Question: Requirements 1. Compute Brooks' predetermined manufacturing overhead rate. 2. How much manufacturing overhead was allocated to jobs during the year? 3. How much manufacturing overhead

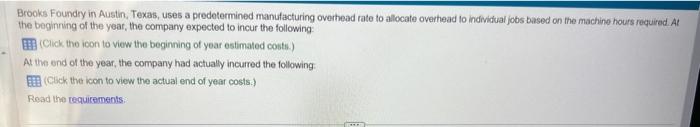

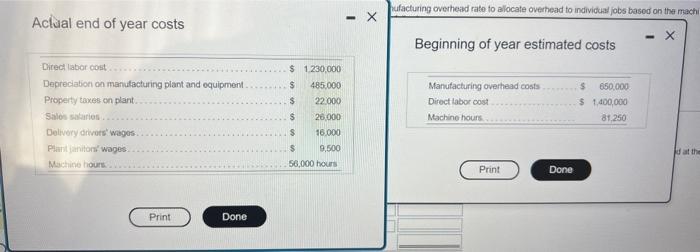

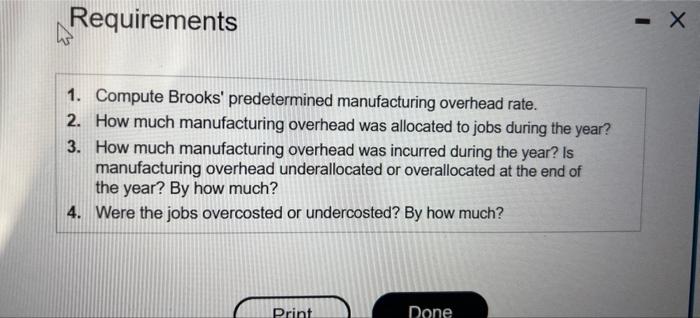

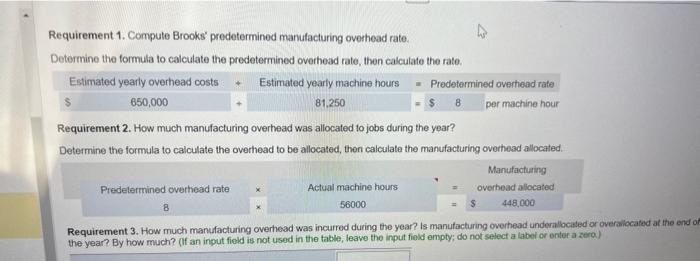

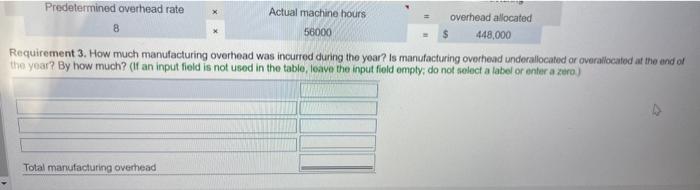

Requirements 1. Compute Brooks' predetermined manufacturing overhead rate. 2. How much manufacturing overhead was allocated to jobs during the year? 3. How much manufacturing overhead was incurred during the year? Is manufacturing overhead underallocated or overallocated at the end of the year? By how much? 4. Were the jobs overcosted or undercosted? By how much? Aclual end of year costs Beginning of year estimated costs Brooks Foundry in Austin, Texas, uses a predetermined manufacturing overhead rate to allocate overhead lo individual jobs based on the machine hours requirad. At the beginning of the yeat, the company expected to incur the following: (Click the icon to view the beginning of year estimated costs.) At the end of the year, the company had actually incurred the following (Click the icon to view the actual end of year costs.) Read the requirements: Requirement 1. Compute Brooks' predetermined manufacturing overhead rate. Determine the formula to calculate the predetermined overhead rate, then calculate the rate. Requirement 2. How much manufacturing overhead was allocated to jobs during the year? Determine the formula to calculate the overhead to be allocated, then calculate the manufacturing overhead allocated. Requirement 3. How much manufacturing overhead was incurred during the year? is manutacturing overhead underallocated or overallocated at the end the year? By how much? (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zera) Requirement 3. How much manufacturing overhead was incurred during the year? is manufacturing overhead underallocated or overallocated at the end of the year? By how much? (If an input field is not used in the table, leave the input field emply; do not select a label or enter a zero)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts