Question: Requirements: Prepare and summarize the adjusting entries using the 2-column journal sheet. a. Accounts payable includes the P15,000 purchase of fuel, oil and lubricants which

Requirements:

Prepare and summarize the adjusting entries using the 2-column journal sheet.

a. Accounts payable includes the P15,000 purchase of fuel, oil and lubricants which

remained outstanding and not paid for over 2 years.

b. The office supplies inventory was overstated since the accountant failed to record the

issuances totaling P30,000. The MRSMI submitted by the custodian was misplaced.

Issuances not recorded as of December 31, 2021 includes spare parts totaling P6,000.

c. Refund or prior years cash advance for travelling expenses in the amount of P2,000 was

erroneously credited to travelling expense.

d. Recognize the expense of rent paid in advance.

e. Depreciation for December 31, 2021:

Office equipment 6,200

Building 38,160

Motor vehicle 9,250

Medical equipment 75,000

f. Advance payment of insurance premium for government vehicles amounting to P12,000

was made on October 1, 2021 but not recorded. Adjust the expired portion at year-end.

(10/1/2021-9/30/2022)

g. On December 25, 2021, COA approved the accountant request to write off, P3,500 of

Accounts Receivable.

h. Reversion of unused NCA.

NOTE:

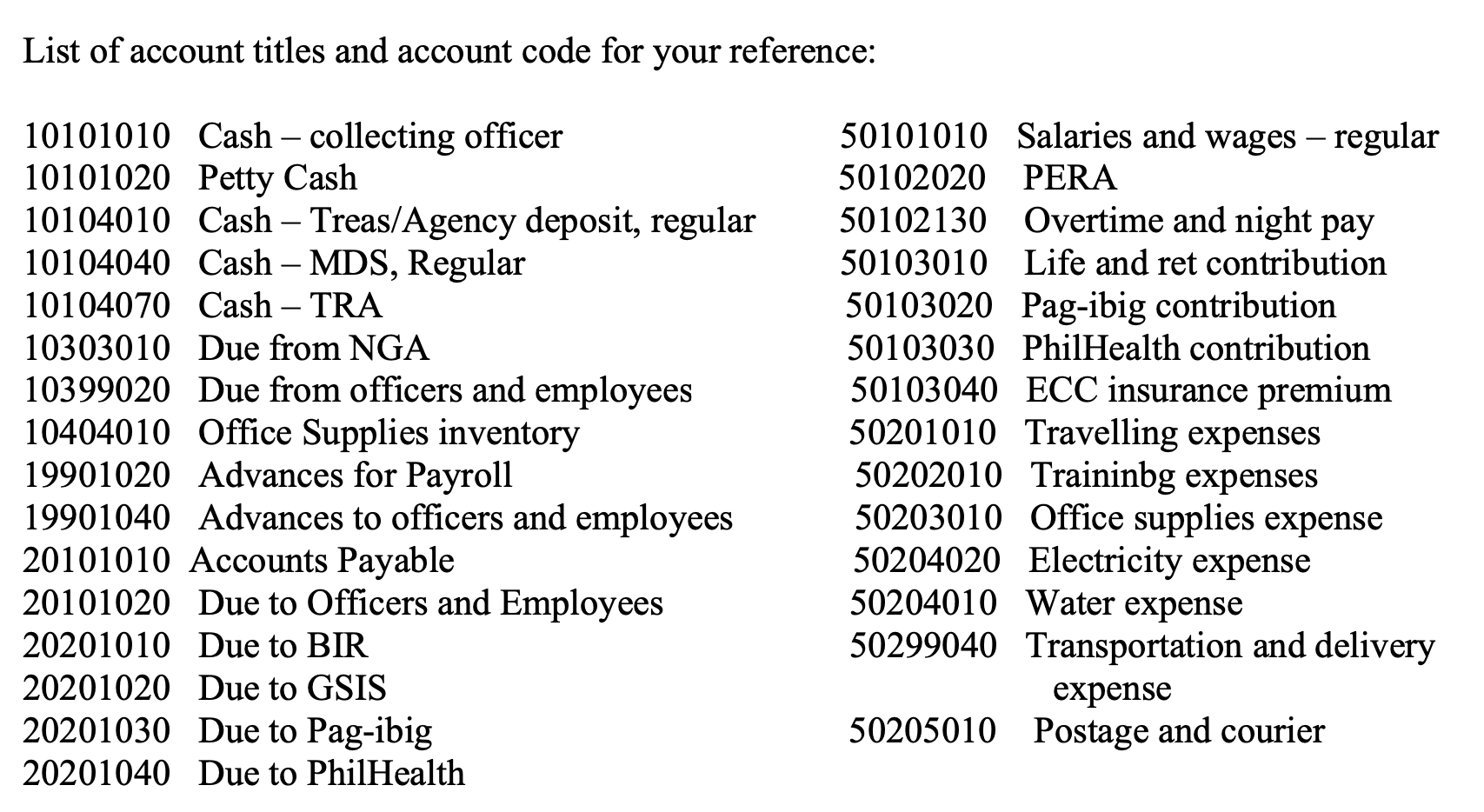

use these list of account titles

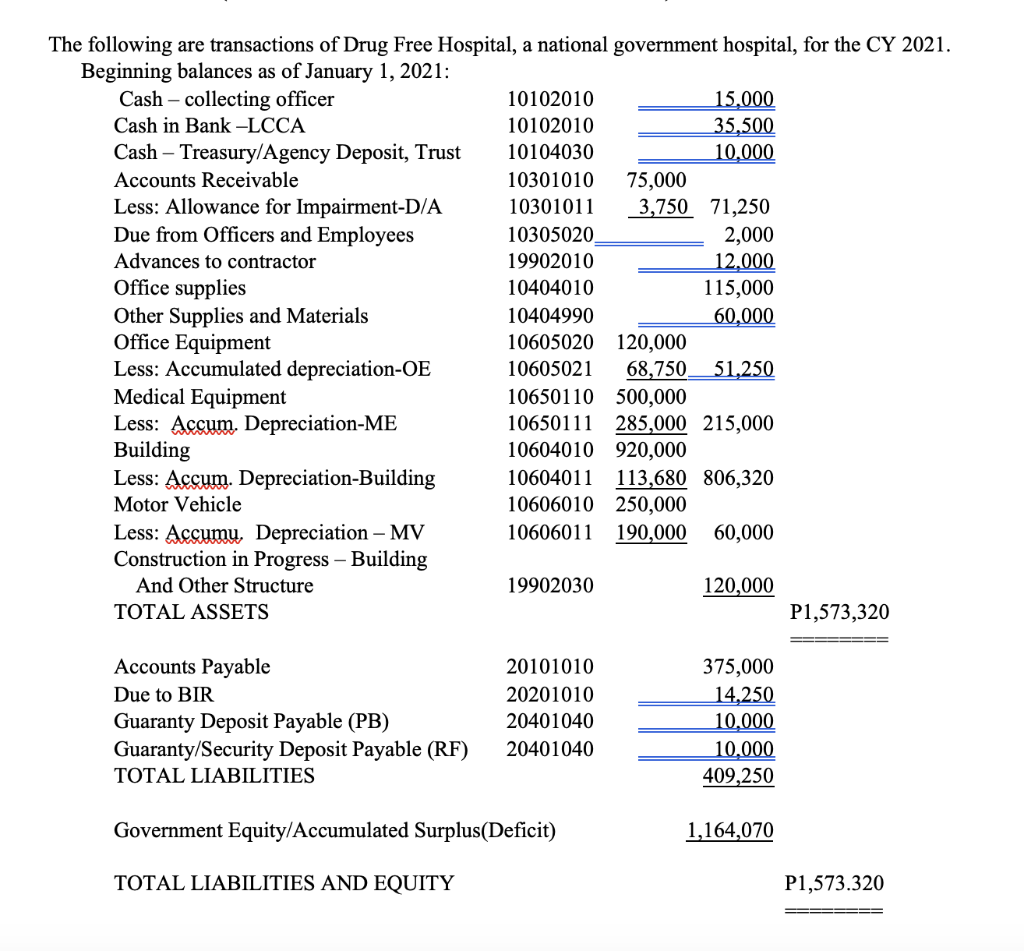

The following are transactions of Drug Free Hospital, a national government hospital, for the CY 2021. Beginning balances as of January 1, 2021: Cash - collecting officer Cash in Bank -LCCA Cash - Treasury/Agency Deposit, Trust Accounts Receivable Less: Allowance for Impairment-D/A Due from Officers and Employees Advances to contractor Office supplies Other Supplies and Materials Office Equipment Less: Accumulated depreciation-OE Medical Equipment Less: Accum. Depreciation-ME Building Less: Accum. Depreciation-Building Motor Vehicle Less: Accumu, Depreciation - MV Construction in Progress - Building And Other Structure TOTAL ASSETS Accounts Payable Due to BIR Guaranty Deposit Payable (PB) Guaranty/Security Deposit Payable (RF) TOTAL LIABILITIES P1,573,320 \begin{tabular}{rr} 20101010 & 375,000 \\ 20201010 & 14,250 \\ 20401040 & 10,000 \\ 20401040 & 10,000 \\ \hline \hline \end{tabular} 1,164,070 Government Equity/Accumulated Surplus(Deficit) P1,573.320 TOTAL LIABILITIES AND EQUITY List of account titles and account code for your reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts