Question: Requirements: 1) Record the above transactions in general journal using Physical/Periodic Inventory System March 1 2 3 4 5 Owners issued 50,000 shares to public

Requirements: 1) Record the above transactions in general journal using Physical/Periodic Inventory System

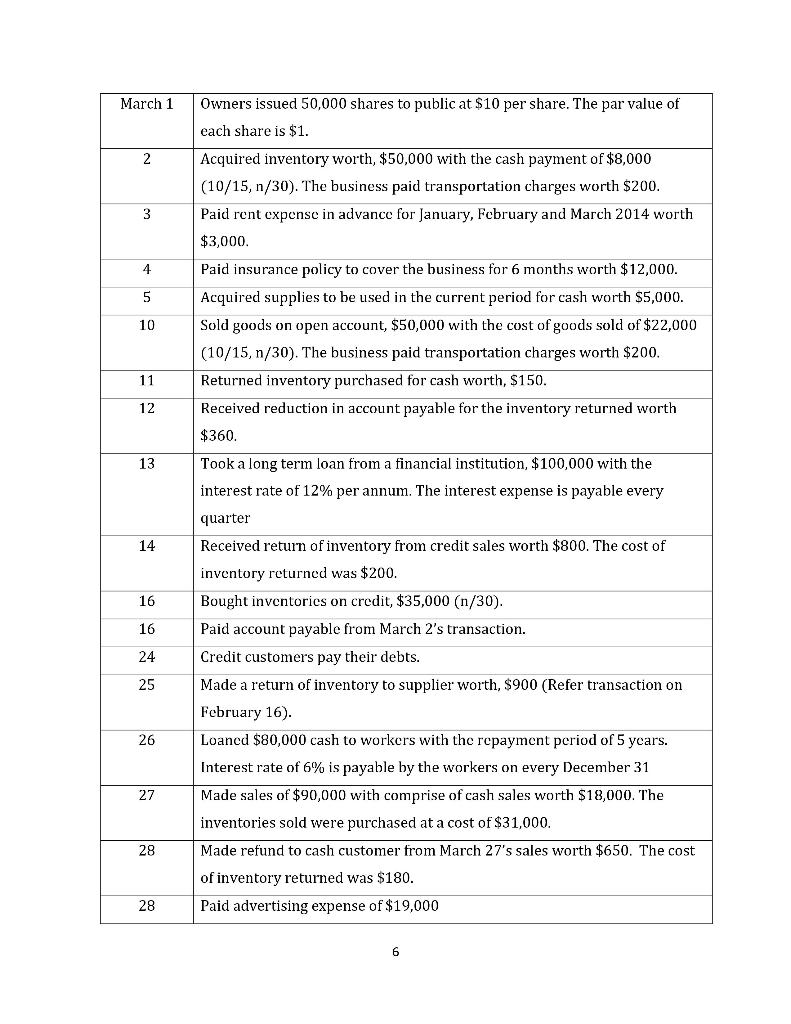

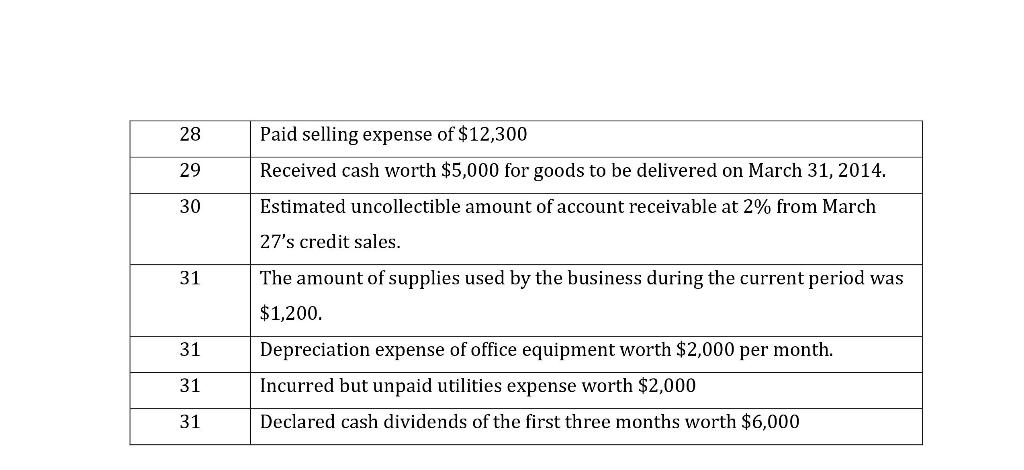

March 1 2 3 4 5 Owners issued 50,000 shares to public at $10 per share. The par value of each share is $1. Acquired inventory worth, $50,000 with the cash payment of $8,000 (10/15, n/30). The business paid transportation charges worth $200. Paid rent expense in advance for January, February and March 2014 worth $3,000 Paid insurance policy to cover the business for 6 months worth $12,000. Acquired supplies to be used in the current period for cash worth $5,000. Sold goods on open account, $50,000 with the cost of goods sold of $22,000 (10/15, n/30). The business paid transportation charges worth $200. Returned inventory purchased for cash worth, $150. Received reduction in account payable for the inventory returned worth $360. Took a long term loan from a financial institution, $100,000 with the interest rate of 12% per annum. The interest expense is payable every 10 11 12 13 quarter 14 16 16 24 25 Received return of inventory from credit sales worth $800. The cost of inventory returned was $200. Bought inventories on credit, $35,000 (n/30). Paid account payable from March 2's transaction. Credit customers pay their debts. Made a return of inventory to supplier worth, $900 (Refer transaction on February 16). Loaned $80,000 cash to workers with the repayment period of 5 years. Interest rate of 6% is payable by the workers on every December 31 Made sales of $90,000 with comprise of cash sales worth $18,000. The inventories sold were purchased at a cost of $31,000. Made refund to cash customer from March 27's sales worth $650. The cost 26 27 28 of inventory returned was $180. 28 Paid advertising expense of $19,000 6 28 Paid selling expense of $12,300 Received cash worth $5,000 for goods to be delivered on March 31, 2014. 29 30 Estimated uncollectible amount of account receivable at 2% from March 27's credit sales. 31 31 The amount of supplies used by the business during the current period was $1,200. Depreciation expense of office equipment worth $2,000 per month. Incurred but unpaid utilities expense worth $2,000 Declared cash dividends of the first three months worth $6,000 31 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts