Question: Requirements 9, 10, 11, & 12 answer how it is shown 2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On

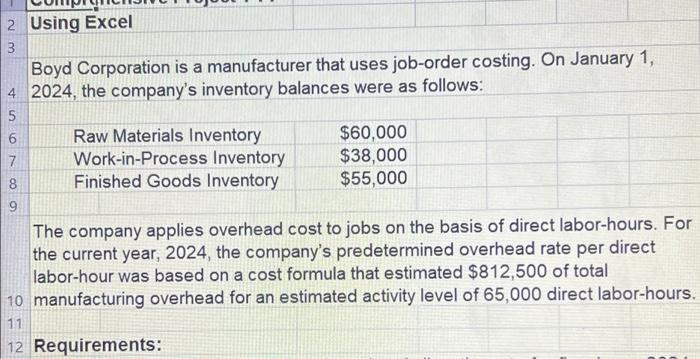

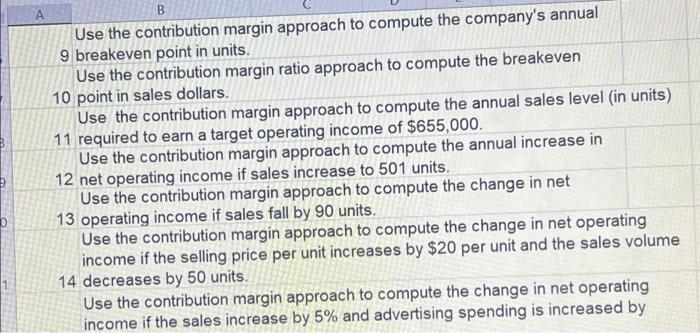

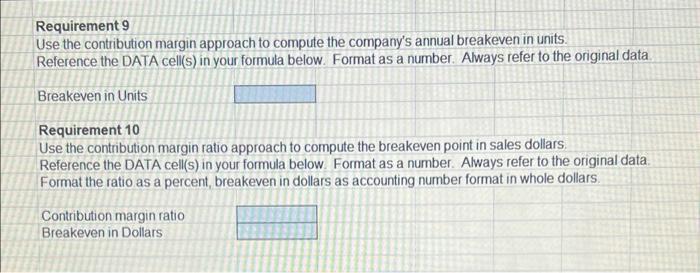

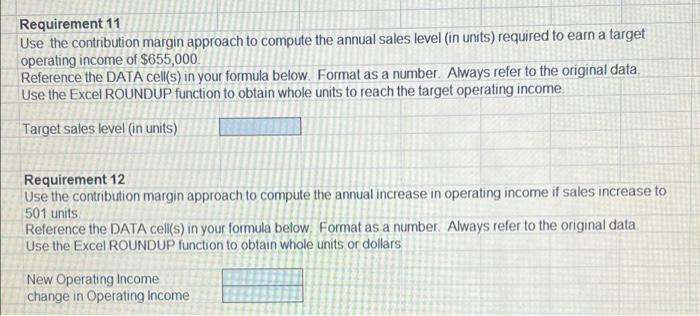

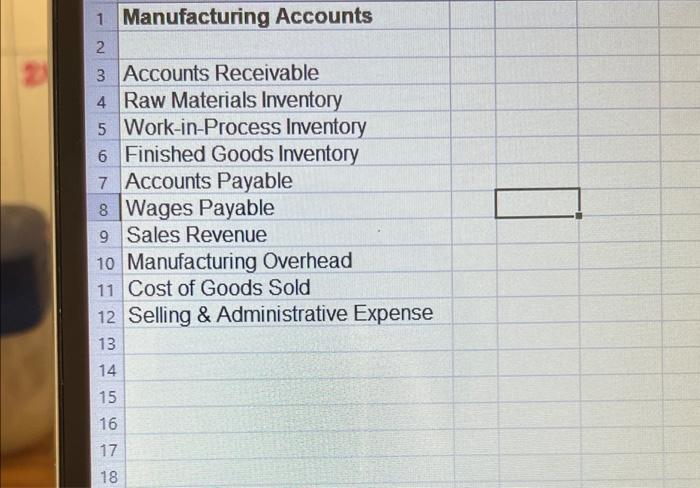

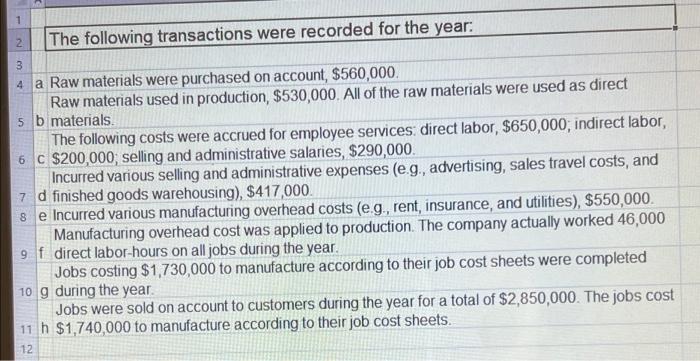

2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 4 2024, the company's inventory balances were as follows: 5 6 Raw Materials Inventory $60,000 7 Work-in-Process Inventory $38,000 8 Finished Goods Inventory $55,000 9 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $812,500 of total 10 manufacturing overhead for an estimated activity level of 65,000 direct labor-hours. 11 12 Requirements: B A Use the contribution margin approach to compute the company's annual 9 breakeven point in units. Use the contribution margin ratio approach to compute the breakeven 10 point in sales dollars. Use the contribution margin approach to compute the annual sales level (in units) 11 required to earn a target operating income of $655,000. Use the contribution margin approach to compute the annual increase in 12 net operating income if sales increase to 501 units. Use the contribution margin approach to compute the change in net 13 operating income if sales fall by 90 units. Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $20 per unit and the sales volume 14 decreases by 50 units. Use the contribution margin approach to compute the change in net operating income if the sales increase by 5% and advertising spending is increased by Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Format the ratio as a percent, breakeven in dollars as accounting number format in whole dollars. Contribution margin ratio Breakeven in Dollars Requirement 11 Use the contribution margin approach to compute the annual sales level (in units) required to earn a target operating income of $655,000. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units to reach the target operating income Target sales level (in units) Requirement 12 Use the contribution margin approach to compute the annual increase in operating income if sales increase to 501 units Reference the DATA cel(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating Income 2 1 Manufacturing Accounts 2 3 Accounts Receivable 4 Raw Materials Inventory 5 Work-in-Process Inventory 6 Finished Goods Inventory 7 Accounts Payable 8 Wages Payable 9 Sales Revenue 10 Manufacturing Overhead 11 Cost of Goods Sold 12 Selling & Administrative Expense 13 14 15 16 17 18 1 2 The following transactions were recorded for the year: 3 4 a Raw materials were purchased on account, $560,000. Raw materials used in production, $530,000. All of the raw materials were used as direct 5 b materials The following costs were accrued for employee services direct labor, $650,000; indirect labor, 6 C $200,000, selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (eg, advertising, sales travel costs, and 7 d finished goods warehousing), $417,000. 8 e Incurred various manufacturing overhead costs (eg, rent, insurance, and utilities), $550,000 Manufacturing overhead cost was applied to production. The company actually worked 46,000 9 f direct labor-hours on all jobs during the year. Jobs costing $1,730,000 to manufacture according to their job cost sheets were completed 10 g during the year Jobs were sold on account to customers during the year for a total of $2,850,000. The jobs cost 11 h $1,740,000 to manufacture according to their job cost sheets. 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts