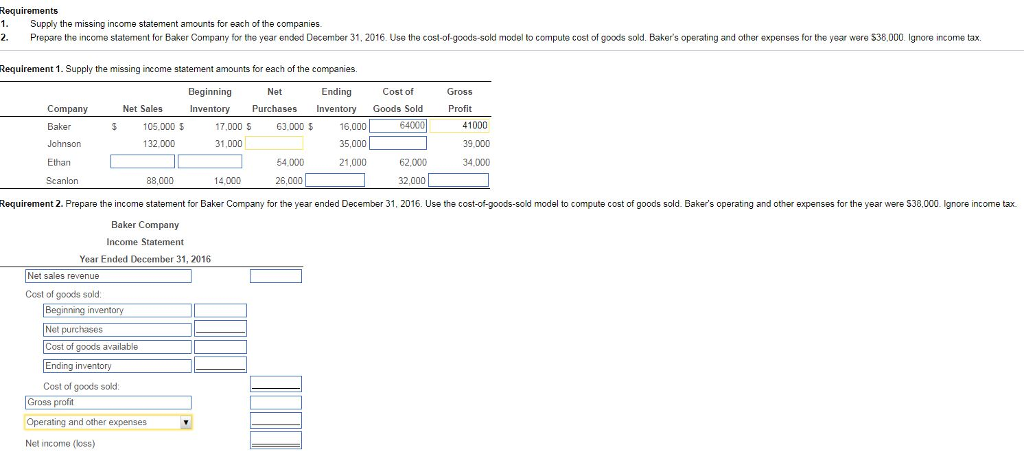

Question: Requirements 1. Supply the missing income statement amounts for each of the companies. 2. Prepare the income statement for Baker Company for the year ended

Requirements 1. Supply the missing income statement amounts for each of the companies. 2. Prepare the income statement for Baker Company for the year ended Db, 2016. Use the cost-of-gcods-sold model to compute cost of goods sold. Baker's operating and other expenses for the year were 538,000. Ignore income tax. Requirement1. Supply the missing income statement amounts for each of the companies. Beginning Net Ending Cost of Gross Company Baker Johnson Ethan Scanlon Net Sales nventory Purchases Inventory Goods Sold Pofit 41000 39,000 34.000 105.000 17,000 S 63.000 64000 16,000 35,000 21,000 132.000 31,000 54,000 62,000 88,000 14,000 6.000 32,000 Requirement 2. Prepare the income statemnfor Baker Company for the year ended December 31, 2016. Use the cost-of-goods-sold model to compute cost of goods sold. Baker's operating and other expenses for the year were 538,000. Ignore income tax Baker Company Income Statement Year Ended December 31, 2016 Net sales revenue Cost of goods sold: invento Net purchases Cost of Ending in Cost of goods sold available and other expenses Net income (oss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts