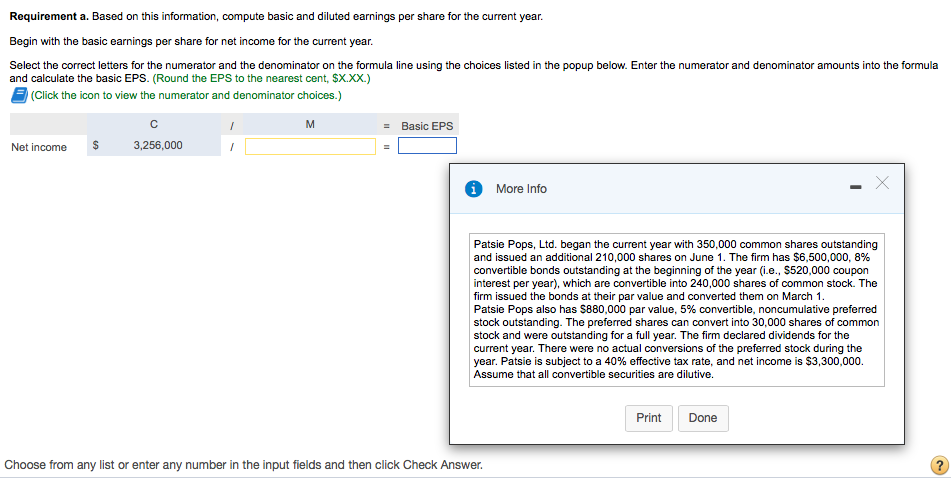

Question: Requirement a. Based on this information, compute basic and diluted earnings per share for the current year Begin with the basic earnings per share for

Requirement a. Based on this information, compute basic and diluted earnings per share for the current year Begin with the basic earnings per share for net income for the current year Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the basic EPS. (Round the EPS to the nearest cent, SX.xx.) (Click the icon to view the numerator and denominator choices.) -Basic EPS Net income More Info Patsie Pops, Ltd. began the current year with 350,000 common shares outstanding and issued an additional 210,000 shares on June 1. The firm has $6,500,000, 8% convertible bonds outstanding at the beginning of the year (i.e., S520,000 coupon interest per year), which are convertible into 240,000 shares of common stock. The firm issued the bonds at their par value and converted them on March 1 Patsie Pops also has S880000 par value, 5% convertible, noncumulative preferred stock outstanding. The preferred shares can convert into 30,000 shares of common stock and were outstanding for a full year. The firm declared dividends for the current year. There were no actual conversions of the preferred stock during the year. Patsie is subject to a 40% effective tax rate, and net income is $3,300,000 Assume that all convertible securities are dilutive. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Requirement a. Based on this information, compute basic and diluted earnings per share for the current year Begin with the basic earnings per share for net income for the current year Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the basic EPS. (Round the EPS to the nearest cent, SX.xx.) (Click the icon to view the numerator and denominator choices.) -Basic EPS Net income More Info Patsie Pops, Ltd. began the current year with 350,000 common shares outstanding and issued an additional 210,000 shares on June 1. The firm has $6,500,000, 8% convertible bonds outstanding at the beginning of the year (i.e., S520,000 coupon interest per year), which are convertible into 240,000 shares of common stock. The firm issued the bonds at their par value and converted them on March 1 Patsie Pops also has S880000 par value, 5% convertible, noncumulative preferred stock outstanding. The preferred shares can convert into 30,000 shares of common stock and were outstanding for a full year. The firm declared dividends for the current year. There were no actual conversions of the preferred stock during the year. Patsie is subject to a 40% effective tax rate, and net income is $3,300,000 Assume that all convertible securities are dilutive. Print Done Choose from any list or enter any number in the input fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts