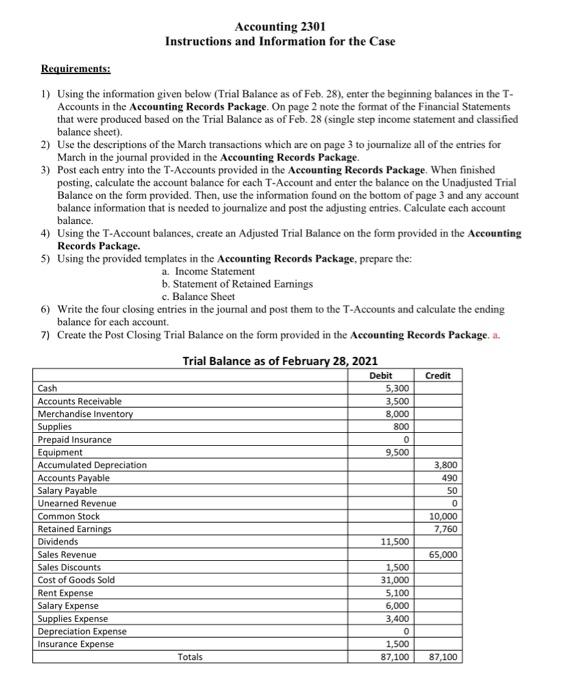

Question: Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the TAccounts in the Accounting Records Package.

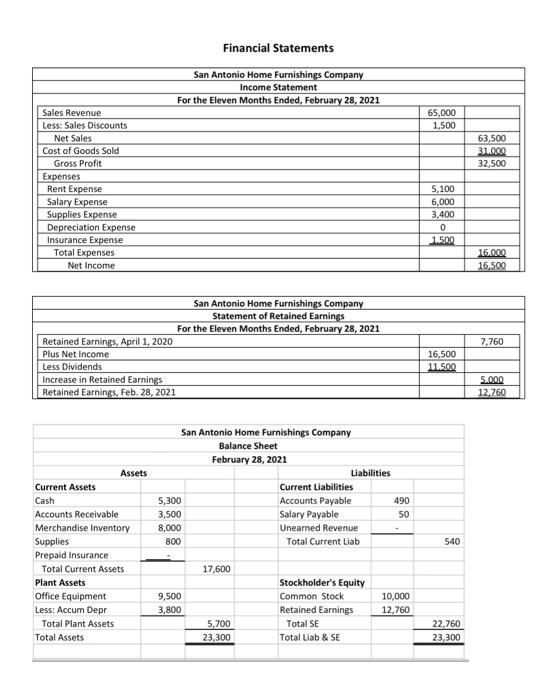

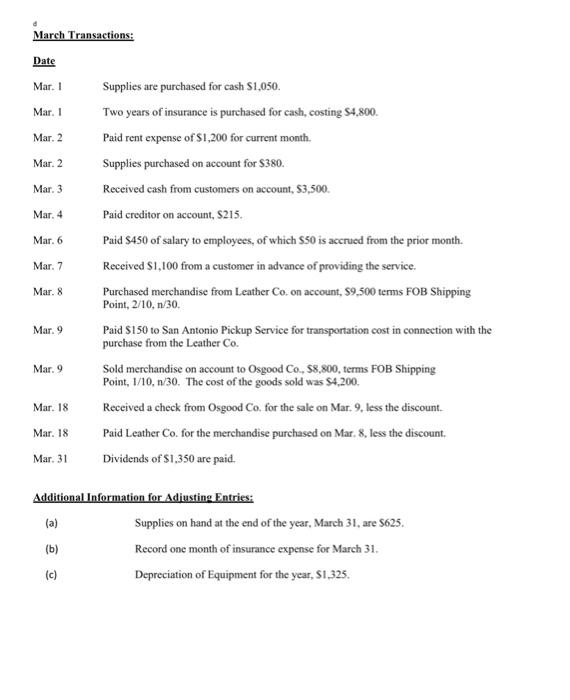

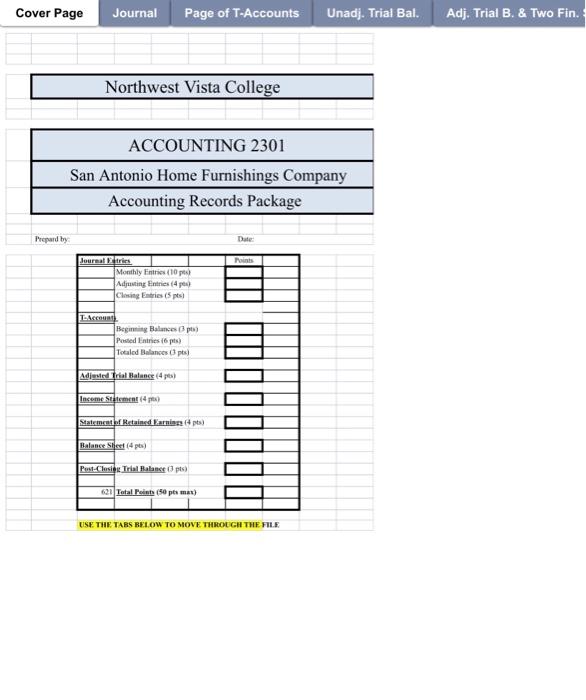

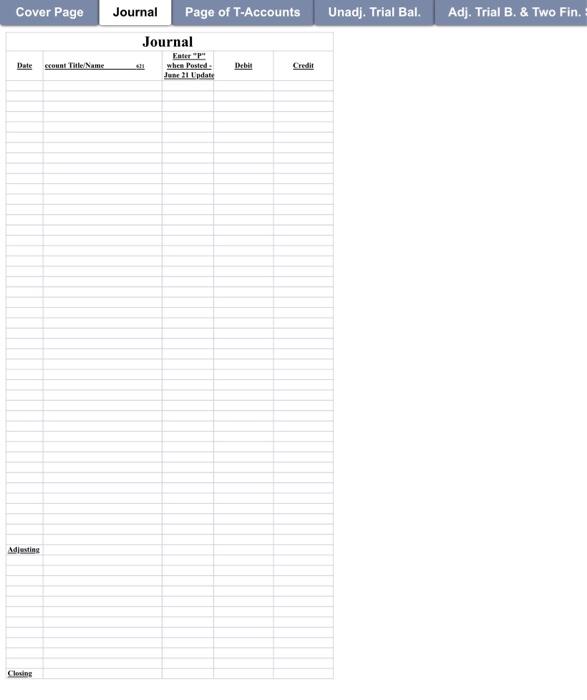

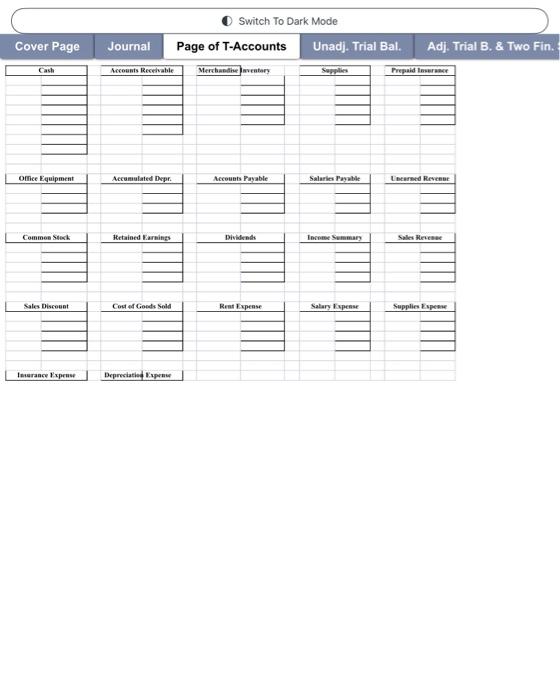

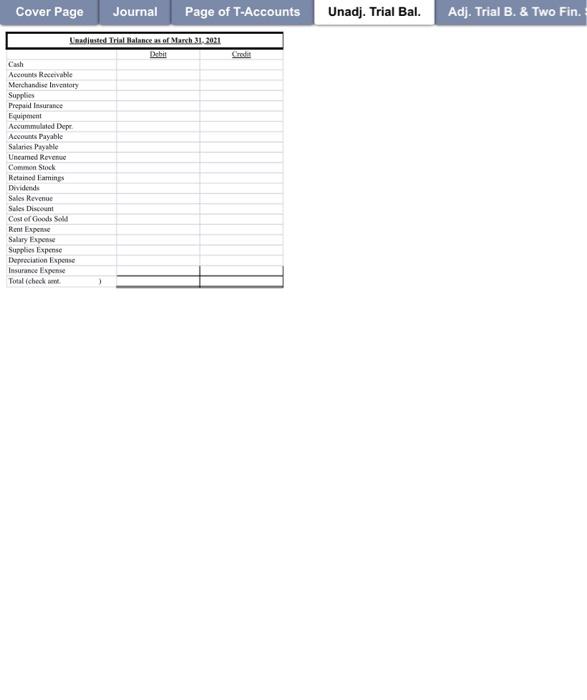

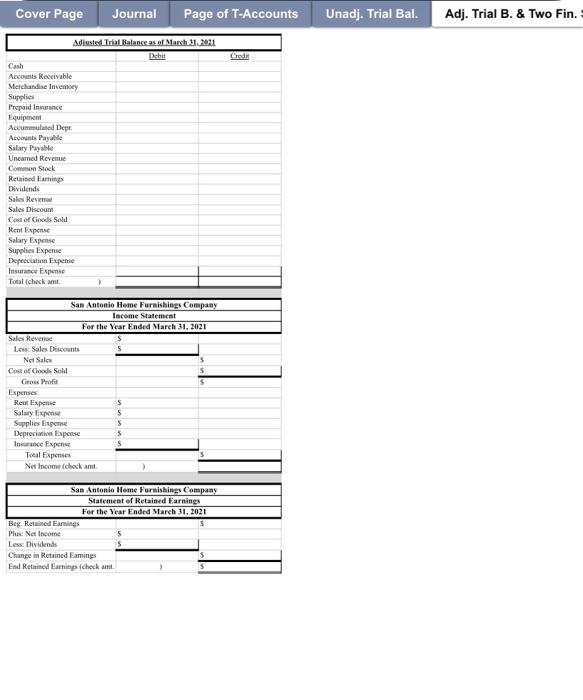

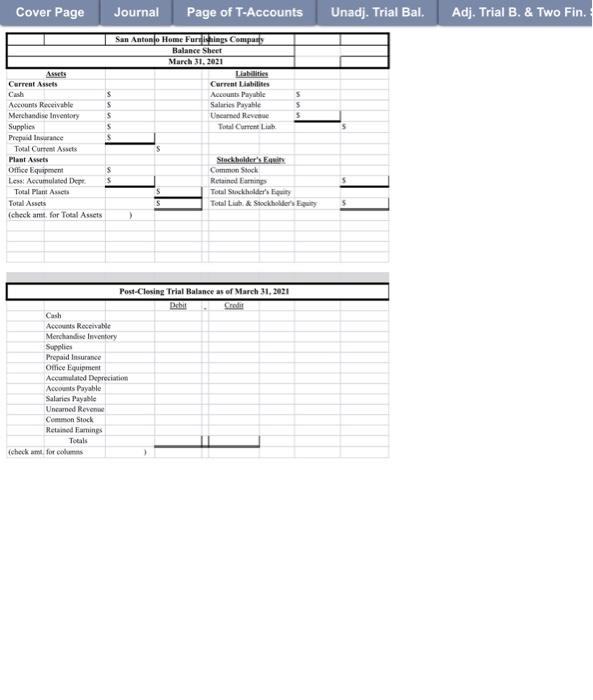

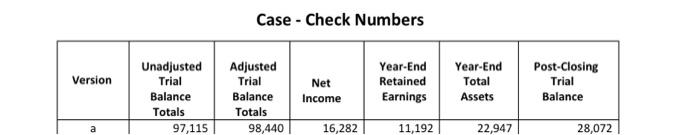

Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the TAccounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the journal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance. 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the joumal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. a. Financial Statements d March Transactions: Date Mar. 1 Supplies are purchased for cash \$1,050. Mar. 1 Two years of insurance is purchased for cash, costing $4,800. Mar. 2 Paid rent expense of $1,200 for current month. Mar. 2 Supplies purchased on account for $380. Mar. 3 Received cash from customers on account, $3,500. Mar. 4 Paid creditor on account, \$215. Mar. 6 Paid $450 of salary to employees, of which $50 is accrued from the prior month. Mar. 7 Received $1,100 from a customer in advance of providing the service. Mar. 8 Purchased merchandise from Leather Co. on account, $9,500 terms FOB Shipping Point, 2/10,n/30. Mar. 9 Paid $150 to San Antonio Pickup Service for transportation cost in connection with the purchase from the Leather Co. Mar. 9 Sold merchandise on account to Osgood Co, $8,800, terms FOB Shipping Point, 1/10,n/30. The cost of the goods sold was $4,200. Mar. 18 Received a check from Osgood Co. for the sale on Mar. 9, less the discount. Mar. 18 Paid Leather Co. for the merchandise purchased on Mar, 8, less the discount. Mar. 31 Dividends of $1,350 are paid. Additional Information for Adiusting Entries: (a) (b) (c) (c) (c) Depreciation of Equipment for the year, $1,325. Supplies on hand at the end of the year, March 31, are \$625. Record one month of insurance expense for March 31. Depreciation of Equipment for the year, $1,325. Cover Page Journal Page of T-Accounts Unadj. Trial Bal. Adj. Trial B. \& Two Fin. Northwest Vista College ACCOUNTING 2301 San Antonio Home Furnishings Company Accounting Records Package Propurd by Date: USE THE. TABS BEL.OW TO MOVE THROCGH THE FH. Cover Page Journal Page of T-Accounts Unadj. Trial Bal. Adj. Trial B. \& Two Fin. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Journal } \\ \hline Date & ccount Tite/Name & & & Probit & Credit \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline Adisating & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline Cloning & & & & & \\ \hline \end{tabular} Cover Page Journal Page of T-Accounts Unadj. Trial Bal. Adj. Trial B. \& Two Fin. Inatiuted Trial Halance as of Manh 31.2021 Canh Dahit Crodit Aecouts Rectrvable Merchandive Inventory Supplies Prepail lesurance Equiponent Aocummalated Depe Accounts Payable Salanies Payalle Uncamed Roverna Commen Stoch Retained Farnings Dividends Sales Revenue Sales Discount Cosu er Goods Soll Rent Expense Salary Expense Supplies Expense Depecciation Expsise Insurance Experse Total (check aene. \begin{tabular}{l|l|} \hline & \\ \hline & \\ \hline \end{tabular} Cover Page Journal Page of T-Accounts Unadj. Trial Bal. Adj. Trial B. \& Two Fin. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Adiusted Trial Balance as of Manh 3. 2021} \\ \hline & Debit & Crodi \\ \hline \multicolumn{3}{|l|}{ Cash } \\ \hline \multicolumn{3}{|l|}{ Accounts Receivable } \\ \hline \multicolumn{3}{|l|}{ Merclandiae Invemoey } \\ \hline \multicolumn{3}{|l|}{ Supplies } \\ \hline \multicolumn{3}{|l|}{ Prepaid Insarance } \\ \hline \multicolumn{3}{|l|}{ Equipment } \\ \hline \multicolumn{3}{|l|}{ Accummulated Depr. } \\ \hline \multicolumn{3}{|l|}{ Acoonints Payolle } \\ \hline \multicolumn{3}{|l|}{ Salary Payable } \\ \hline \multicolumn{3}{|l|}{ Uneamed Revenue } \\ \hline \multicolumn{3}{|l|}{ Common Slock } \\ \hline \multicolumn{3}{|l|}{ Retained Farnings } \\ \hline \multicolumn{3}{|l|}{ Dividends } \\ \hline \multicolumn{3}{|l|}{ Sales Revemor } \\ \hline \multicolumn{3}{|l|}{ Sales Discoum } \\ \hline \multicolumn{3}{|l|}{ Cosn of Gioceds Sola } \\ \hline \multicolumn{3}{|l|}{ Rent Expense } \\ \hline \multicolumn{3}{|l|}{ Salary Exponse } \\ \hline \multicolumn{3}{|l|}{ Supplies Expense } \\ \hline \multicolumn{3}{|l|}{ Depecciation Fxpenic } \\ \hline \multicolumn{3}{|l|}{ Insurahee Expense } \\ \hline Total fcheck amt. & & \\ \hline \multicolumn{3}{|c|}{ Sas Antonio Heme Furnishings Company } \\ \hline & Inceme Statem & \\ \hline For the V & rear Fnded Mar & 021 \\ \hline Sales Revenae & & \\ \hline Les: Sales Disocants & $ & \\ \hline Not Sales & & \\ \hline Coil of Giocsis Sold & & 5 \\ \hline Geoss Profit & & 3 \\ \hline Expenses: & & \\ \hline Rent Fxpenie & 5 & \\ \hline Salary Exponse & s & \\ \hline Supplics Eupense & s & \\ \hline Deprecianive Expense & 5 & \\ \hline Invarance Fixpence & $ & \\ \hline Toual Expenses & & 5 \\ \hline Nes lnoome (chock amt. & 1 & \\ \hline San Antenio & Heme Furnish & mapany \\ \hline Stateme & ent of Retained & \\ \hline For the Ye & Cear Fnded Mar & 021 \\ \hline Beg. Reizined Eamings & & 5 \\ \hline Plas: Net Incotne & 5 & \\ \hline Less: Dividends & 5 & \\ \hline Change in Retained Eamings & & 5 \\ \hline End Retaisod Earnitges ichock ami. & l & 5 \\ \hline \end{tabular} Cover Page Journal Page of T-Accounts Unadj. Trial Bal. Adj. Trial B. \& Two Fin. Case - Check Numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts