Question: Requirements . 1. 2. Use the PV function in Excel to calculate the issue price of the bonds. Prepare a bond amortization table for the

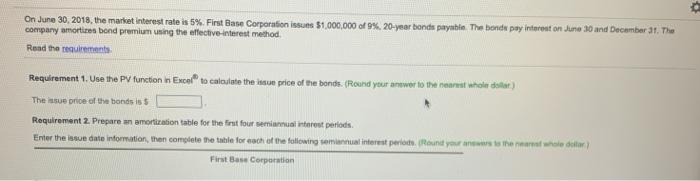

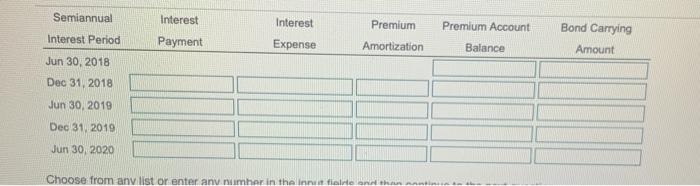

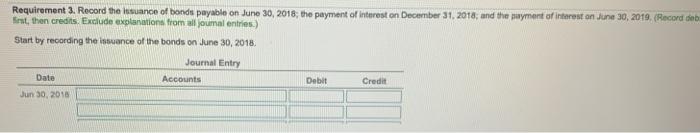

Requirements . 1. 2. Use the PV function in Excel to calculate the issue price of the bonds. Prepare a bond amortization table for the first four semiannual interest periods. Record the issuance of bonds payable on June 30, 2018; the payment of interest on December 31, 2018; and the payment of interest on June 30, 2019. 3. ce Par Print Done On June 30, 2018, the market interest rate is 5%. First Base Corporation issus 1,000,000 of 9%, 20-year bonds payahin. The bond pay interest on June 30 and December 31. The company amortizes bond premium using the effective interest method Read the requirements Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dator) These price of the bonds is $ Requirement 2. Prepare an amortization table for the first four semiannual interent periods. Enter the issue date information, the complete the table for each of the following semiannual interest periode. Round you to the whole dar) First Bass Corporation Semiannual Interest Premium Interest Payment Premium Account Interest Period Expense Bond Carrying Amount Amortization Balance Jun 30, 2018 Dec 31, 2018 Jun 30, 2019 Dec 31, 2019 Jun 30, 2020 Choose from any list or enter any number in the initiate and then Requirement 3. Record the usuance of bonds payable on June 30, 2018; the payment of lettrost on December 31, 2018; and the payment of interest on June 30, 2018. (Record dieb Erst, then credits. Exclude explanations from all oumal entries.) Start by recording the issuance of the bonds on June 30, 2018 Journal Entry Debit Credit Date Accounts Jun 30, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts