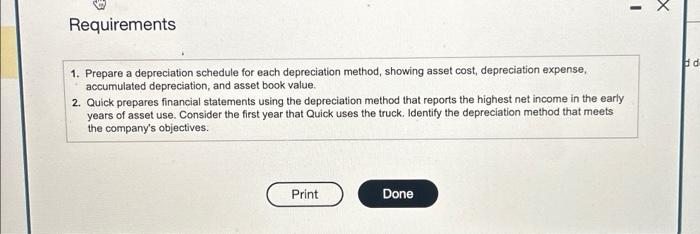

Question: Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. Quick prepares financial

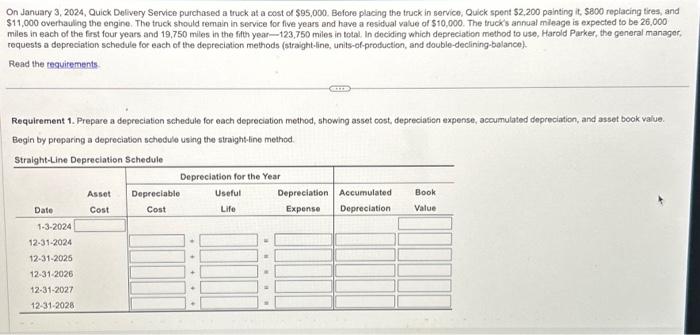

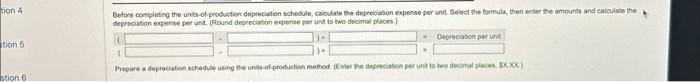

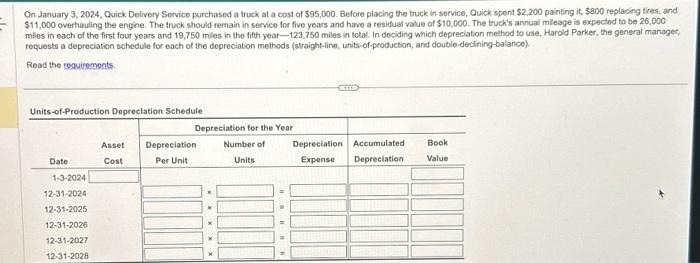

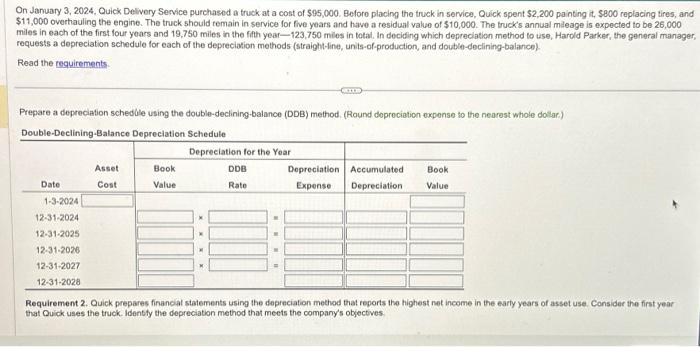

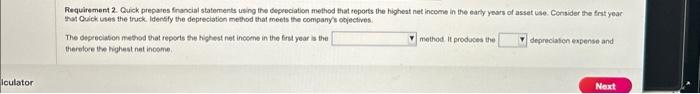

Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. Quick prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Quick uses the truck. Identify the depreciation method that meets the company's objectives. On January 3, 2024, Quick Dolivery Service purchased a truck at a cost of $95,000. Before placing the truck in servico, Quick spent $2,200 painting it, $800 replacing tires, and $11,000 overthauling the engine. The truck should remnin in service for five years and have a residuat vatue of $10,000. The frucks annual mileage is expected to be 26,000 miles in each of the first four years and 19,750 miles in the fith year-123,750 miles in total. In deciding which depreciation method to use, Harold Parker, the general manager, requests a doprociation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-bolance). Read the teguitements. Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. Begin by preparing a depreciation schedule using the straight-fine method. depreciation expense per unit. (Flound deoneciation expente per una to two decimat places) \begin{tabular}{|c|c|c|c|c|} \hline & 12 & 1+ & - & Depreciation per unt \\ \hline & & j+ & & \\ \hline \end{tabular} On January 3, 2024, Quick, Delivery Service purchased a truck at a cost of $95,000. Before placing the truck in service, Quick spent $2,200 painting it, $800 replacing tres, and $11,000 overhauling the engine. The truck should remain in service for five years and have a resiffuat vatue of $10,000. The truck's annual mileage is expected to be 26,000 milos in each of the first four years and 19,750 miles in the fith year-123,750 miles in total. In dociding which depreciation method to use, Harcild Parker, the generat manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). Read the reauirements: On January 3, 2024, Quick Delivery Service purchased a truck at a cost of $95,000. Beforo placing the truck in service, Quick spent $2,200 painting it, \$800 replacing tires, and $11,000 overthauling the engine. The truck should temain in service for flve years and have a tesidual valuo of $10,000. The trucks annual mileage is expected to be 26,000 miles in each of the first four years and 19,750 miles in the fith year- 123,750 miles in total. In deciding which depreciation method to use, Harcld Parker, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). Read the requirements. Prepare a depreciation schedble using the double-declining-balance (DDB) method. (Round doprociation oxpense to the nearest whole dollar.) Double-Declinina-Balance Depreciation Schedule Requirement 2. Quick prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Ouick uses the truck. Identify the depreciation method that meets the company's objectives. Requirement 2. Quick prepares financial statements using the depreciation method that reports the higheat net income in the early years of asset ise. Consider the frat year that Quick uses the fruck. Idensfy the depreciation method that meets the company's objectives. Thediperecistonmescodthatreporsthehighestnetincomeinthefrutyearisthemethoditproducesthetherelorethehighestnetincome.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts