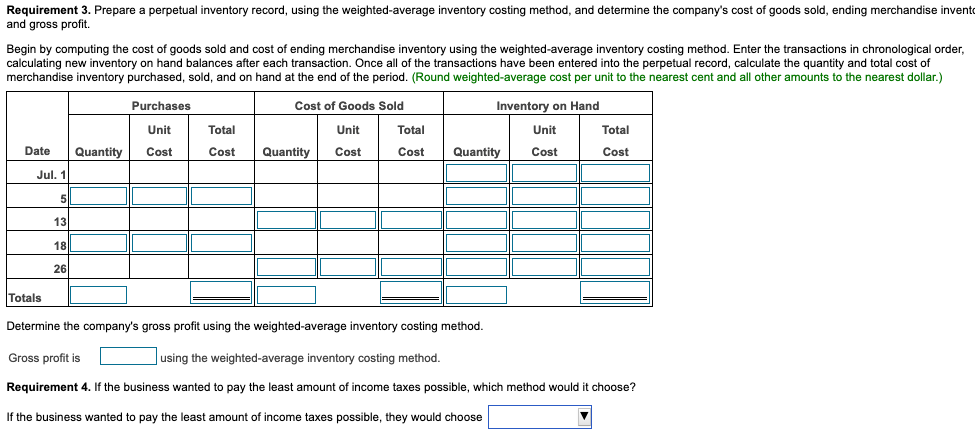

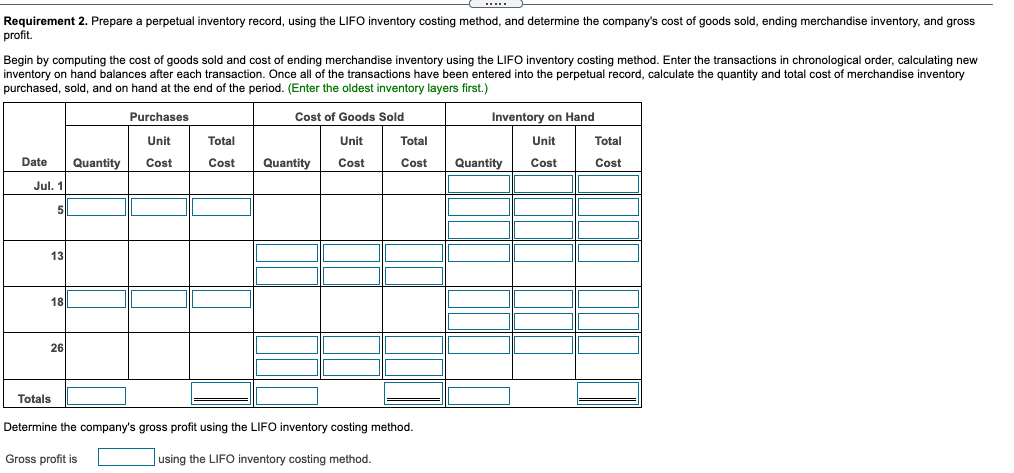

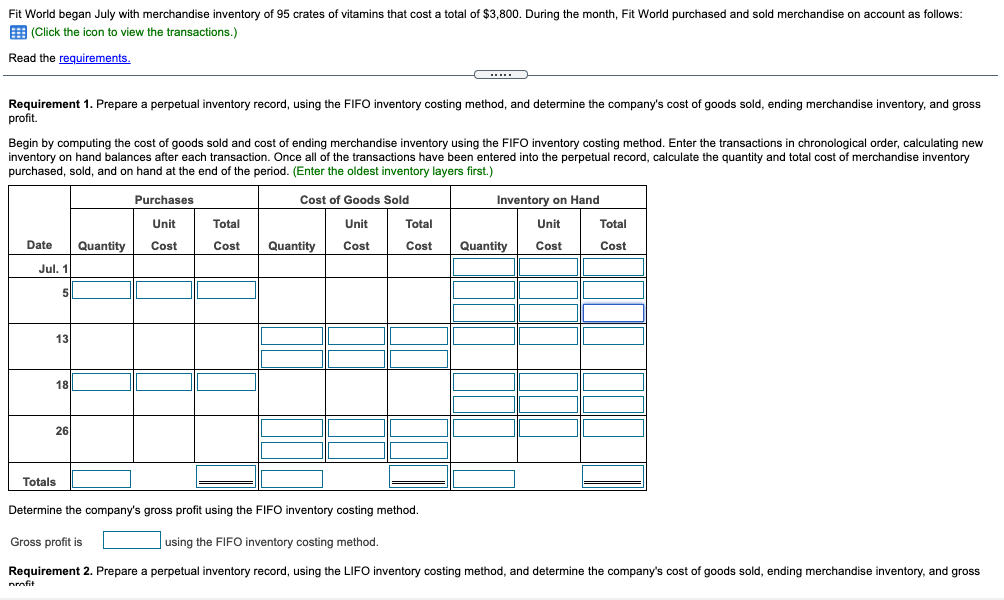

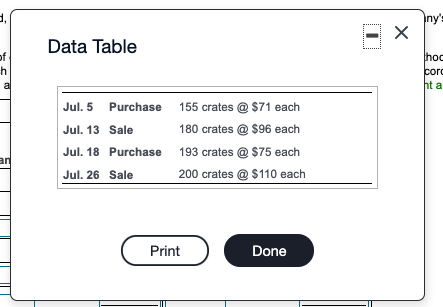

Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold, ending merchandise invento and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Total Unit Total Unit Cost Date Quantity Cost Cost Quantity Cost Quantity Cost Cost Jul. 5 13 18 26 Totals Determine the company's gross profit using the weighted average inventory costing method. Gross profit is using the weighted average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Total Unit Total Unit Cost Date Quantity Cost Quantity Cost Cost Quantity Cost Cost Jul. 1 13 18 26 Totals Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. Fit World began July with merchandise inventory of 95 crates of vitamins that cost a total of $3,800. During the month, Fit World purchased and sold merchandise on account as follows: (Click the icon to view the transactions.) Read the requirements C. Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Unit Total Cost of Goods Sold Unit Total Quantity Cost Cost Inventory on Hand Unit Total Quantity Cost Cost Date Quantity Cost Cost Jul. 11 13 18 26 Totals Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method. Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross nonfit ny: Data Table of h a hoc cord ht a Jul. 5 Purchase 155 crates @ $71 each . 5 Jul. 13 Sale 180 crates @ $96 each Jul. 18 Purchase 193 crates @ $75 each Jul. 26 Sale 200 crates @ $110 each an Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts