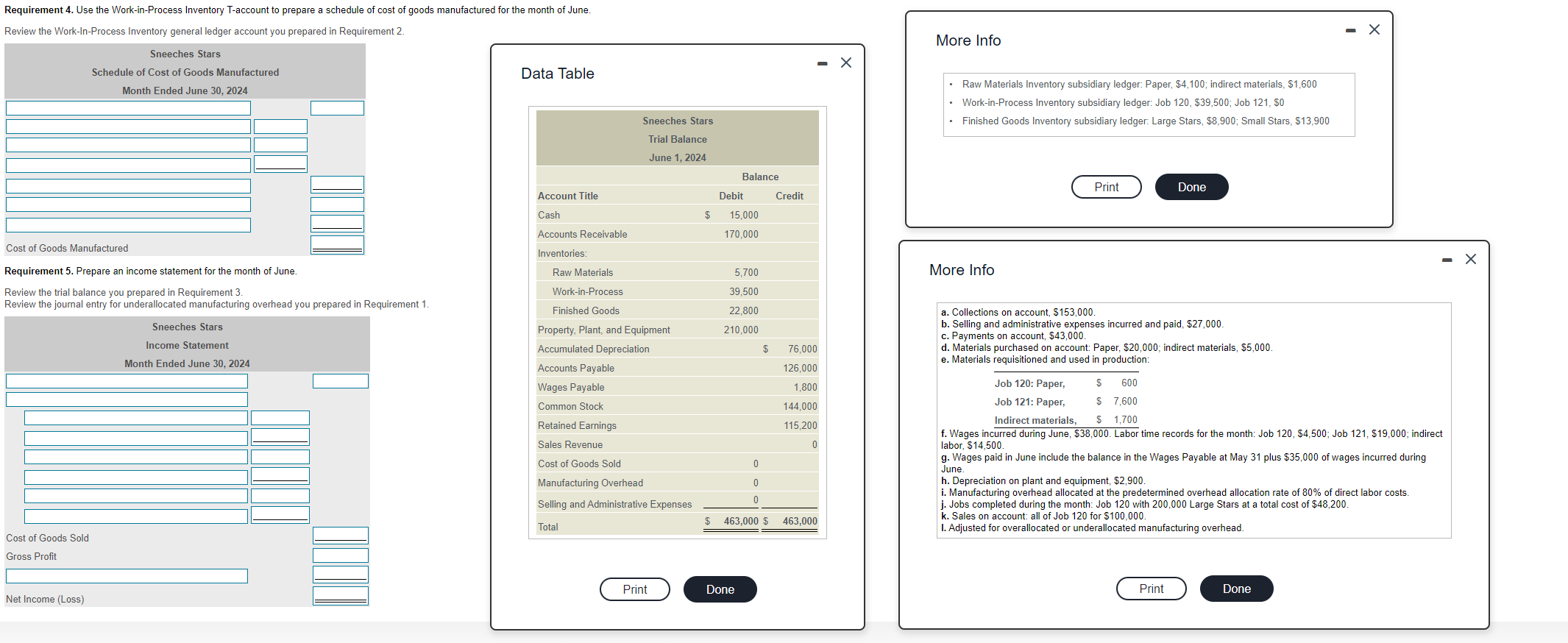

Question: Requirement 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. Review the Work-In-Process Inventory

Requirement 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. Review the Work-In-Process Inventory general ledger account you prepared in Requirement 2. More Info Sneeches Stars Schedule of Cost of Goods Manufactured - X Data Table Month Ended June 30, 2024 Raw Materials Inventory subsidiary ledger: Paper, $4,100; indirect materials, $1,600 Work-in-Process Inventory subsidiary ledger: Job 120, $39,500; Job 121, 50 Finished Goods Inventory subsidiary ledger: Large Stars, $8,900; Small Stars, $13,900 Sneeches Stars Trial Balance June 1, 2024 Balance Print Done Account Title Debit Credit Cash $ 15,000 Accounts Receivable 170,000 Cost of Goods Manufactured Inventories: Raw Materials 5,700 More Info Requirement 5. Prepare an income statement for the month of June. Review the trial balance you prepared in Requirement 3. Review the journal entry for underallocated manufacturing overhead you prepared in Requirement 1. Work-in-Process 39,500 22,800 210,000 Sneeches Stars Income Statement a. Collections on account, $153,000. b. Selling and administrative expenses incurred and paid, $27,000 c. Payments on account, $43,000. d. Materials purchased on account: Paper, $20,000; indirect materials, $5,000. e. Materials requisitioned and used in production: $ 76,000 Month Ended June 30, 2024 126,000 1.800 Finished Goods Property, Plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses 144,000 115,200 0 Job 120: Paper, $ 600 Job 121: Paper, $ 7,600 Indirect materials, $ 1,700 f. Wages incurred during June, $38,000. Labor time records for the month: Job 120, $4,500; Job 121, $19,000; indirect labor, $14,500 g. Wages paid in June include the balance in the Wages Payable at May 31 plus $35,000 of wages incurred during h. Depreciation on plant and equipment, $2,900. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs. j. Jobs completed during the month: Job 120 with 200,000 Large Stars at a total cost of $48,200. k. Sales on account: all of Job 120 for $100,000. 1. Adjusted for overallocated or underallocated manufacturing overhead. 0 June 0 0 $ 463,000 $ Total 463,000 Cost of Goods Sold Gross Profit Print Done Print Done Net Income (Loss) Requirement 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. Review the Work-In-Process Inventory general ledger account you prepared in Requirement 2. More Info Sneeches Stars Schedule of Cost of Goods Manufactured - X Data Table Month Ended June 30, 2024 Raw Materials Inventory subsidiary ledger: Paper, $4,100; indirect materials, $1,600 Work-in-Process Inventory subsidiary ledger: Job 120, $39,500; Job 121, 50 Finished Goods Inventory subsidiary ledger: Large Stars, $8,900; Small Stars, $13,900 Sneeches Stars Trial Balance June 1, 2024 Balance Print Done Account Title Debit Credit Cash $ 15,000 Accounts Receivable 170,000 Cost of Goods Manufactured Inventories: Raw Materials 5,700 More Info Requirement 5. Prepare an income statement for the month of June. Review the trial balance you prepared in Requirement 3. Review the journal entry for underallocated manufacturing overhead you prepared in Requirement 1. Work-in-Process 39,500 22,800 210,000 Sneeches Stars Income Statement a. Collections on account, $153,000. b. Selling and administrative expenses incurred and paid, $27,000 c. Payments on account, $43,000. d. Materials purchased on account: Paper, $20,000; indirect materials, $5,000. e. Materials requisitioned and used in production: $ 76,000 Month Ended June 30, 2024 126,000 1.800 Finished Goods Property, Plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses 144,000 115,200 0 Job 120: Paper, $ 600 Job 121: Paper, $ 7,600 Indirect materials, $ 1,700 f. Wages incurred during June, $38,000. Labor time records for the month: Job 120, $4,500; Job 121, $19,000; indirect labor, $14,500 g. Wages paid in June include the balance in the Wages Payable at May 31 plus $35,000 of wages incurred during h. Depreciation on plant and equipment, $2,900. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs. j. Jobs completed during the month: Job 120 with 200,000 Large Stars at a total cost of $48,200. k. Sales on account: all of Job 120 for $100,000. 1. Adjusted for overallocated or underallocated manufacturing overhead. 0 June 0 0 $ 463,000 $ Total 463,000 Cost of Goods Sold Gross Profit Print Done Print Done Net Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts