Question: REQUIREMENTS (DO IT IN TABLE): i. JOURNALISE THE TRANSACTION ii. PREPARE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME iii. PREPARE STATEMENT CHANGES OF

REQUIREMENTS (DO IT IN TABLE):

i. JOURNALISE THE TRANSACTION

ii. PREPARE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

iii. PREPARE STATEMENT CHANGES OF EQUITY

iv. PREPARE STATEMENT OF FINANCIAL POSITION

v. NOTES TO THE FINANCIAL STATEMENT

vi. PROPERTY, PLANT & EQUIPMENT

vii. CONTINGENT LIABILITY/ CONTINGENT ASSET (IF ANY)

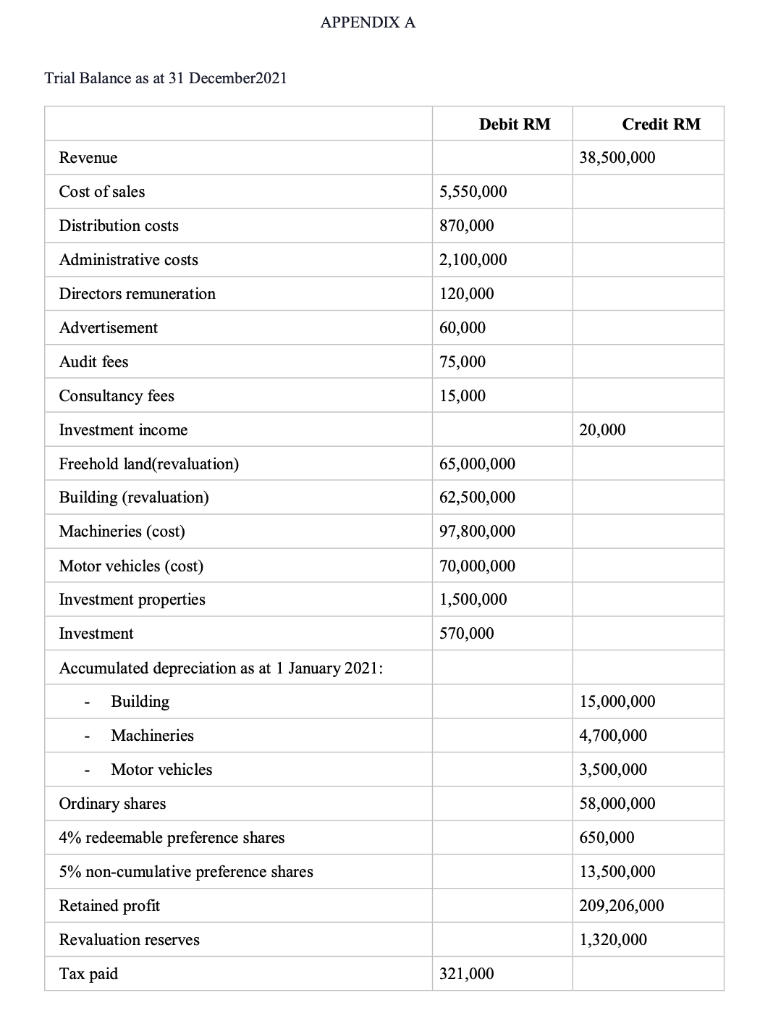

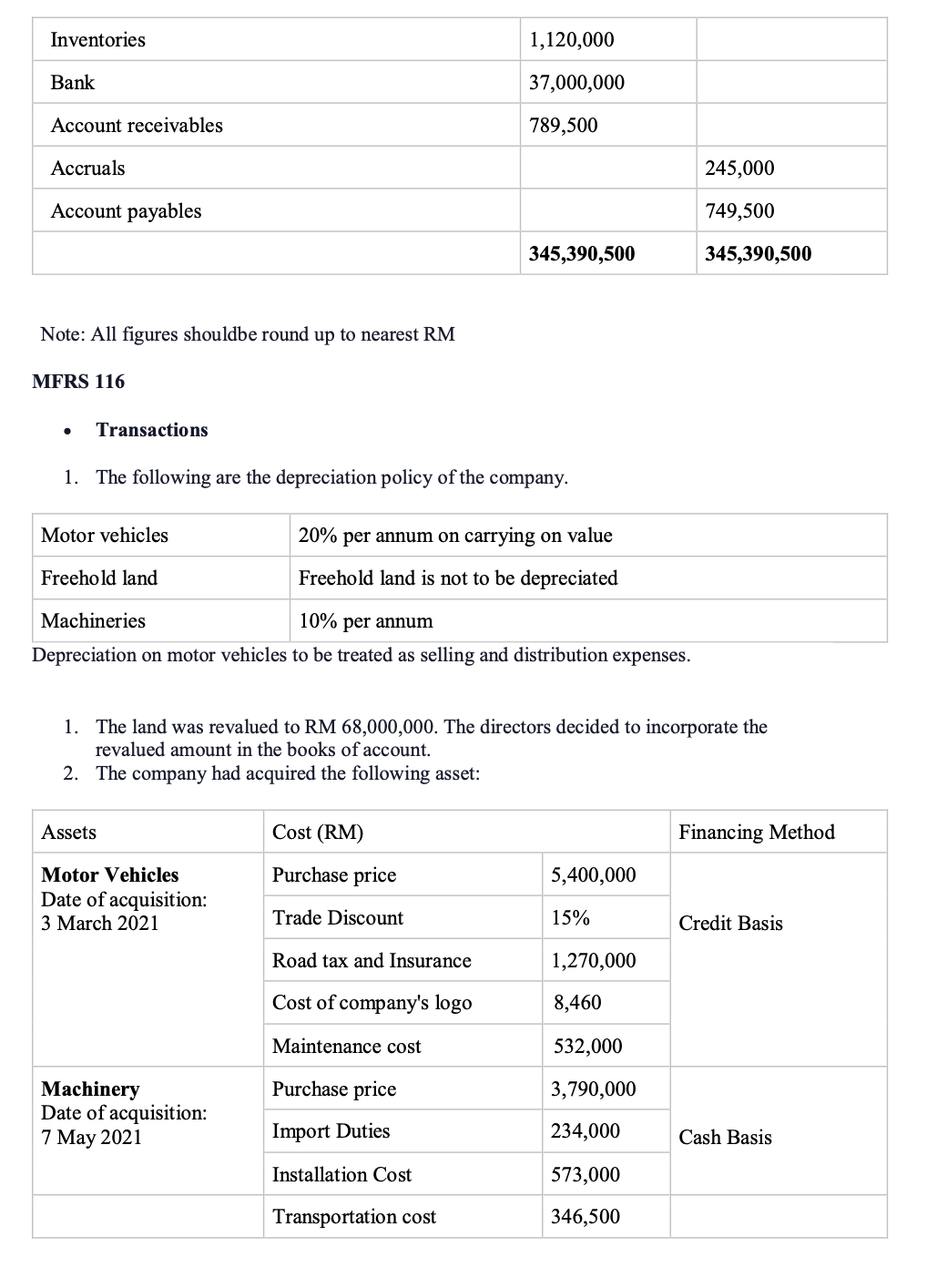

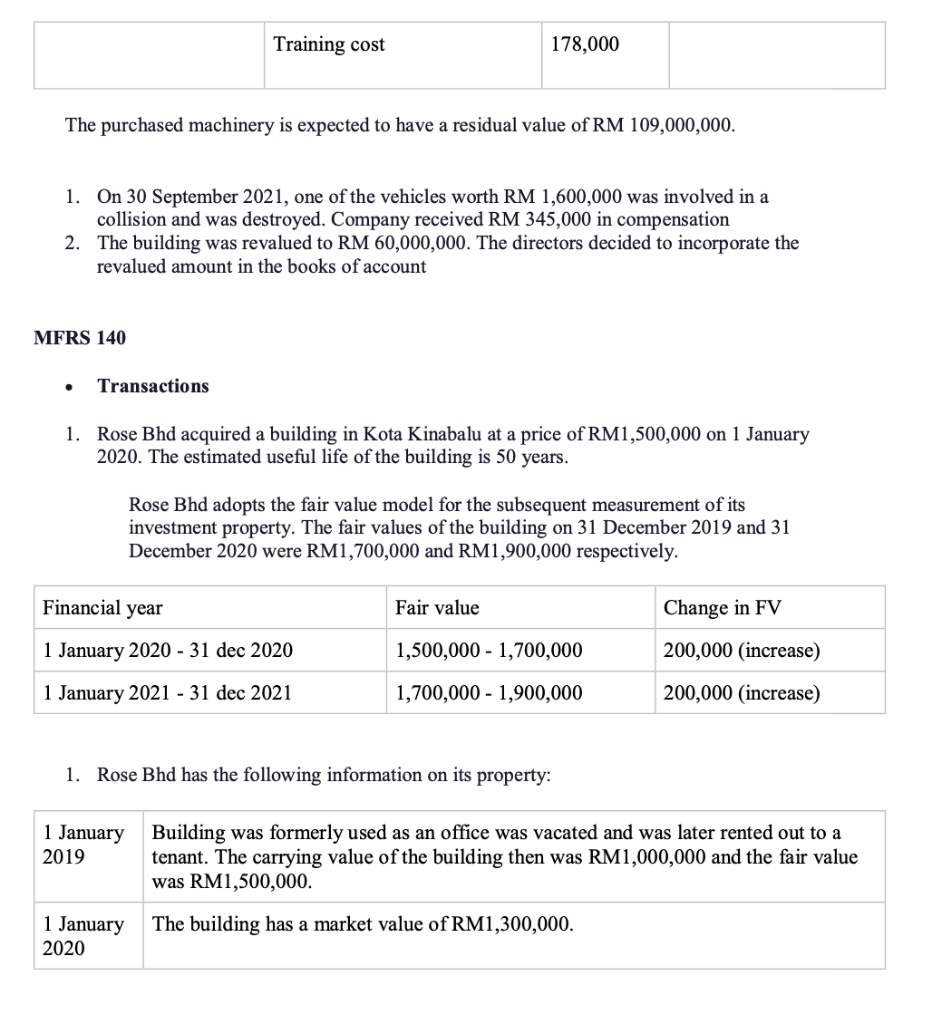

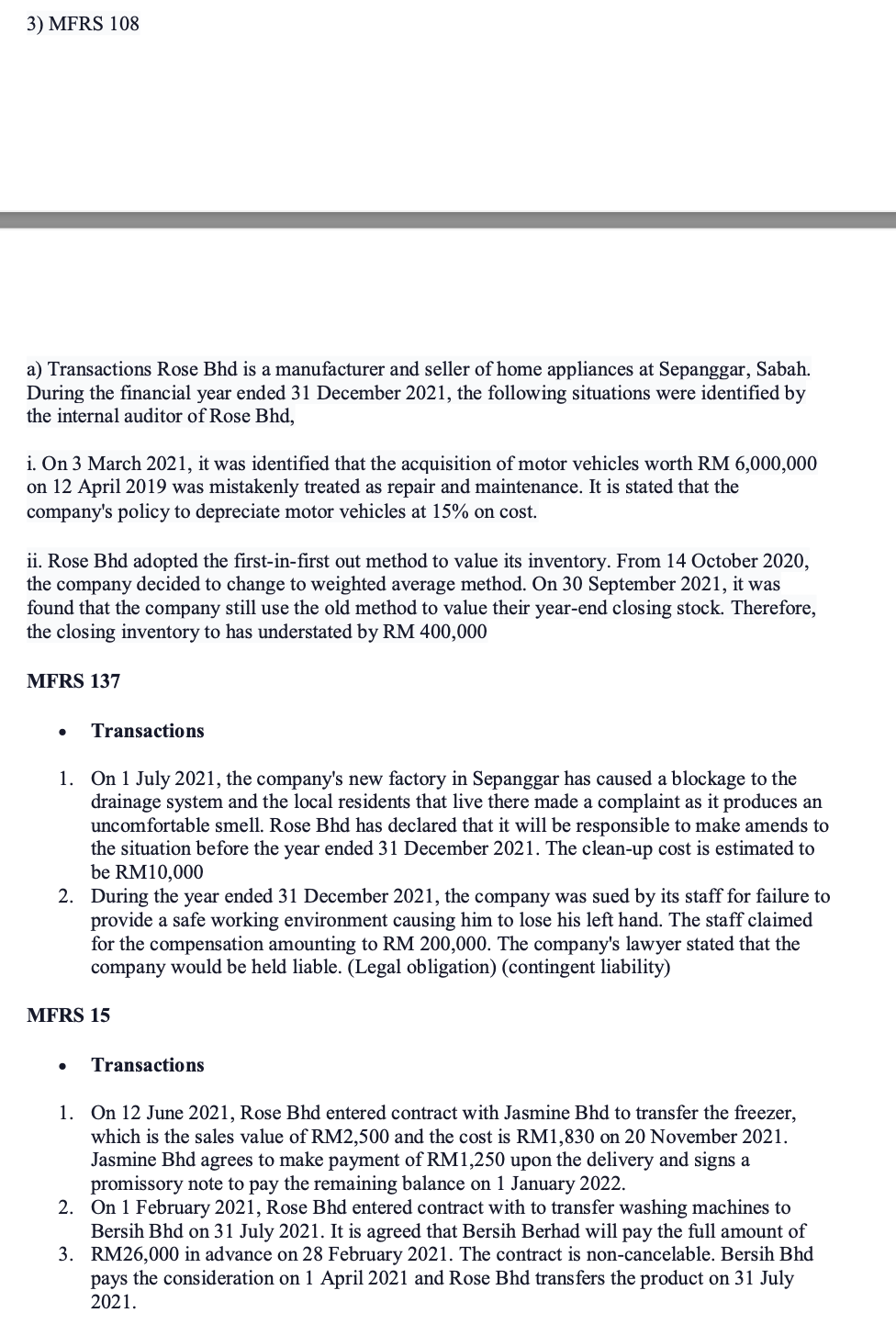

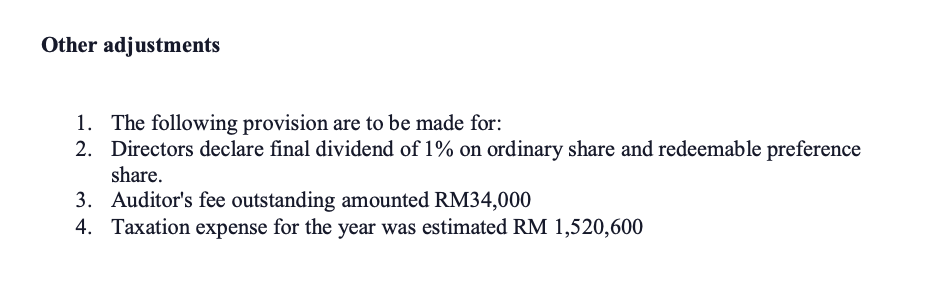

APPENDIX A Note: All figures shouldbe round up to nearest RM MFRS 116 - Transactions 1. The following are the depreciation policy of the company. Depreciation on motor vehicles to be treated as selling and distribution expenses. 1. The land was revalued to RM68,000,000. The directors decided to incorporate the revalued amount in the books of account. 2. The company had acquired the following asset: MFRS 140 - Transactions 1. Rose Bhd acquired a building in Kota Kinabalu at a price of RM1,500,000 on 1 January 2020 . The estimated useful life of the building is 50 years. Rose Bhd adopts the fair value model for the subsequent measurement of its investment property. The fair values of the building on 31 December 2019 and 31 December 2020 were RM1,700,000 and RM1,900,000 respectively. 1. Rose Bhd has the following information on its property: a) Transactions Rose Bhd is a manufacturer and seller of home appliances at Sepanggar, Sabah. During the financial year ended 31 December 2021, the following situations were identified by the internal auditor of Rose Bhd, i. On 3 March 2021, it was identified that the acquisition of motor vehicles worth RM 6,000,000 on 12 April 2019 was mistakenly treated as repair and maintenance. It is stated that the company's policy to depreciate motor vehicles at 15% on cost. ii. Rose Bhd adopted the first-in-first out method to value its inventory. From 14 October 2020 , the company decided to change to weighted average method. On 30 September 2021, it was found that the company still use the old method to value their year-end closing stock. Therefore, the closing inventory to has understated by RM 400,000 MFRS 137 - Transactions 1. On 1 July 2021, the company's new factory in Sepanggar has caused a blockage to the drainage system and the local residents that live there made a complaint as it produces an uncomfortable smell. Rose Bhd has declared that it will be responsible to make amends to the situation before the year ended 31 December 2021 . The clean-up cost is estimated to be RM10,000 2. During the year ended 31 December 2021, the company was sued by its staff for failure to provide a safe working environment causing him to lose his left hand. The staff claimed for the compensation amounting to RM 200,000. The company's lawyer stated that the company would be held liable. (Legal obligation) (contingent liability) MFRS 15 - Transactions 1. On 12 June 2021, Rose Bhd entered contract with Jasmine Bhd to transfer the freezer, which is the sales value of RM2,500 and the cost is RM1,830 on 20 November 2021 . Jasmine Bhd agrees to make payment of RM1,250 upon the delivery and signs a promissory note to pay the remaining balance on 1 January 2022. 2. On 1 February 2021 , Rose Bhd entered contract with to transfer washing machines to Bersih Bhd on 31 July 2021 . It is agreed that Bersih Berhad will pay the full amount of 3. RM26,000 in advance on 28 February 2021 . The contract is non-cancelable. Bersih Bhd pays the consideration on 1 April 2021 and Rose Bhd transfers the product on 31 July 2021. Other adjustments 1. The following provision are to be made for: 2. Directors declare final dividend of 1% on ordinary share and redeemable preference share. 3. Auditor's fee outstanding amounted RM34,000 4. Taxation expense for the year was estimated RM 1,520,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts