Question: Requirements 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and

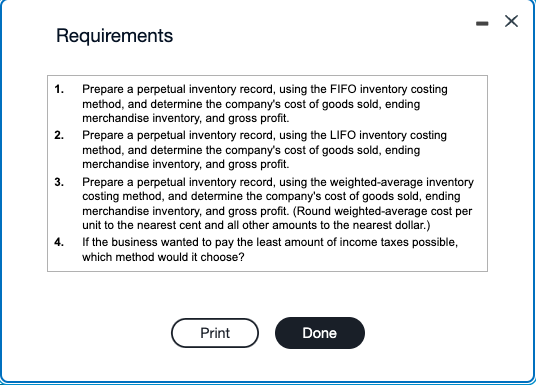

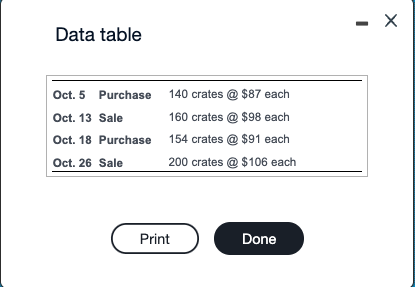

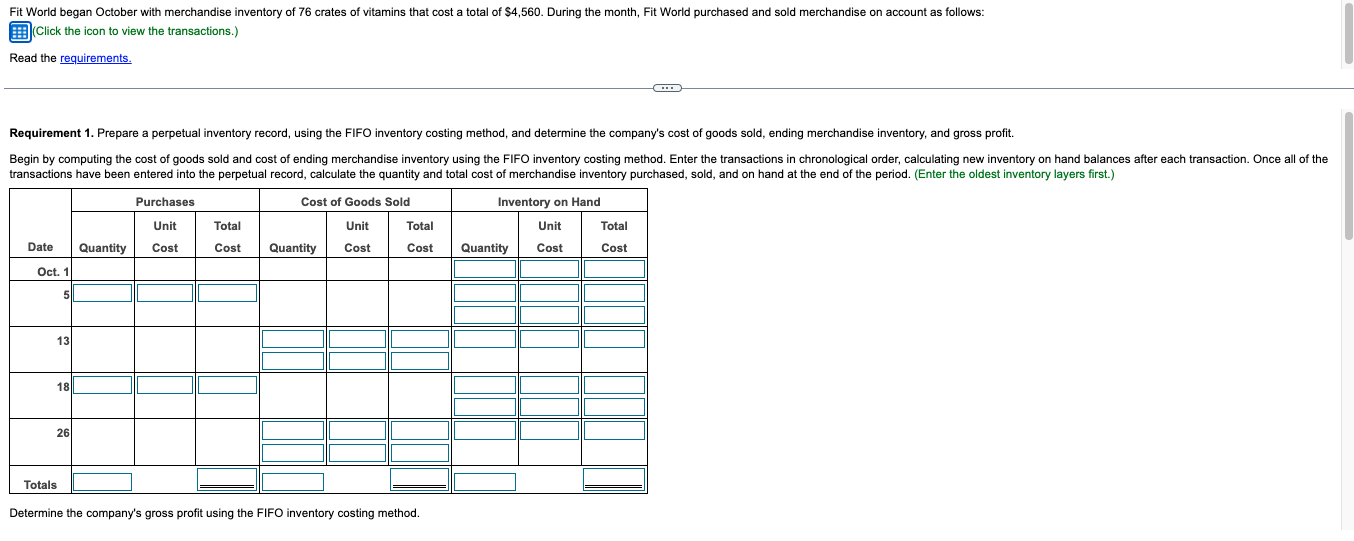

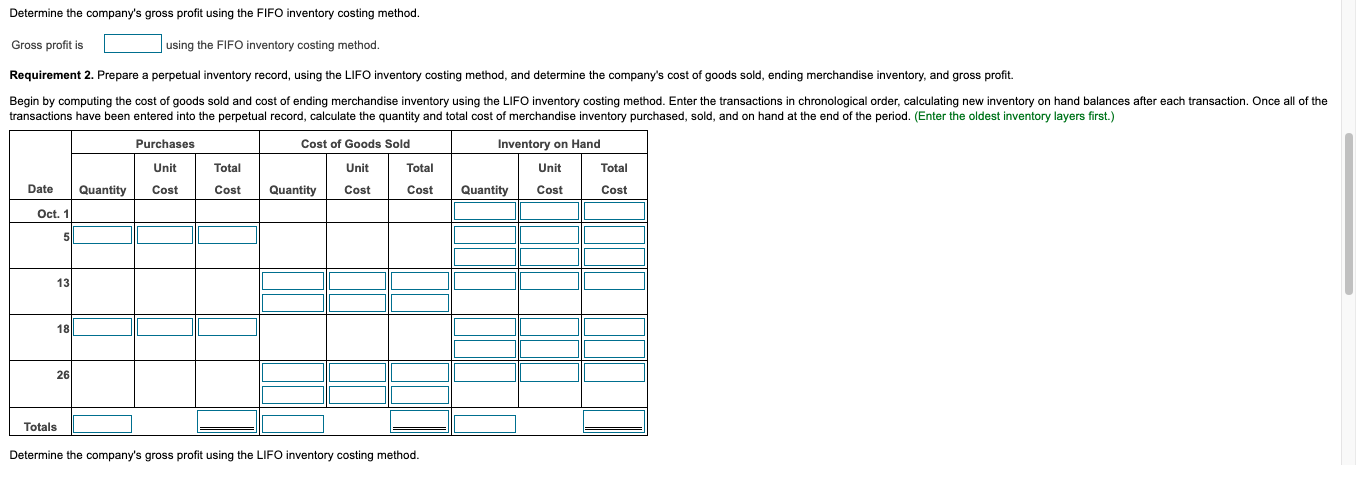

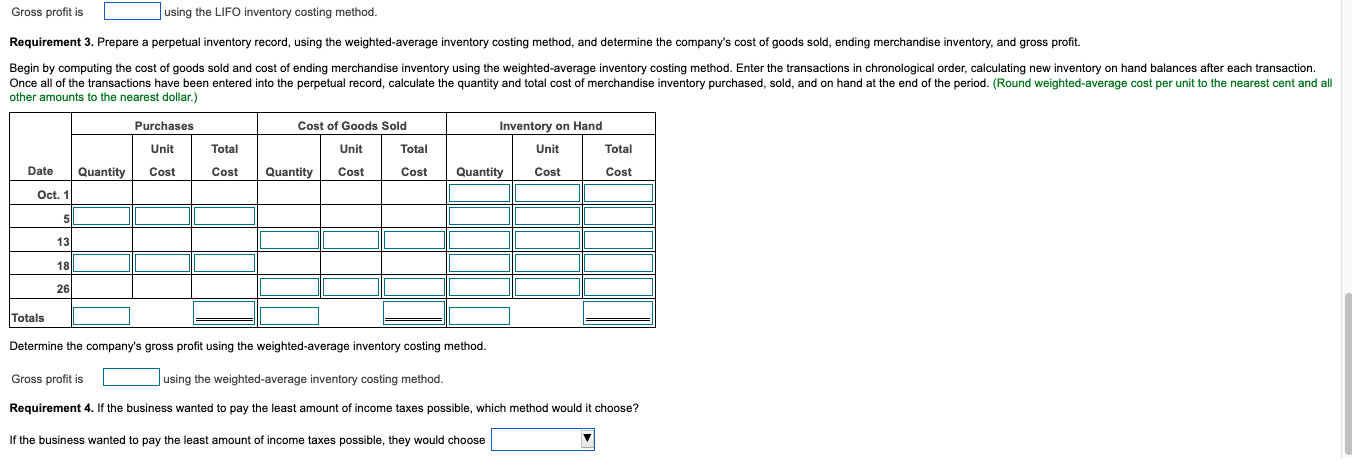

Requirements 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. 3. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? Data table Determine the company's gross profit using the FIFO inventory costing method. Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method. Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. other amounts to the nearest dollar.) Determine the company's gross profit using the weighted-average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts