Question: Requirement #6: Ch 14: Using the Risk-Free rate (2 % Risk-Free Rate) and assuming a 10 percent market risk premium, a) What is the cost

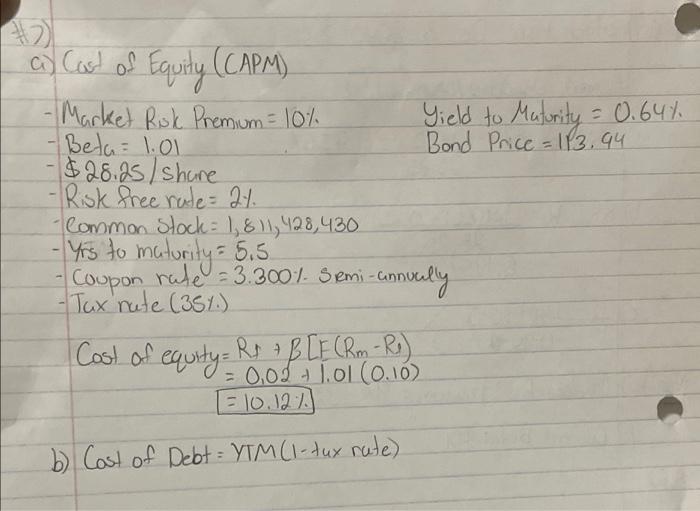

Requirement #6: Ch 14: Using the Risk-Free rate (2 % Risk-Free Rate) and assuming a 10 percent market risk premium, a) What is the cost of equity for your selected company using CAPM? b) You now need to calculate the cost of debt (after-tax YTM) for your selected company. Use the info from Requirement 3, c). co Cart of Equity (CAPM) a) - Market Risk Premum = 10% Yield to Maturity = 0.64% Bela = 1.01 Bond Price = 113.94 $28.25/share - Risk free rate= 21. Common Stock = 1,8 11,428,430 -Yrs to maturity = 5.5 Coupon rule 3.3001. Semi-annurally Tux nate (361.) -- Cost of equity = RD., OP 11.01 (0.10) 0.00 =10.12 b) Cast of Debt: YTM (1-tux rate)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock