Question: Requirement-1: Journalize the following transactions. Note: You do not need to consider any account for Interest payable and wages payable, as those are being paid

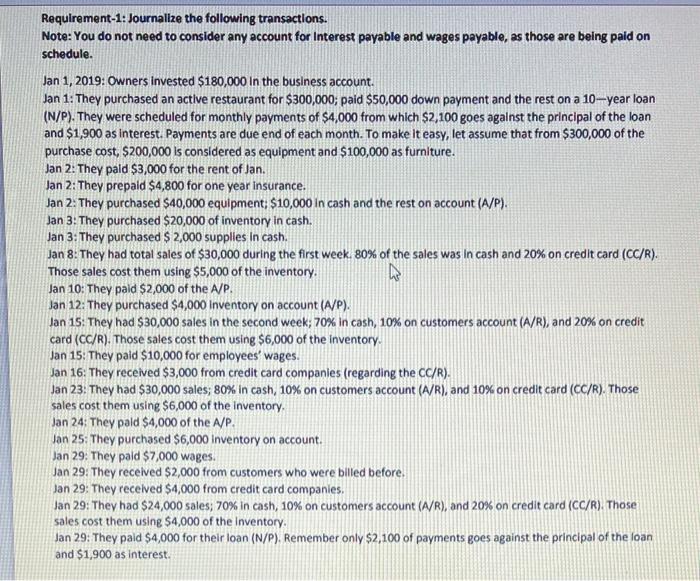

Requirement-1: Journalize the following transactions. Note: You do not need to consider any account for Interest payable and wages payable, as those are being paid on schedule. Jan 1, 2019: Owners invested $180,000 in the business account. Jan 1: They purchased an active restaurant for $300,000; paid $50,000 down payment and the rest on a 10-year loan (N/P). They were scheduled for monthly payments of $4,000 from which $2,100 goes against the principal of the loan and $1,900 as interest. Payments are due end of each month. To make it easy, let assume that from $300,000 of the purchase cost, $200,000 is considered as equipment and $100,000 as furniture. Jan 2: They paid $3,000 for the rent of Jan. Jan 2: They prepaid $4,800 for one year Insurance. Jan 2: They purchased $40,000 equipment; $10,000 in cash and the rest on account (A/P). Jan 3: They purchased $20,000 of inventory in cash. Jan 3: They purchased $ 2,000 supplies in cash. Jan 8. They had total sales of $30,000 during the first week. 80% of the sales was in cash and 20% on credit card (CC/R). Those sales cost them using $5,000 of the inventory. Jan 10: They paid $2,000 of the A/P. Jan 12: They purchased $4,000 Inventory on account (A/P). Jan 15: They had $30,000 sales in the second week; 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $6,000 of the inventory Jan 15: They paid $10,000 for employees' wages. Jan 16: They received $3,000 from credit card companies (regarding the CC/R). Jan 23: They had $30,000 sales; 80% in cash, 10% on customers account (A/R), and 10% on credit card (CC/R). Those sales cost them using $6,000 of the inventory Jan 24: They pald $4,000 of the A/P. Jan 25: They purchased $6,000 Inventory on account. Jan 29. They paid $7,000 wages. Jan 29: They received $2,000 from customers who were billed before. Jan 29: They received $4,000 from credit card companies. Jan 29: They had $24,000 sales; 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $4,000 of the Inventory. Jan 29: They paid $4,000 for their loan (N/P). Remember only $2,100 of payments goes against the principal of the loan and $1,900 as interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts