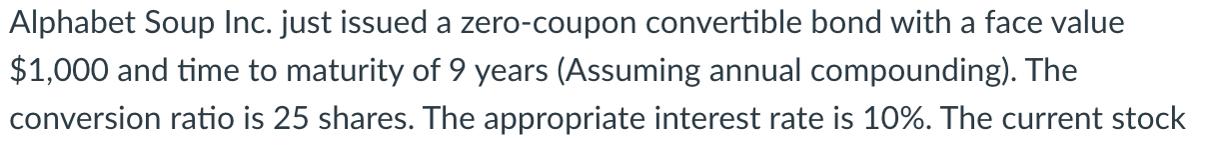

Question: Alphabet Soup Inc. just issued a zero-coupon convertible bond with a face value $1,000 and time to maturity of 9 years (Assuming annual compounding).

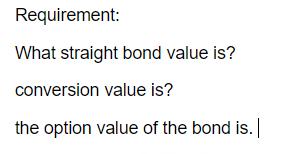

Alphabet Soup Inc. just issued a zero-coupon convertible bond with a face value $1,000 and time to maturity of 9 years (Assuming annual compounding). The conversion ratio is 25 shares. The appropriate interest rate is 10%. The current stock price is $12 per share. Each convertible is trading at $500 in the market. Requirement: What straight bond value is? conversion value is? the option value of the bond is. |

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

ANSWER Straight bond value 42410 Conversion Value 300 Option value of the bond 7590 ... View full answer

Get step-by-step solutions from verified subject matter experts