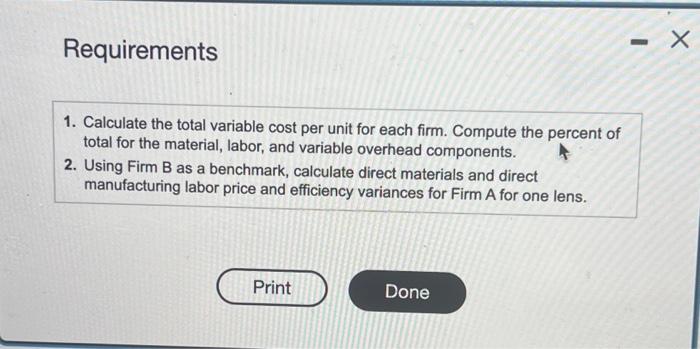

Question: Requirements 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components.

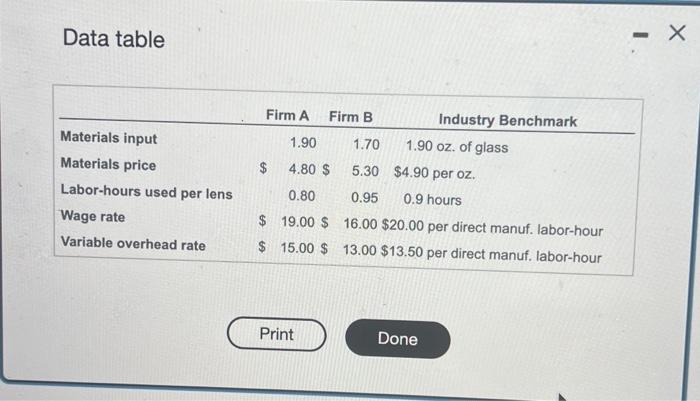

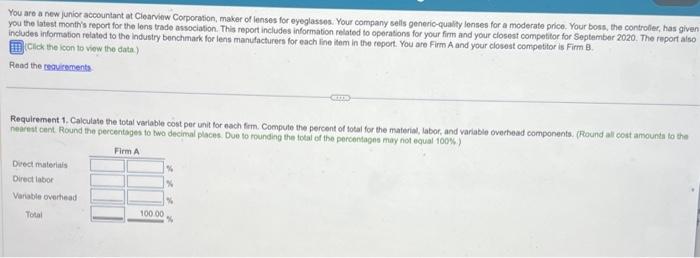

Requirements 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. 2. Using Firm \\( B \\) as a benchmark, calculate direct materials and direct manufacturing labor price and efficiency variances for Firm A for one lens. Data table You are a new junior accountant at Cleaniew Corporation, maker of lenses for eyeglasses. Your company selis generic-quality lonses for a moderate price. Your boss, the controler, has given you the latest month's report for the lons trade association. This report includes information related to oporations for your firm and your closest compotitor for September 2020 . The report also includes information retated to the industry benchmark for lens manufacturers for each fine item in the ceport. You are Firm A and your closost competitar is Firm \\( B \\). Click the kon to viow the data) Read the ceguirements. Requirement 1. Calculate the total variable cost per unit for each frm. Compute the percent of lotal for the material, labor, and variable overhead components, (Round all cost amounta lo the nearest cent. Round the percentages to two decimal places. Due to rounding the fotal of the porcontapes may not equal \100 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts