Question: requirement 4,5,6,7need to be solved. help please During its first month of operation, HFRM completed the following transactions. Date March 1 March 1 March 1

requirement 4,5,6,7need to be solved. help please

requirement 4,5,6,7need to be solved. help please

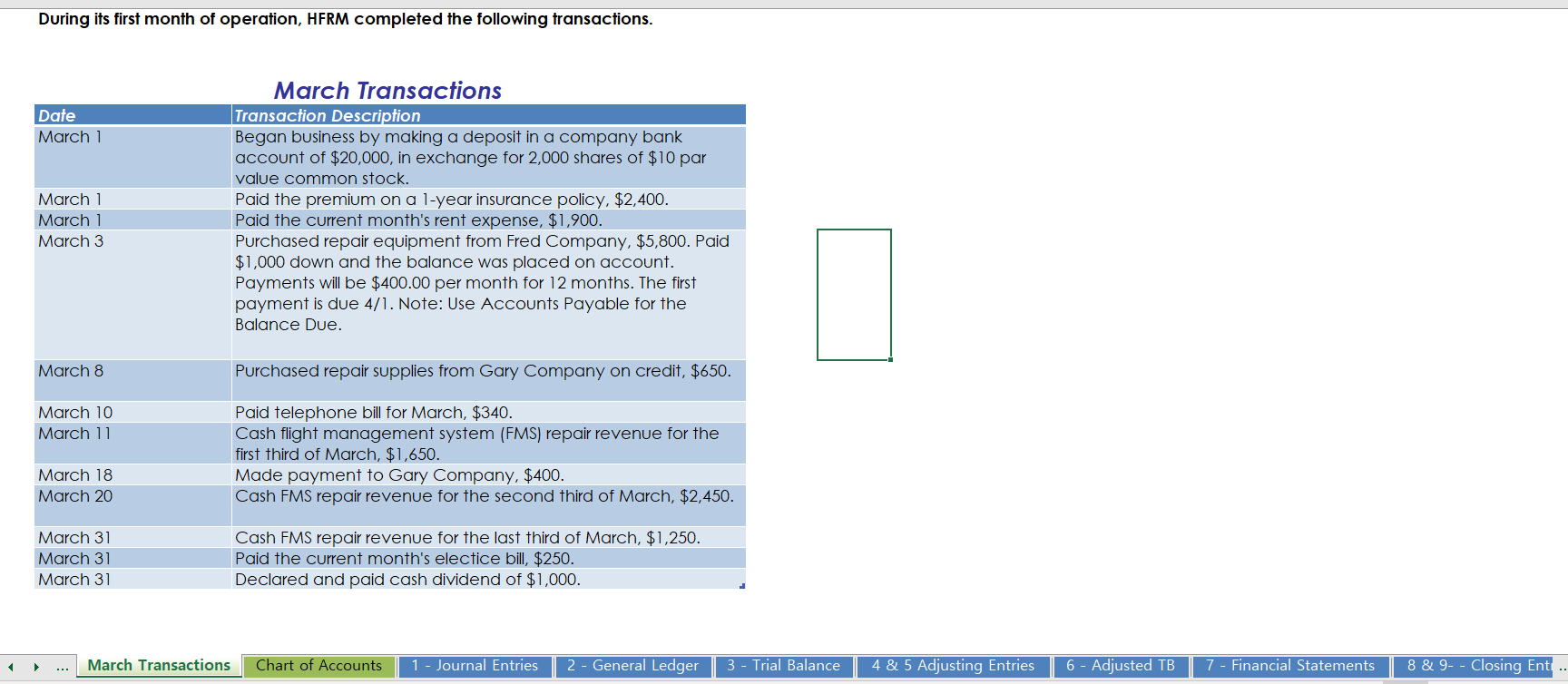

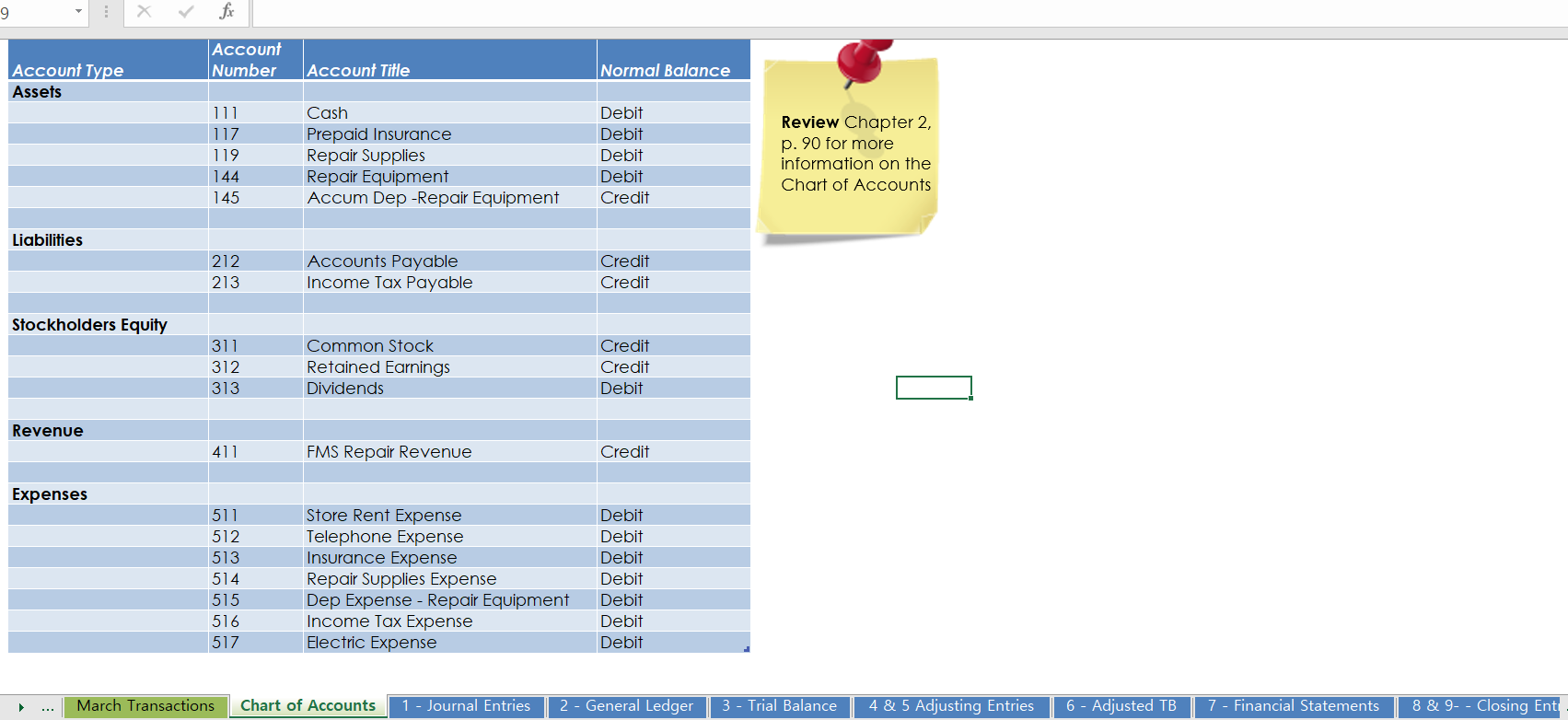

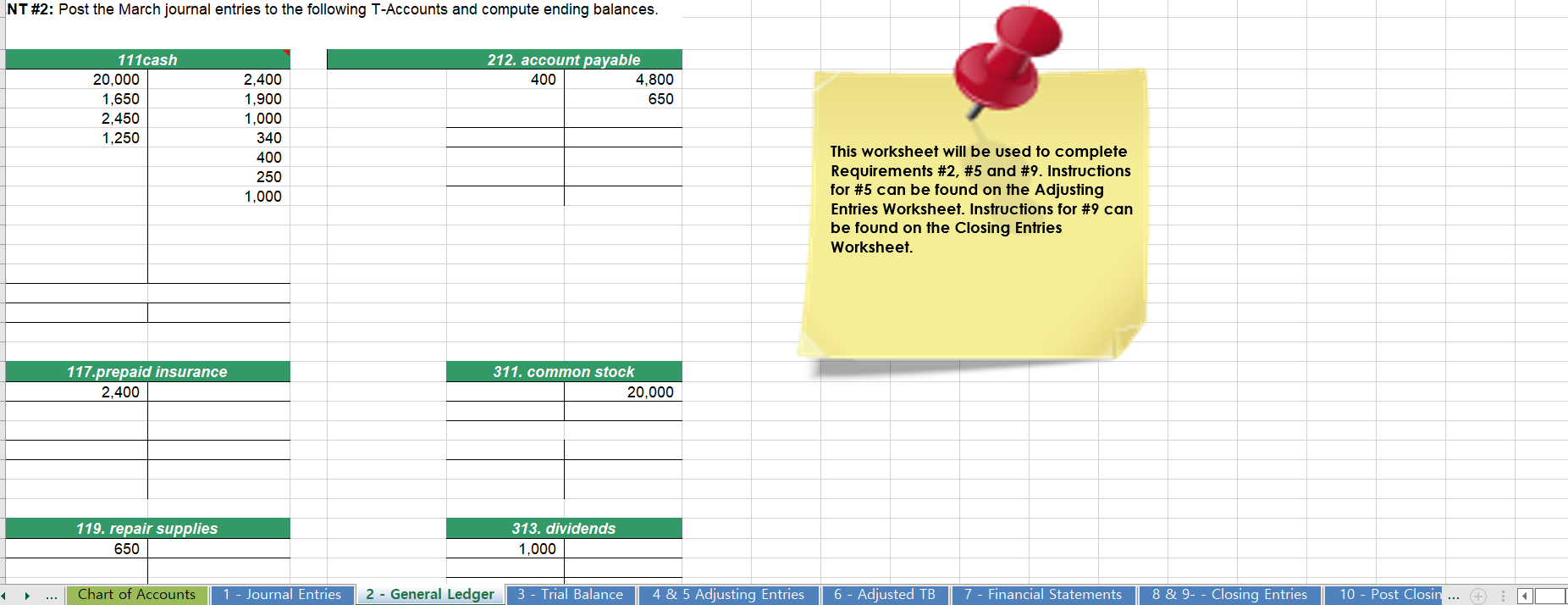

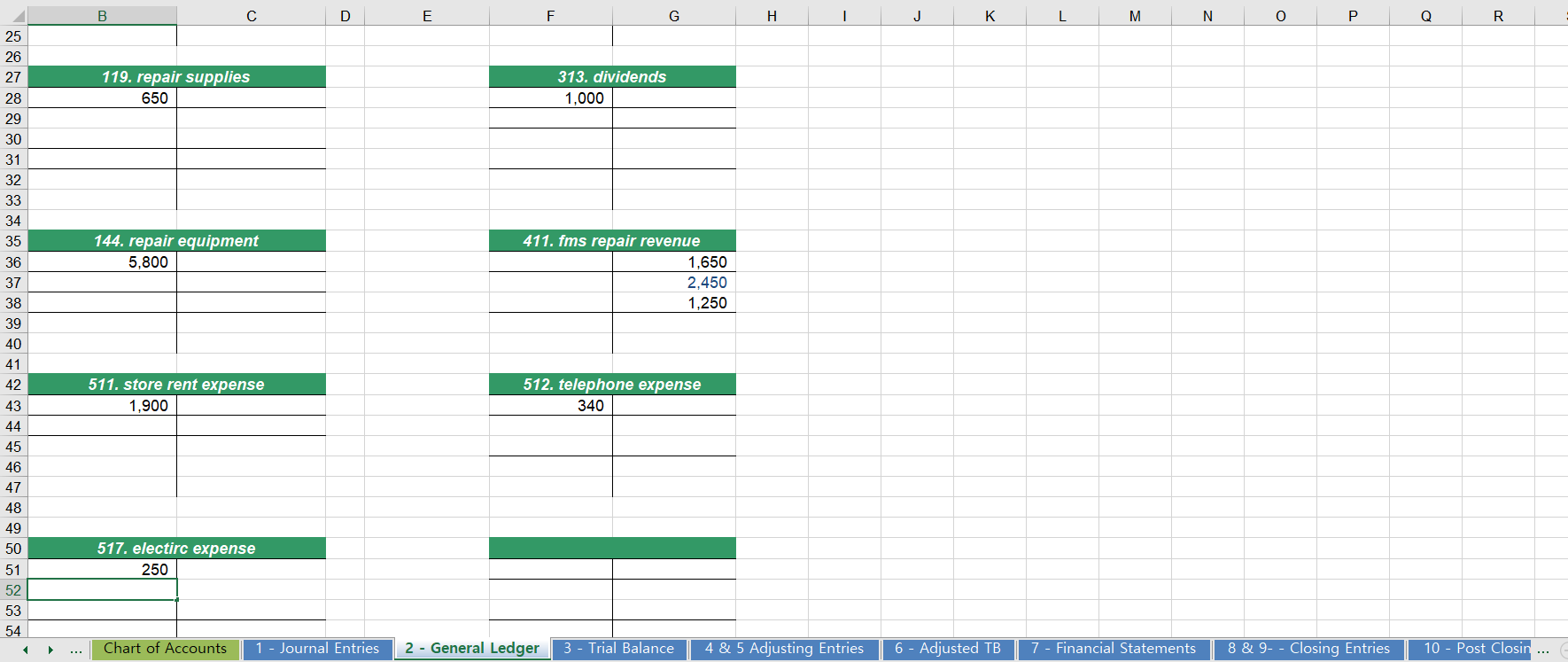

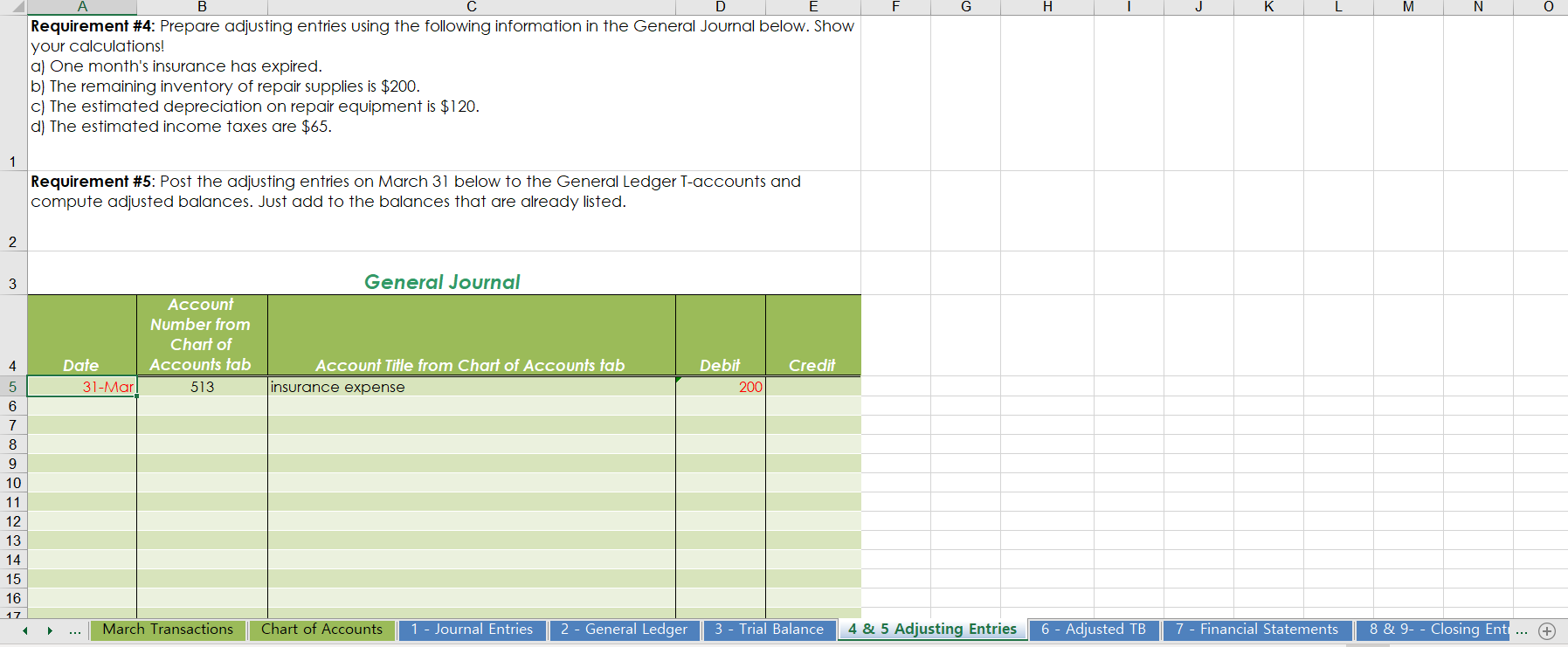

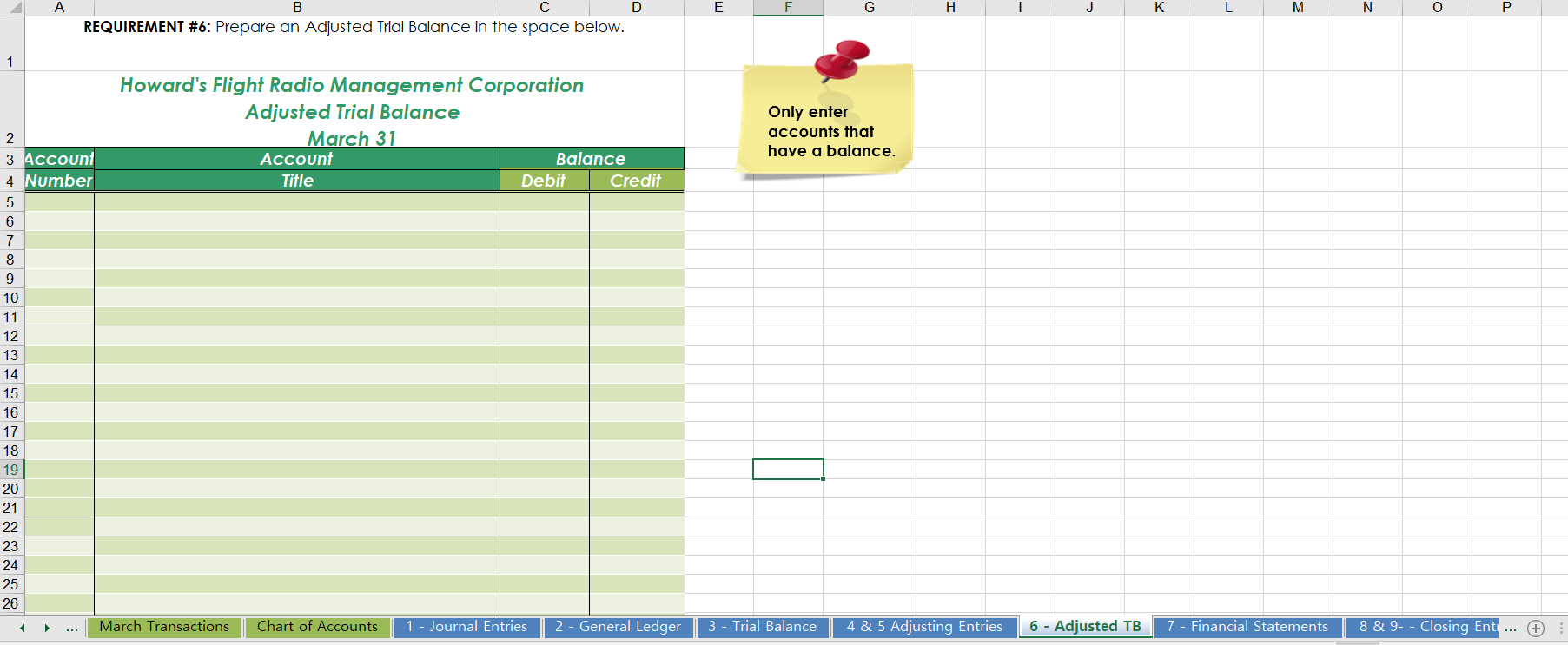

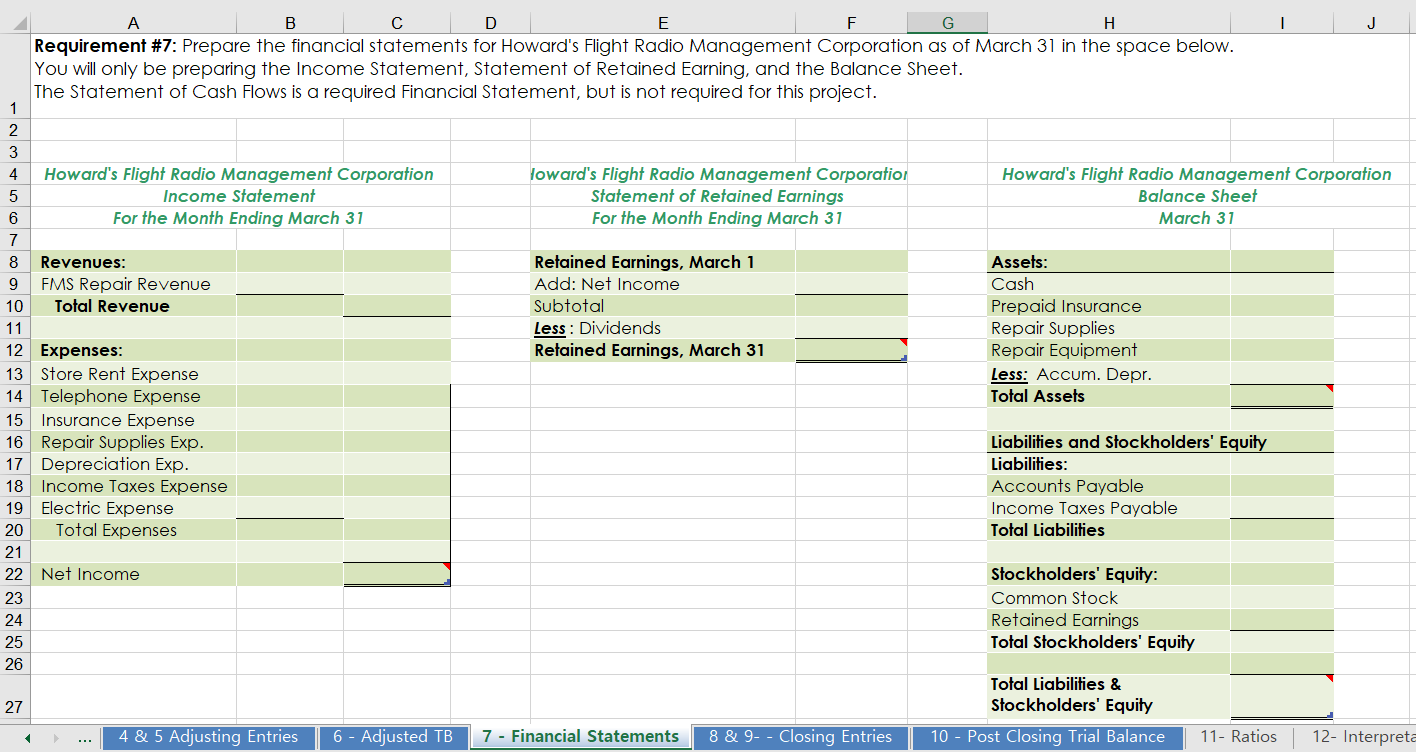

During its first month of operation, HFRM completed the following transactions. Date March 1 March 1 March 1 March 3 March 8 March 10 March 11 March 18 March 20 March 31 March 31 March 31 March Transactions March Transactions Transaction Description Began business by making a deposit in a company bank account of $20,000, in exchange for 2,000 shares of $10 par value common stock. Paid the premium on a 1-year insurance policy, $2,400. Paid the current month's rent expense, $1,900. Purchased repair equipment from Fred Company, $5,800. Paid $1,000 down and the balance was placed on account. Payments will be $400.00 per month for 12 months. The first payment is due 4/1. Note: Use Accounts Payable for the Balance Due. Purchased repair supplies from Gary Company on credit, $650. Paid telephone bill for March, $340. Cash flight management system (FMS) repair revenue for the first third of March, $1,650. Made payment to Gary Company, $400. Cash FMS repair revenue for the second third of March, $2,450. Cash FMS repair revenue for the last third of March, $1,250. Paid the current month's electice bill, $250. Declared and paid cash dividend of $1,000. Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4 & 5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 8 & 9- - Closing Ent.. 9 Account Type Assets Liabilities Stockholders Equity Revenue H X Expenses fx Account Number 111 117 119 144 145 212 213 311 312 313 411 511 512 513 514 515 516 517 Account Title Cash Prepaid Insurance Repair Supplies Repair Equipment Accum Dep -Repair Equipment Accounts Payable Income Tax Payable Common Stock Retained Earnings Dividends FMS Repair Revenue Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income Tax Expense Electric Expense March Transactions Chart of Accounts 1 - Journal Entries Normal Balance Debit Debit Debit Debit Credit Credit Credit Credit Credit Debit Credit Debit Debit Debit Debit Debit Debit Debit Review Chapter 2, p. 90 for more information on the Chart of Accounts 2- General Ledger 3 - Trial Balance 4 & 5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 8 & 9- - Closing Ent NT #2: Post the March journal entries to the following T-Accounts and compute ending balances. 111cash 20,000 1,650 2,450 1,250 117.prepaid insurance 2,400 119. repair supplies 650 Chart of Accounts 2,400 1,900 1,000 340 400 250 1,000 212. account payable 400 311. common stock 1 - Journal Entries 2 - General Ledger 313. dividends 1,000 3- Trial Balance 4,800 650 20,000 4 & 5 Adjusting Entries This worksheet will be used to complete Requirements #2, #5 and #9. Instructions for #5 can be found on the Adjusting Entries Worksheet. Instructions for #9 can be found on the Closing Entries Worksheet. 6 - Adjusted TB 7 - Financial Statements 8 & 9- - Closing Entries 10 - Post Closin ... 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 B C 119. repair supplies 650 144. repair equipment 5,800 511. store rent expense 1,900 517. electirc expense 250 D E F 313. dividends 1,000 G 411. fms repair revenue 1,650 2,450 1,250 512. telephone expense 340 H I Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4 & 5 Adjusting Entries J K 6 - Adjusted TB L M 7 - Financial Statements N O P 8 & 9- - Closing Entries Q R 10 - Post Closin ... 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 A B D E Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $120. d) The estimated income taxes are $65. Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. Date 31-Marl Account Number from Chart of Accounts tab 513 March Transactions General Journal Account Title from Chart of Accounts tab insurance expense Chart of Accounts 1 - Journal Entries 2 - General Ledger Debit 200 Credit 3 - Trial Balance F G H 4 & 5 Adjusting Entries 6 - Adjusted TB J K L 7 - Financial Statements M N 8 & 9- - Closing Ent... 0 1 23456780 3 Account 9 10 11 12 13 14 15 4 Number 16 17 18 19 20 21 22 23 24 25 26 A B REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 March Transactions Account Title Chart of Accounts Balance Debit D Credit E F G Only enter accounts that have a balance. 1 - Journal Entries 2- General Ledger 3 - Trial Balance H 4 & 5 Adjusting Entries I J 6 - Adjusted TB K L M 7 - Financial Statements N O P 8 & 9- - Closing Ent... 1 2 3 4 5 6 B D E F G H Requirement #7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. 7 8 Revenues: 9 FMS Repair Revenue 10 Total Revenue 11 12 Expenses: 13 Store Rent Expense 14 Telephone Expense 23 24 25 26 A 15 Insurance Expense 16 Repair Supplies Exp. 17 Depreciation Exp. 18 Income Taxes Expense 19 Electric Expense 20 Total Expenses 27 Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 21 22 Net Income 4 & 5 Adjusting Entries loward's Flight Radio Management Corporation Statement of Retained Earnings For the Month Ending March 31 Retained Earnings, March 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, March 31 6 - Adjusted TB 7 - Financial Statements 8 & 9- - Closing Entries Howard's Flight Radio Management Corporation Balance Sheet March 31 Assets: Cash Prepaid Insurance Repair Supplies Repair Equipment Less: Accum. Depr. Total Assets Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity J Total Liabilities & Stockholders' Equity 10 - Post Closing Trial Balance 11- Ratios 12- Interpreta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts