Question: REQUIREMENTS: In the Excel spreadsheet available in the Assignment sub-folder in LEARN, Total Return Index monthly observations are available for sixteen International Market Indices, with

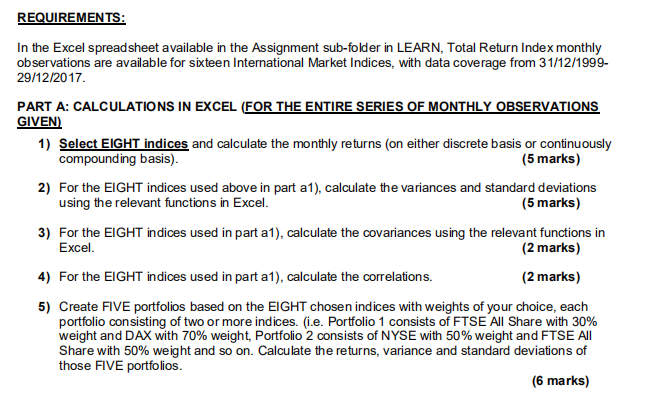

REQUIREMENTS: In the Excel spreadsheet available in the Assignment sub-folder in LEARN, Total Return Index monthly observations are available for sixteen International Market Indices, with data coverage from 31/12/1999- 29/12/2017 PART A: CALCULATIONS IN EXCEL (FOR THE ENTIRE SERIES OF MONTHLY OBSERVATIONS GIVEN) 1) Select EIGHT indices and calculate the monthly returns (on either discrete basis or continuously compounding basis). (5 marks) 2) For the EIGHT indices used above in part a1), calculate the variances and standard deviations using the relevant functions in Excel. (5 marks) 3) For the EIGHT indices used in part al), calculate the covariances using the relevant functions in Excel. (2 marks) 4) For the EIGHT indices used in part al), calculate the correlations. (2 marks) 5) Create FIVE portfolios based on the EIGHT chosen indices with weights of your choice, each portfolio consisting of two or more indices. (i.e. Portfolio 1 consists of FTSE All Share with 30% weight and DAX with 70% weight, Portfolio 2 consists of NYSE with 50% weight and FTSE ALL Share with 50% weight and so on. Calculate the returns, variance and standard deviations of those FIVE portfolios. (6 marks) REQUIREMENTS: In the Excel spreadsheet available in the Assignment sub-folder in LEARN, Total Return Index monthly observations are available for sixteen International Market Indices, with data coverage from 31/12/1999- 29/12/2017 PART A: CALCULATIONS IN EXCEL (FOR THE ENTIRE SERIES OF MONTHLY OBSERVATIONS GIVEN) 1) Select EIGHT indices and calculate the monthly returns (on either discrete basis or continuously compounding basis). (5 marks) 2) For the EIGHT indices used above in part a1), calculate the variances and standard deviations using the relevant functions in Excel. (5 marks) 3) For the EIGHT indices used in part al), calculate the covariances using the relevant functions in Excel. (2 marks) 4) For the EIGHT indices used in part al), calculate the correlations. (2 marks) 5) Create FIVE portfolios based on the EIGHT chosen indices with weights of your choice, each portfolio consisting of two or more indices. (i.e. Portfolio 1 consists of FTSE All Share with 30% weight and DAX with 70% weight, Portfolio 2 consists of NYSE with 50% weight and FTSE ALL Share with 50% weight and so on. Calculate the returns, variance and standard deviations of those FIVE portfolios. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts